Hey Crypto Folks!

Bitcoin's Big Break? As the crypto market gears up for a potential surge, all eyes are on today's Jackson Hole speech by Fed Chair Jerome Powell. Will this spark Bitcoin's next move?

Crypto Market Overview

Market Cap: The market cap is up by 86, while the trading volume is down by 18.1%.

Inflows: No new inflow data has been reported since midnight. Yesterday saw inflows totaling 2,849 BTC.

Fear and Greed Index: Currently at 34, indicating fear in the market. The sentiment is leaning towards a strong buy based on the last hour's data.

Heat Map: The heat map shows green, with Bitcoin up by 21% and Ethereum at 2.02%.

Bitcoin Price Analysis

Resistance Testing: Bitcoin is facing consistent resistance at the $62,000-$63,000 levels. Analysts believe breaking this resistance could quickly push Bitcoin towards $70,000 and potentially spark a major recovery in the altcoin market.

Volume Impact: The current lack of significant trading volume is keeping this resistance level intact. Increased volume could be key to breaking through.

Weekend Volatility: Trading volume typically drops on weekends, leading to increased volatility. Lower liquidity can exaggerate price movements, with the current 24-hour volume around $25 billion.

Funding Rates: Bitcoin’s funding rates have recently turned negative, indicating potential volatility and suggesting an upcoming bounce.

Market Liquidity: Lower weekend volume impacts market liquidity, making it easier for small trades to cause significant price changes.

Upcoming U.S. Data:

Powell's Keynote Speech: Jerome Powell, Fed Chair, is set to hint at a potential rate cut in his keynote speech at the Jackson Hole Economic Symposium on Friday at 10 am ET. The current Fed rate is at a 23-year high of 5.25-5.50%.

Rate Cut Expectations: Deutsche Bank’s Matthew Luzzetti expects Powell to indicate that a rate cut is imminent but may not detail its size. The final decision will depend on upcoming economic data, including the jobs report on September 6.

Market Impact: If Powell confirms a rate cut, it could positively affect the cryptocurrency market. Watch for increased market volatility in the evening and night following the speech.

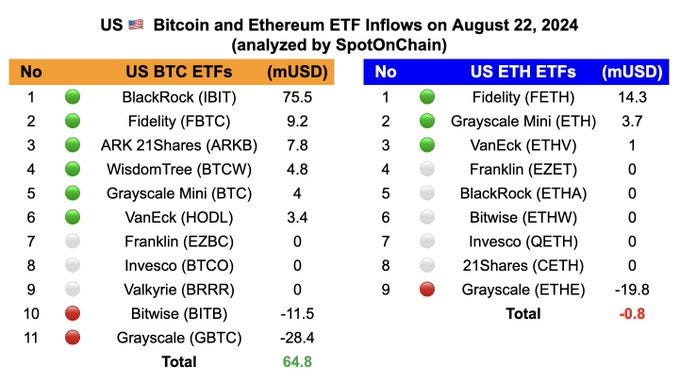

ETF Updates

Bitcoin ETF Updates:

BlackRock: Purchased $75.5 million worth of Bitcoin.

Bitwise and Grayscale: Bitwise is selling, and Grayscale continues its selling trend. Despite this, the overall net position is positive.

Ethereum ETF:

Trading volume remains low. BlackRock's ETF has seen a declining trend over six consecutive days. Fidelity remains a consistent buyer, but overall, selling is dominant in the market.

Growing Global Crypto Adoption

Russia's Crypto Initiatives: Russia is making significant strides in the crypto space, with President Vladimir Putin introducing a bill to legalize crypto mining and further plans to expand the country's involvement.

New Exchanges and Stablecoin: Russia is reportedly establishing two new cryptocurrency exchanges tied to the Chinese Yuan and BRICS currencies, along with launching a stablecoin, signaling a major policy shift

El Salvador's Daily Bitcoin Purchases

Daily Bitcoin Purchases: The country has marked 160 consecutive days of buying Bitcoin, starting its commitment to purchasing 1 BTC daily on March 16, 2023.

El Salvador's Bitcoin Success: El Salvador's Bitcoin portfolio has increased by 35%, with an unrealized profit of $93.45 million. The country now holds 5,851 BTC worth $357.3 million, acquired at an average price of $44,835.

Impact on Adoption: Bukele’s persistence has contributed to Bitcoin’s growing adoption, inspiring other companies like MicroStrategy, Metaplanet, Semler Scientific, and DeFi Technology to adopt Bitcoin as a strategic reserve.

As Bitcoin nears $61,000 and the crypto market anticipates key developments, all eyes are on Jerome Powell's upcoming Jackson Hole speech, which could significantly impact market trends and sentiment.