Hey Crypto Lovers!

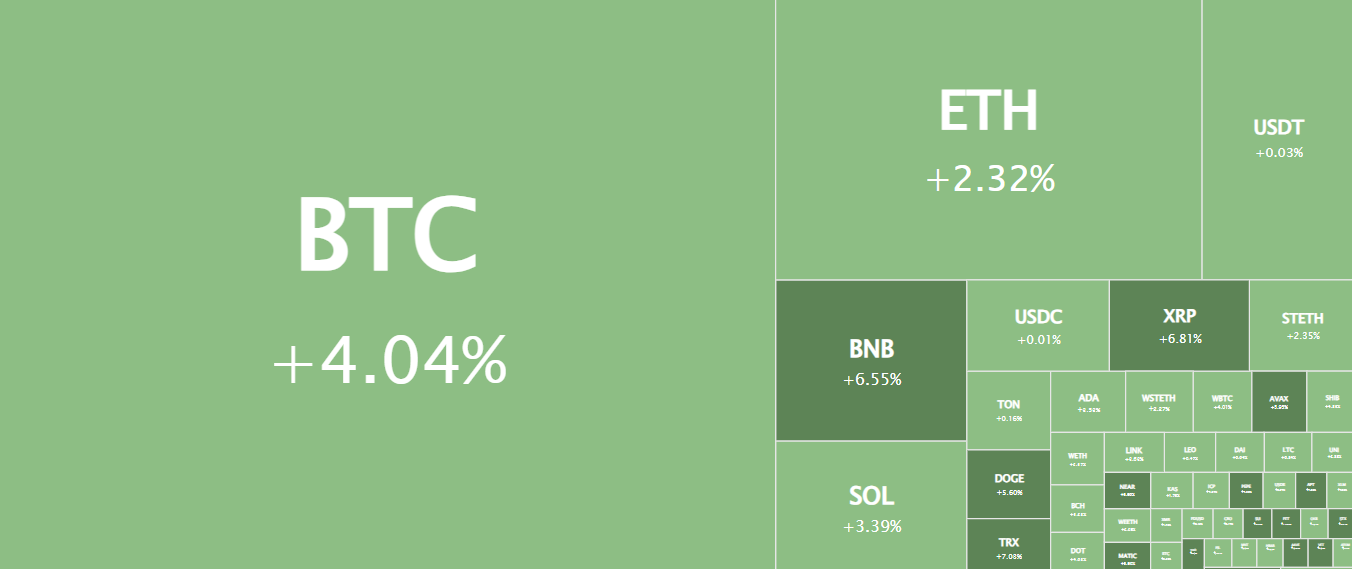

The cryptocurrency market has witnessed a significant uptick in the past 24 hours, with Bitcoin leading the charge. Below is a breakdown of the key highlights from today's crypto market data.

BTC Dominance on the Rise

Dominance Increase: Bitcoin's market dominance increased to 56.055%, up by 0.273% from the previous day.

Market Cap Growth: The total market cap of all cryptocurrencies surged by 3.522%, reaching $2.15 trillion from $2.07 trillion.

Trading Volume Spike: There was a significant 30.583% increase in trading volume, jumping from $49.55 billion to $64.7 billion.

BTC Inflows: Bitcoin saw substantial inflows, with 5161 BTC today compared to 1374 BTC yesterday. This uptick signals strong buying interest.

Fear in the Market: Despite the price increase, the Fear and Greed Index is at 30, indicating that fear still lingers among investors.

Bitcoin Price Analysis

Current Price: Bitcoin is trading at $60,942.97, a 3.68% increase over the past 24 hours.

Price Recovery: The crypto market is rebounding, with $73 billion in inflows within the last day.

Bitcoin is back above $60,000 but needs to confirm this level as support to continue its upward momentum.

Potential Rally: If Bitcoin solidifies $60,000 as support, it could rally towards $63,100 and potentially hit $65,000. However, if the momentum weakens, the price could struggle to break past $63,100.

Market Movements and Tether Activity

Tether Treasury: The Tether treasury minted $1 billion USDT on the Tron network, reflecting growing adoption of Tron. Over the past year, Tether minted 33 billion USDT, with 19 billion on Tron and 14 billion on Ethereum.

Market Cap Growth: The crypto market added $65 billion in the last 24 hours, with Bitcoin reclaiming $61,000 and Ethereum reaching $2.7K.

Corporate Bitcoin Investments

Metaplanet’s Purchase: Metaplanet Inc bought an additional 57.273 BTC, worth $3.39 million, increasing their total holdings to 360.368 BTC. This purchase led to a 13% surge in the company’s stock price after the announcement by CEO Simon Gerovich.

