Hey Crypto Champs,

Are traders leaning towards selling? The crypto market is buzzing with changes as Bitcoin faces volatility, ETF developments, and global tensions. Let’s explore the latest trends and market insights!

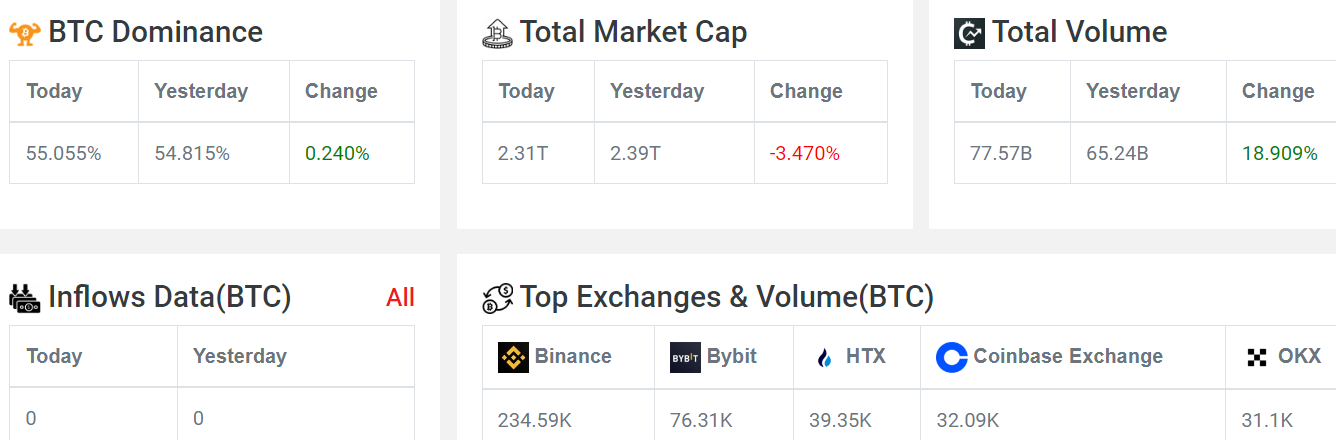

Crypto Market Overview

Market Cap: $2.9 trillion

Trading Volume: Up by 20.9%

Fear and Greed Index: Neutral at 52

Market Sentiment: Leaning towards selling

Heat Map: Mostly red, with Bitcoin down by 3.10%

Insights on ETFs

BlackRock Activity: BlackRock actively bought $118 million worth of Ethereum (ETH).

Grayscale Performance: Grayscale did not make significant purchases; instead, it sold about $133 million worth of assets. However, its mini ETF for ETH saw an inflow of approximately $19.5 million.

Market Sentiment: Overall, market sentiment appears to be negative despite some buying activity.

Future Predictions: Katalin Tischhauser from Sygnum Bank predicts that Ethereum spot ETFs could reach between $5 billion and $10 billion in assets under management (AUM) within their first year, driven by positive net flows.

Potential Price Increase: Tischhauser believes that strong inflows could significantly increase Ether’s price, potentially reaching $6,000.

FOMC Meeting Insights

Rates Remain at 5.5%: The FED decided to keep interest rates unchanged at 5.5% until there is clear evidence that inflation is moving towards the 2% target.

Possible Rate Cut in September: Jerome Powell indicated that a rate cut in September depends on better inflation data. If inflation improves, a cut may be considered.

Future Rate Cuts: Powell stated that the possibility of multiple rate cuts will depend on future data.

Political Independence: Powell emphasized that political factors do not influence their decisions, despite speculation about the timing of rate cuts.

Market Trends and Influences

Middle East Tensions: Rising tensions in the Middle East are putting pressure on the market.

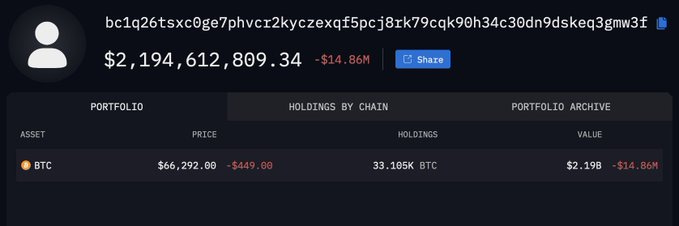

Mt. Gox Impact: The movement of 33.96K BTC (worth $2.25 billion) to addresses likely associated with BitGo is affecting market sentiment.

US Government Transfers: The recent transfer of $2 billion in Bitcoin by the US government, following Trump’s “no sell” statement, is also contributing to market fluctuations.

Trump's Sneakers on eBay: Donald Trump’s limited-edition Bitcoin-themed sneakers have been listed on eBay by scalpers for prices between $700 and $2,500.

Shift in Trump's Crypto Views: Trump, who was once skeptical of Bitcoin, is now promoting pro-crypto policies as part of his re-election campaign.

Bitcoin Price Analysis

Current Price: Bitcoin is trading at around $64,402.

Support Zone: Key support is between $65,000 and $61,000. If this level fails, prices could drop to $59,000.

Resistance Level: The main resistance to watch is around $67,000.

Market Activity: There’s a battle between buyers and sellers. Significant bid orders are between $66,000 and $65,370, while ask orders are between $66,800 and $67,000. This competition is causing the price to stagnate.

Coinglass reports $45M in Bitcoin long liquidations and $10.94M in shorts. Key liquidity clusters: $63,460 and $70,380.

Bitcoin faces downward pressure amid market volatility, influenced by recent Fed decisions, geopolitical tensions, and significant ETF activities, while strong support and resistance levels remain critical to watch.