Why traders are betting on Ethereum crash, driving market sell-off

Can Ethereum price reclaim $3,000 before Q2?

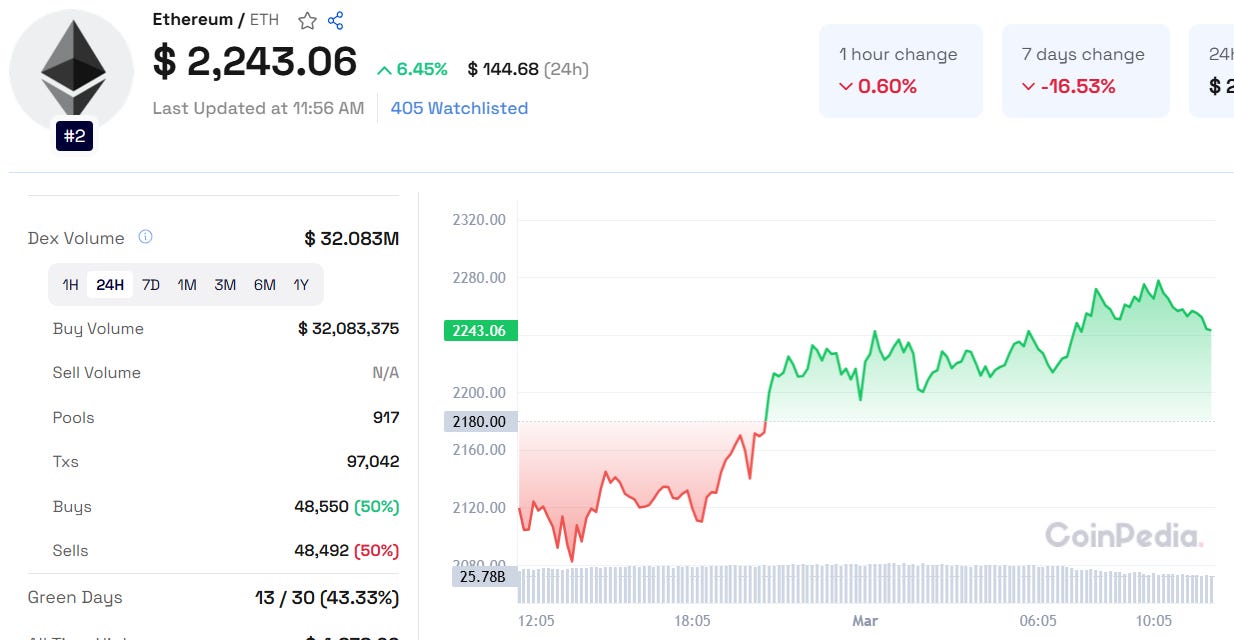

Ethereum (ETH) fell 4% on Friday, trading at $2,214 as the broader crypto market experienced a sharp sell-off. The altcoin’s price action was influenced by Bitcoin’s drop below $80,000 before a partial recovery.

Market Overview

ETH long/short ratio stands at 0.9562, indicating more short positions than long ones. A ratio below 1 suggests traders expect further downside.

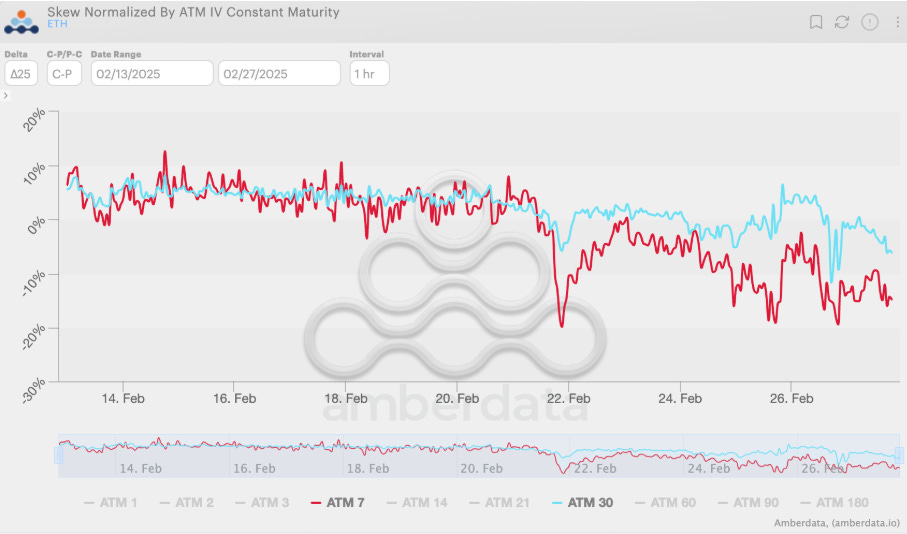

Implied volatility (IV) for 7-day at-the-money (ATM) options dropped from 84% to 65%, signaling temporary price stabilization. However, IV could rise ahead of the March 19 FOMC meeting and Ethereum’s Pectra upgrade in April.

Read ETH Price Prediction for more detailed insights

Institutional Outflows and Selling Pressure

Bitcoin ETFs recorded significant outflows:

February 25: -$1.14 billion

February 24: -$540 million

These outflows add selling pressure across crypto markets.

ETH’s 25-delta skew for 7-day and 30-day options declined by 15% and 6%, respectively, with strong demand for put options, indicating traders are hedging against further downside.

Also Read: CFX Price Prediction 2025, 2026 – 2030: Will CFX Price Hit $1?

Key Support and Resistance Levels

$1,890 is a major support zone, with 1.82 million ETH accumulated in August 2023. A break below $2,100 could accelerate a decline toward this level.

While some whales are selling, long-term investors continue accumulating ETH, signaling mixed sentiment in the market.

Market Outlook

Some traders remain cautious, expecting more downside pressure.

Others, including BecauseBitcoin’s CEO, believe ETH is set for a breakout once the monthly RSI surpasses 70, signaling strong momentum.