Hey there, Crypto Champs!

The average retail investor might struggle to hold Bitcoin during downturns, often selling due to expenses. Institutions, with more staying power, may scoop up most of the circulating Bitcoin. Let’s dive into the dynamics!

Bitcoin's Recent Decline

Current Price: Bitcoin is trading at $58,270.58.

Market Volume: Over the last 24 hours, the total crypto market volume hit $62.29 billion, a 64.13% increase. DeFi’s share is $3.12 billion, or 5% of the total, while stablecoins account for $57.54 billion, making up 92.37% of the market.

Is It Time to Sell Bitcoin?

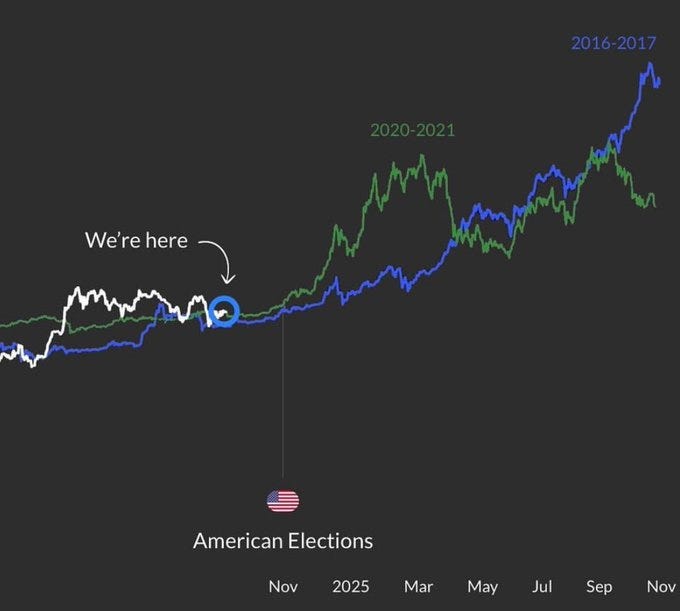

Investor Concerns: Some believe Bitcoin’s market could rebound after the U.S. election in November, as historical trends suggest. With Bitcoin’s recent drop, many investors are anxious, fearing further losses or a loss of their gains. Let’s see if history repeats!

Decision to Sell: Selling Bitcoin to move into paper currencies or traditional assets could be risky, especially with central banks potentially engaging in massive currency printing.

Why Gold Is Gaining Attention?

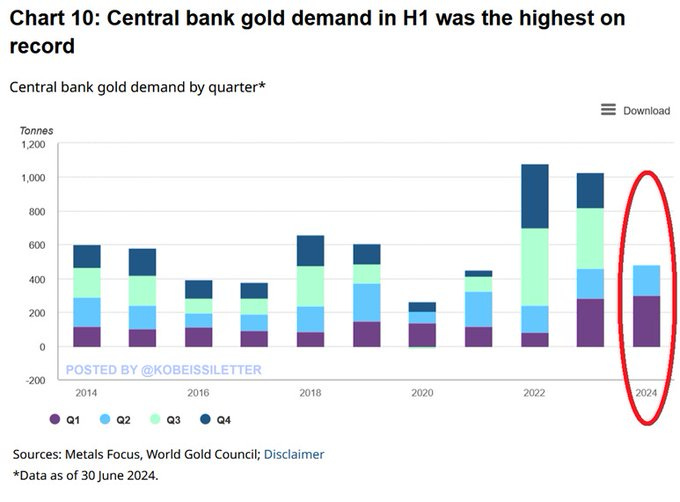

Central Bank Purchases: Central banks have been buying gold in record amounts. In the first half of 2024, they purchased 483 tonnes of gold, surpassing the previous record of 460 tonnes from the first half of 2023.

Major Buyers: Countries like Poland, India, and Turkey are leading these purchases, signaling a shift towards gold as a stable investment.