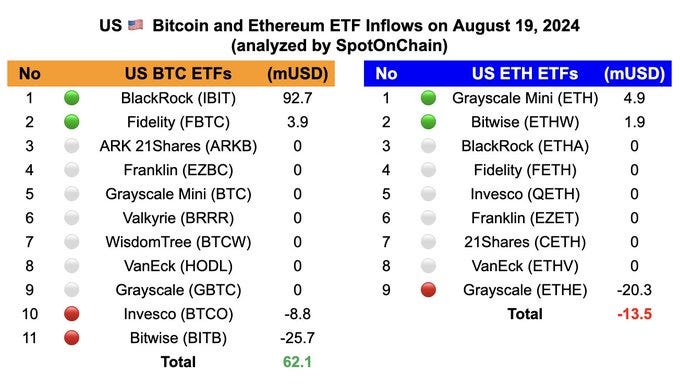

ETF Activity

Bitcoin Net Inflows: Bitcoin ETFs saw a net inflow of $61.98 million, with BlackRock's IBIT ETF leading at $92.68 million. Fidelity's FBTC ETF added $3.87 million.

Total Asset Value: The combined net asset value of Bitcoin spot ETFs is now $53.77 billion.

Ethereum Net Outflows: Ethereum ETFs had a net outflow of $13.52 million, with Grayscale's ETHE ETF losing $20.30 million. However, Grayscale's Mini ETH ETF gained $4.92 million.

Total Asset Value: The total net asset value of Ethereum spot ETFs stands at $7.30 billion.

On-Chain Data Signals

Bearish Indicators: On-chain data for Bitcoin is showing bearish signals, with over 80% of short-term holders facing losses. This situation is similar to past market conditions in 2018, 2019, and mid-2021, suggesting a possible downturn.

Analyst Predictions: Crypto analyst Benjamin Cowen expects Bitcoin’s dominance to continue rising, potentially reaching 60%. However, Bitcoin must consistently close above key moving averages to maintain its bullish momentum.

What’s Next for Bitcoin?

Resistance Challenges: Bitcoin is approaching key resistance levels. Breaking through these could lead to new all-time highs, but failure to do so might result in a pullback.

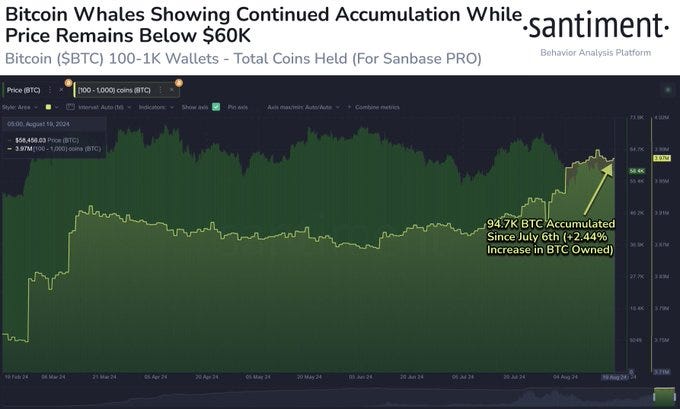

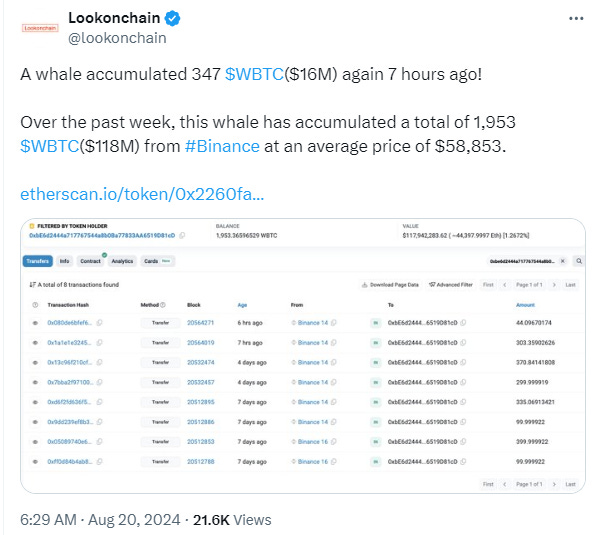

Whale Activity: Recent data shows large Bitcoin holders (whales) accumulating over 94,700 BTC in the past six weeks. This indicates confidence in Bitcoin's long-term potential despite short-term volatility.

The crypto market is experiencing a strong recovery, led by Bitcoin. However, caution is still advised as on-chain data suggests possible bearish trends. Keep an eye on key support and resistance levels as the market navigates its next moves.