Hey there!

Is the Bitcoin Bull Run Just Getting Started? Despite market fears, Bitcoin's price action and weakening dollar point to a potential surge. Institutional adoption is ramping up—get ready for more gains!

Is the 2024 Top in?

The crypto market is facing increased fear, with many altcoins experiencing significant losses.

Monthly and weekly time frames show declines, while the daily time frame is attempting a bounce.

A crucial monthly close is approaching today.

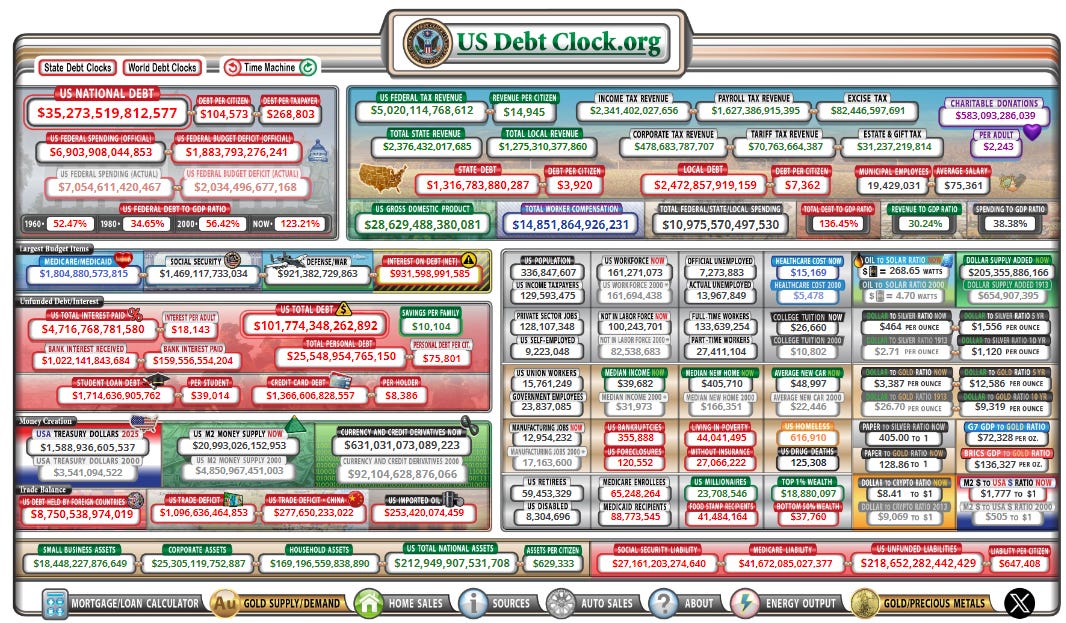

US Debt and Liquidity Impact

The US National Debt Clock is ticking upwards, with the US national debt hitting a staggering $35 trillion. This level of debt is unprecedented and contributes to the ongoing increase in the M2 global money supply. Historically, crypto markets tend to follow liquidity trends, often driven by money printing or quantitative easing.

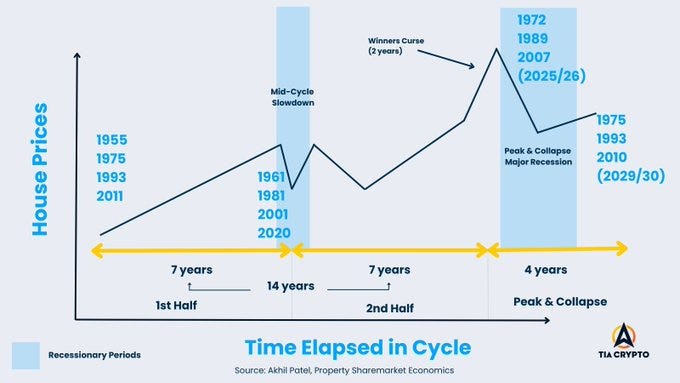

Phil Anderson’s 18.6-Year Real Estate Cycle, which began in 2011, suggests that the current phase might be the final leg of the bull market, but some argue the top may not be reached until next year.