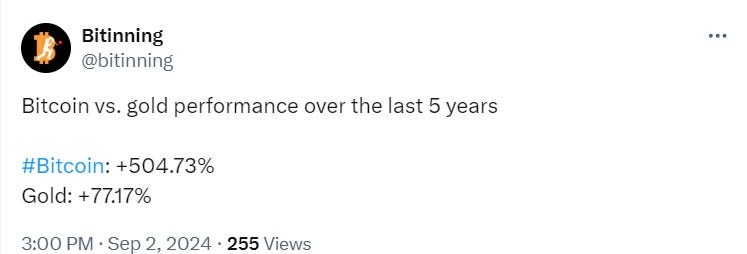

Comparing Bitcoin and Gold

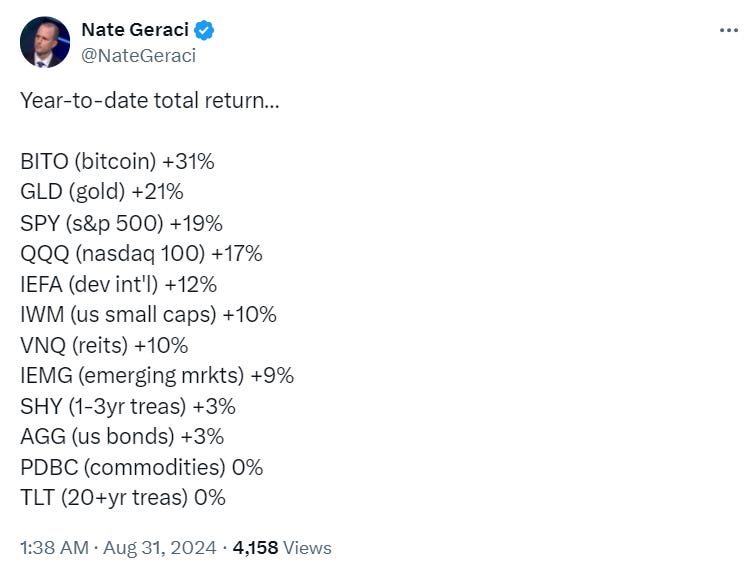

Bitcoin’s Performance: Bitcoin has appreciated 37% in 2024, but it’s down 22% from its all-time high in March.

Gold’s Performance: Gold is up 23% this year, outperforming the S&P 500, which gained 18%. Analysts predict gold could hit $3,000, based on its current rally and past performance.

What’s Behind Bitcoin’s Struggles?

Market Sentiment: General market sentiment might be turning bearish due to economic concerns and profit-taking.

Historical September Trends: September is typically a month of consolidation or downturn for Bitcoin, with an average downside of 5-10%, making this month's market performance consistent with historical patterns.

Impact of Upcoming US Jobs Data: The release of US jobs data could influence the Federal Reserve's decision on rate cuts in September, which may affect Bitcoin’s price movement.

Regulatory Pressures: Regulatory scrutiny on cryptocurrencies could be affecting Bitcoin’s price.

Shift to Stablecoins: Investors are moving capital from Bitcoin to stablecoins, signaling caution and uncertainty. This shift has pushed the stablecoin market cap to nearly $170 billion, an all-time high.

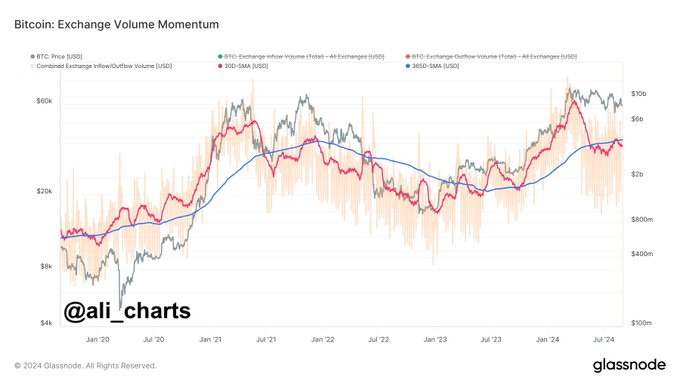

Decline in On-Chain Activity: Crypto analyst Ali Martinez noted a significant drop in exchange-related on-chain activity, indicating reduced investor interest in Bitcoin and decreased network usage.

Diversification: Gold provides stability, which can be appealing compared to Bitcoin’s volatility. Diversifying your portfolio can help manage risks.

Final Thoughts

Bitcoin vs. Gold: While Bitcoin offers high potential returns, it’s also volatile. Gold, with its stability and recent gains, might be a safer bet in uncertain times.

Investment Strategy: Consider your risk tolerance and investment goals. Diversifying with assets like gold could help balance your portfolio.

Historically, Bitcoin prices have broken out 150-160 days post-halving, so a breakout might not occur until the end of September. In these turbulent times, balancing investments in Bitcoin and gold while aligning with your strategy is crucial.

• Twitter • Medium • Steemit • Torum

Read More: