Hello, everyone!

🚨 Crypto Chaos Alert! 🚨 Macroeconomic woes and market trends are hitting Bitcoin hard. TON Foundation reassures users after a brief outage, while Ether ETFs face massive outflows. Dive into the details!

Bitcoin’s Recent Dip

Market Movement: Bitcoin is currently experiencing a drop. This decline has led us to question if it was expected or if it took us by surprise.

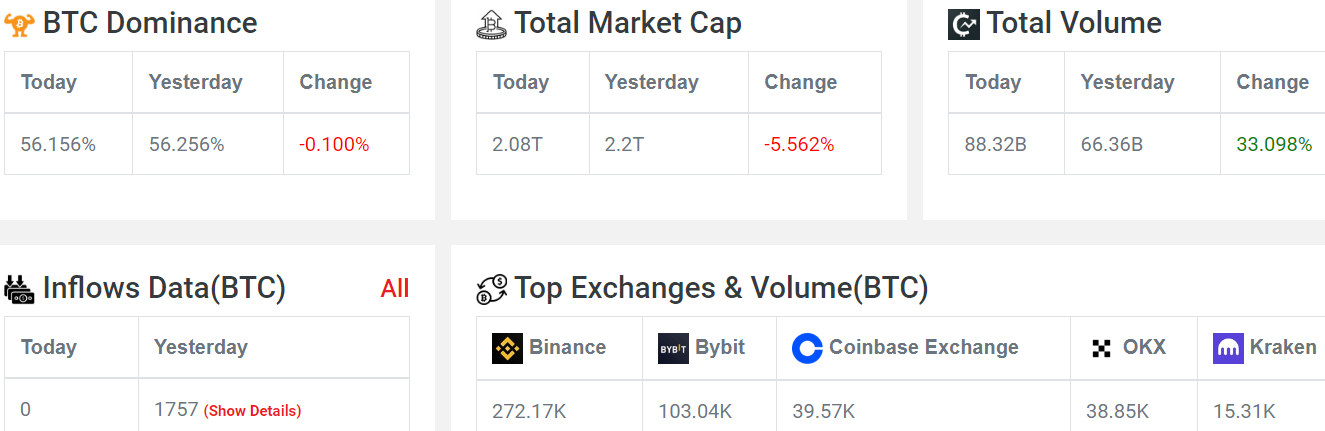

Current Figures: Bitcoin is down by 5.7%. We haven't seen significant inflows since midnight. Yesterday, there was an inflow of 1007 BTC.

Fear & Greed Index: The index is at 30, indicating a lot of fear in the market.

Volume Concerns: The market volume is low, which is contributing to the ongoing decline. We saw a recent candle that ended the previous momentum.

Bitcoin Price Analysis

Details of Drop: Bitcoin fell 6.5% in four hours, with a major drop in just two hours.

Liquidity Issues: Liquidation of long positions in a low-volume market. $621 million worth of positions liquidated, affecting 8757 traders.

Key Reasons for Decline:

Traders anticipating U.S. PCE inflation data.

Nvidia earnings results due August 28.

Increased whale dumps.

Large Bitcoin whale transferred 2,300 BTC ($141.81 million) to Kraken.

Upcoming Data: US PCE inflation data and Fed’s policy stance could impact Bitcoin’s price.

Job Data: US job data on September 6 will influence Fed’s interest rate decisions and Bitcoin’s price.

Speculation: Potential rate cut by the US Federal Reserve, with a 66% chance of a 25bps cut in September. Hotter-than-expected PCE data could affect this outlook.

ETF Activity

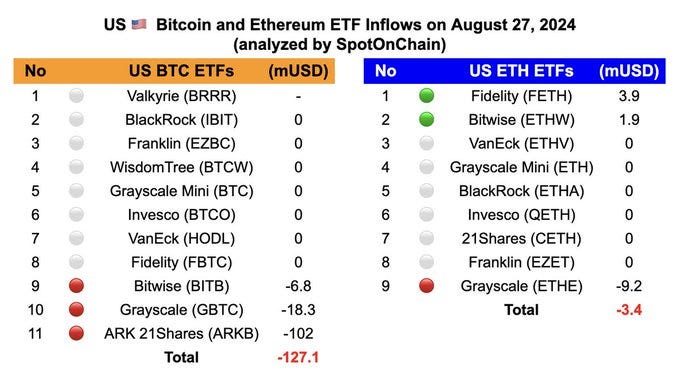

Bitcoin ETFs:

Major Sellers: BlackRock has been selling Bitcoin ETF positions, with no new buys from Fidelity. This led to a net outflow of $127 million on Tuesday.

Recent Trends: This downturn follows a period of inflows where Bitcoin ETFs attracted $756 million over eight days. Ark & 21Shares' ARKB experienced losses of $101.97 million, while Grayscale’s GBTC and Bitwise’s BITB faced outflows of $18.32 million and $6.76 million, respectively.

Ethereum ETFs:

Net Position: Ethereum spot ETFs have seen a consistent net outflow, totaling $3.45 million over nine days. Grayscale’s ETHE had a single-day net outflow of $9.18 million.

Recent Inflows: Fidelity’s FETH saw an inflow of $3.88 million, and Bitwise’s ETHW had an inflow of $1.86 million.

Pavel Durov's Detention

UAE Response: Paused $10 billion contract for fighter jets with France due to Durov’s detention.

Diplomatic Tension: UAE requested French government’s consular assistance for Durov.

French President’s Statement: Macron defended freedom of expression; Durov’s arrest part of a judicial investigation.

Release Odds: Polymarket data shows a 71% chance Durov will be released by September 30, and a 38% chance by September 15.

TON Blockchain Outage and Recovery

Current Status: TON blockchain resumed normal operations after a brief outage.

Cause of Outage: Network congestion due to airdrop of new TON-based memecoin DOGS.

Impact: Validators struggled with old transactions, affecting network consensus.

Assurance: TON Foundation assured users that all transactions are secure and processed.

Arthur Hayes’ Critique

- Monetary Policy Critique: Hayes argues US monetary policy is politically motivated rather than economically needed.

Interest Rate Impact: Recent Fed rate cut narrowed gap between USD and JPY, causing rapid appreciation of JPY, which might lead to market turmoil.

The crypto market is experiencing notable shifts, with Bitcoin’s drop, TON and Telegram issues, and ETF selling impacting sentiment. Historically, Q4 in halving years sparks significant movements. Stay steady and watch for Bitcoin’s potential rebound as it tests $60,000.