Current Market Analysis

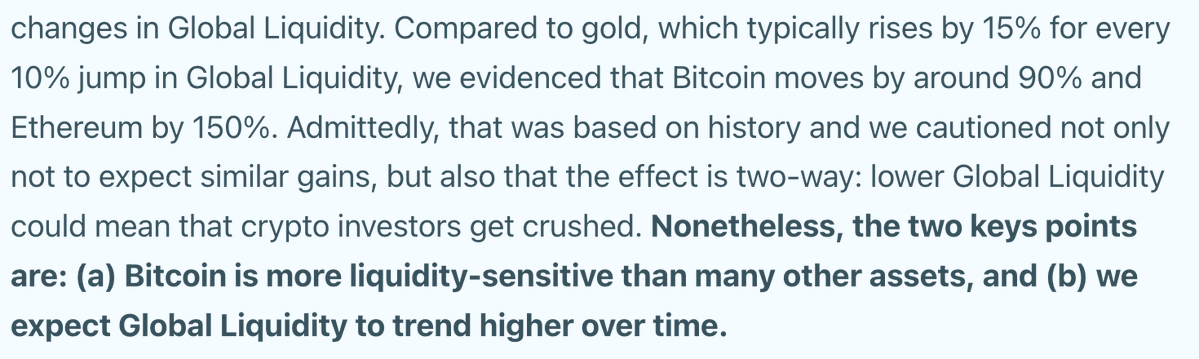

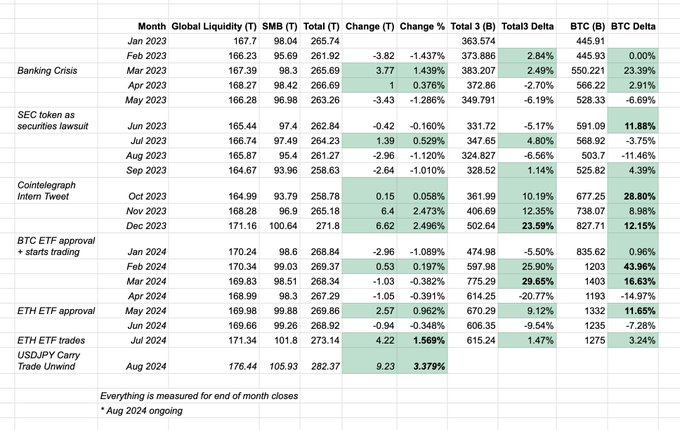

Recent 5% increase in global liquidity has led to flat or slightly negative Bitcoin prices.

Bitcoin historically moves 90% for every 10% increase in global liquidity. Currently, Bitcoin appears to be lagging behind other assets like gold and the stock market.

Factors Affecting Crypto Markets

Insights from Experts

Anthony Pompliano suggests that:

