Will Bitcoin Price Bounce Back After Recent Dip?

Is A Major Shift Happening in Crypto Market This Week?

Hey there, crypto enthusiasts!

Big news just dropped, and it’s shaking the crypto world! Let’s take a look at the latest happenings in the Bitcoin and Ethereum markets.

Crypto Market Overview

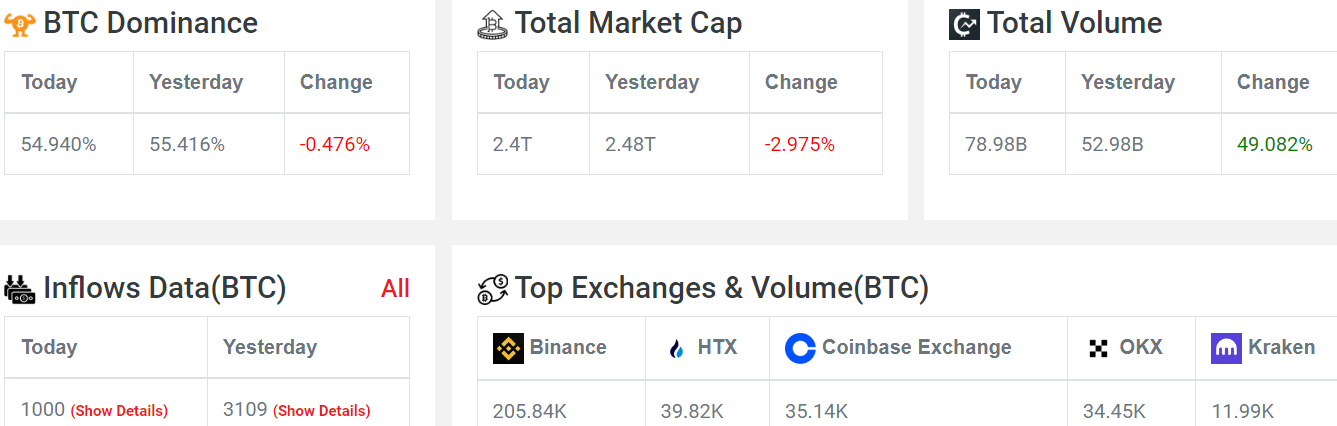

Total Crypto Market Cap: $2.39 trillion, down 3.49% from yesterday’s cap of $2.48 trillion.

Total Crypto Market Volume: $80.22 billion, a 56.07% increase over the last 24 hours.

Bitcoin Dominance is at 54.94%, a decrease of 0.54% from the previous day.

The Fear and Greed Index is at 67, suggesting an Extreme Greed sentiment in the market.

Bitcoin Analysis

Current Trading: Bitcoin is at $66,687.67, down 4.21% in 24 hours after dipping from $70,000 to around $62,000.

Price Targets: Analysts are targeting $64,000 and $60,000, with potential for a short squeeze if sentiment turns overly bearish.

Increased Withdrawals: Rising Bitcoin withdrawals from exchanges indicate positive accumulation, suggesting a possible breakout.

Historical Insight: CryptoKaleo notes Bitcoin’s 500,000% increase since 2012, highlighting the current price range as a strong buying opportunity post-halving.

Short-Term Outlook: Expect possible consolidation or pullback, but the higher timeframe trend remains bullish.

Key Highlights

BlackRock's Game-Changer: Samara Cohen, BlackRock’s CIO for ETF and Index Investments, revealed plans to incorporate crypto ETFs into model portfolios by the end of this year and into 2025.

What Are Model Portfolios?: These are tailored investment portfolios designed to align with a client’s risk profile, aiming for specific outcomes while adapting to market changes.

Retirement Accounts Revolution: Including Bitcoin in retirement accounts might entice more investors to view crypto as a solid long-term investment option.

Legitimacy on the Rise: Following BlackRock's announcement, states like Texas and Louisiana are considering Bitcoin as a strategic reserve asset, signaling its growing acceptance and legitimacy.

Crypto Updates

ETHE's Tough Week: Grayscale’s Ethereum Trust faced a $98 million outflow on July 29, marking four straight days of losses.

This could indicate that some investors are pulling back from Ethereum for now.

Analyst Mads Eberhardt hints at a potential turnaround by week’s end, which could boost ETH prices.

ETH ETF Inflows: While Grayscale's ETH ETF struggles, other ETH ETFs are thriving, with BlackRock leading with $500 million in inflows. The coming days could be crucial for ETH's price trajectory.

BlackRock's ETF Boom: BlackRock scooped up $205.6 million in Bitcoin ETFs, boosting its total holdings to a staggering $19.9 billion since launch. Meanwhile, GBTC saw $54.3 million in outflows, and Fidelity added $5.9 million.

ETF Frenzy: BlackRock and Fidelity’s combined Bitcoin ETF holdings now top 519,597 BTC worth $34.9 billion. With $1.7 billion already pulled out, the market might see a buying opportunity soon.

Key events to watch in the crypto world

July 30 (Tue): EU releases Q2 GDP data.

July 31 (Wed): EU CPI inflation data is announced.

July 31 (Wed): US Federal Reserve announces interest rate decision.

August 01 (Thu): Bank of England reveals interest rate decision.

August 02 (Fri): US unemployment figures are released.

End of July: Speculated settlement in Ripple vs. SEC case.

Keep an eye on Bitcoin's potential recovery, Ethereum's ETF trends, and key economic events that could influence future price movements.

Get ready for an explosive crypto bull run! With possible rate cuts and increased institutional buying, Bitcoin could soar to $72,000. The coming months promise unprecedented market growth, so stay bullish and prepared!