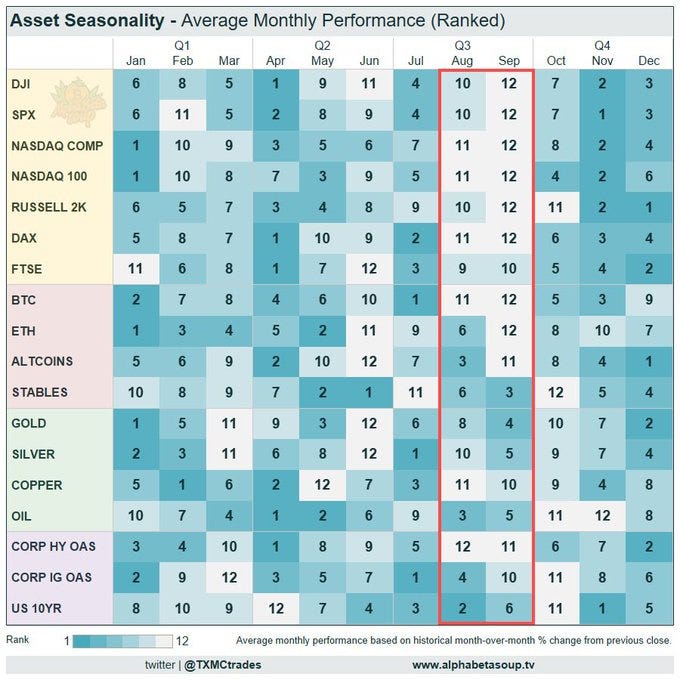

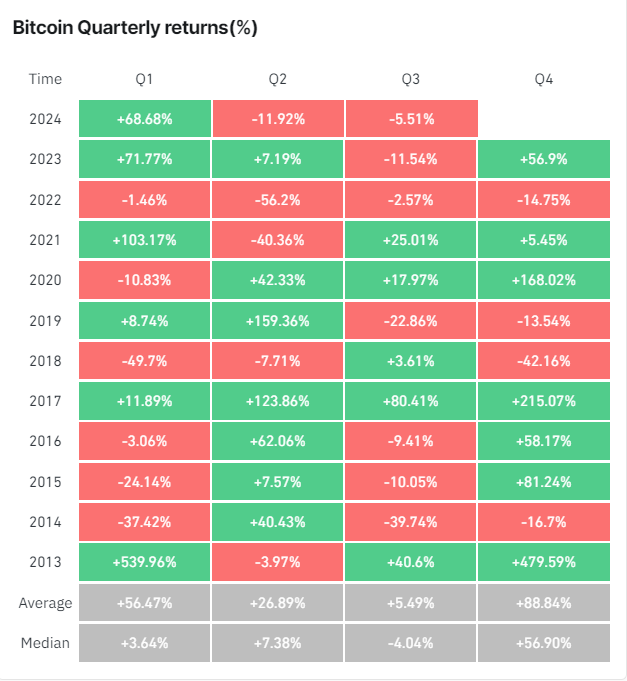

Seasonality: Historically, Q3 is a weak quarter for Bitcoin, with Q4 showing strong gains.

Fed Actions: Anticipated Fed rate cuts could lead to increased investment in risk assets like Bitcoin.

Political Events: Trump's potential re-election may impact Bitcoin prices positively.

Bitcoin Dominance and Market Cycles

Bitcoin dominance is currently at 57%, approaching 60%.

Market cycles often top when Bitcoin dominance bottoms, suggesting a potential cycle peak is not imminent.

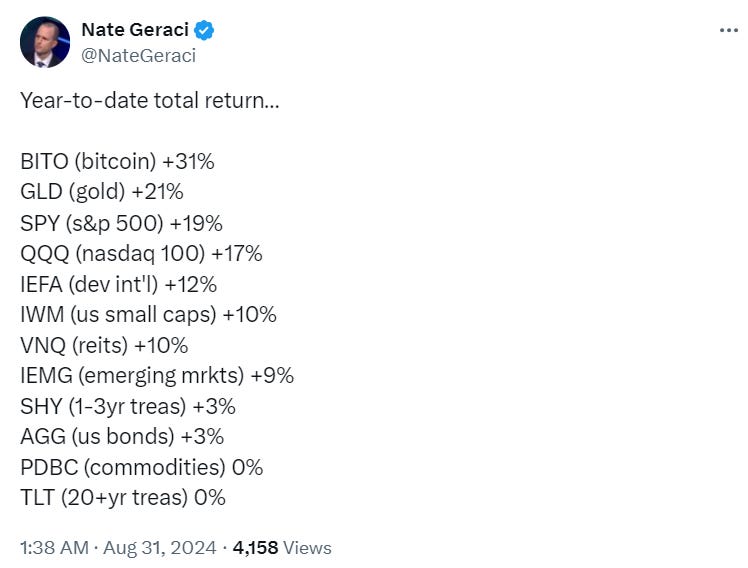

Year-to-Date Returns

Bitcoin has delivered a 31% return, outperforming gold and showing strong performance relative to traditional assets.

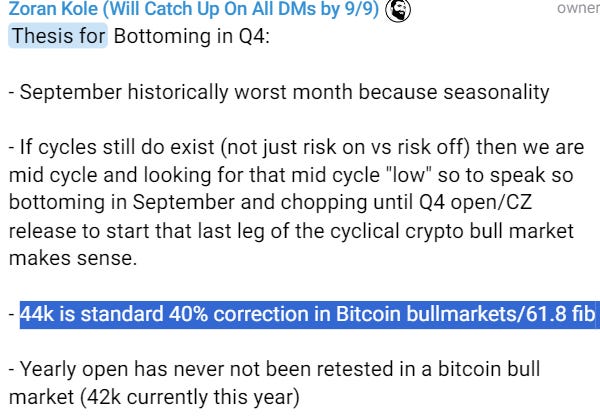

Bearish Case Analysis

A potential bottom could occur between August and September.

A 40% correction from highs could see Bitcoin prices around $44,000.

Historically, Bitcoin's yearly open is often tested, currently at $42,000.

Investment Strategy

Consider dollar-cost averaging into Bitcoin positions.

Be prepared for potential corrections and adjust investment strategies accordingly.

The Bitcoin bull run isn't necessarily over. Historical trends and liquidity patterns hint at potential Q4 rallies. Stay adaptable and informed to navigate the market's mixed signals and evolving conditions.