Hey Crypto Folks!

The recent crypto crash caught many off guard, but the good news is that it might be almost over. We could be gearing up for a strong rebound.

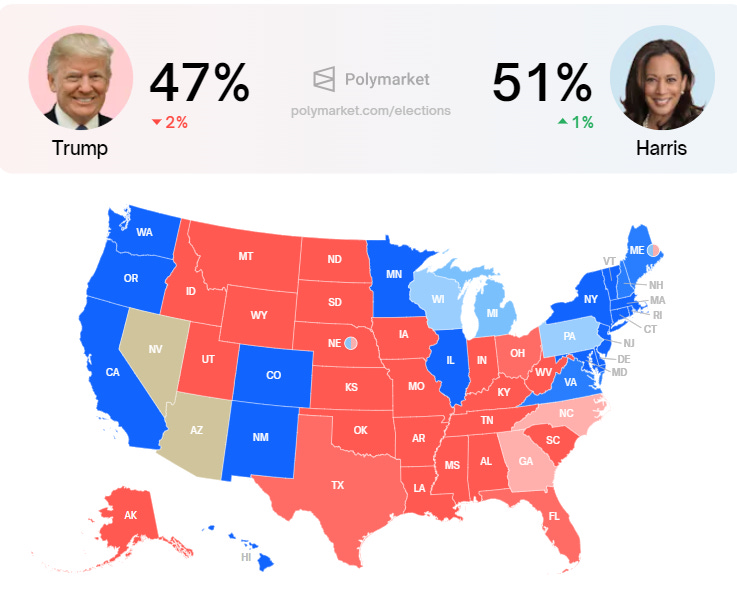

1. Trump’s Pro-Crypto Stance

Trump's Potential Win: Donald Trump is pro-crypto, and there’s a chance he could win the upcoming election. While polls show Kamala Harris leading, remember that polls aren’t always reliable—just look at 2016.

Impact on Crypto: If Trump wins and sticks to his pro-crypto stance, it could be beneficial for the market. However, if he doesn’t win, the impact on crypto might be minimal.

Election Neutral to Positive: Whether Trump wins or not, the election outcome is likely to be neutral to positive for crypto.

2. Bitcoin and Ethereum ETFs

Legitimizing Crypto: The Bitcoin and Ethereum ETFs are significant steps toward mass adoption, legitimizing crypto in the eyes of skeptics.

Increased Inflows: This year, a staggering $19.3 billion worth of Bitcoin has been purchased through U.S. ETFs. These ETFs have significantly boosted the market, driving Bitcoin to new highs. A similar effect is expected for Ethereum.

3. Solana ETF: A Potential Game-Changer

Altcoin Legitimacy: A Solana ETF could be a bigger deal for altcoins than the Bitcoin and Ethereum ETFs. It would bring much-needed legitimacy to the altcoin market.

Trump’s Influence: Trump has promised to replace Gary Gensler with a more crypto-friendly SEC commissioner if elected, potentially speeding up the approval of a Solana ETF.

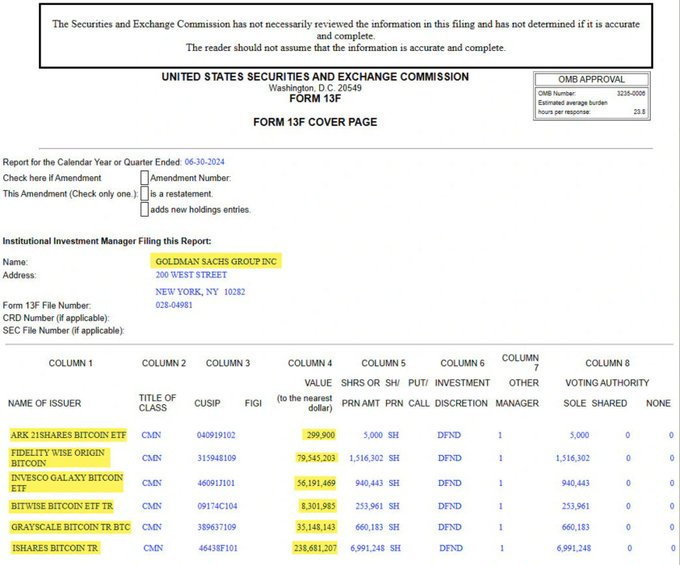

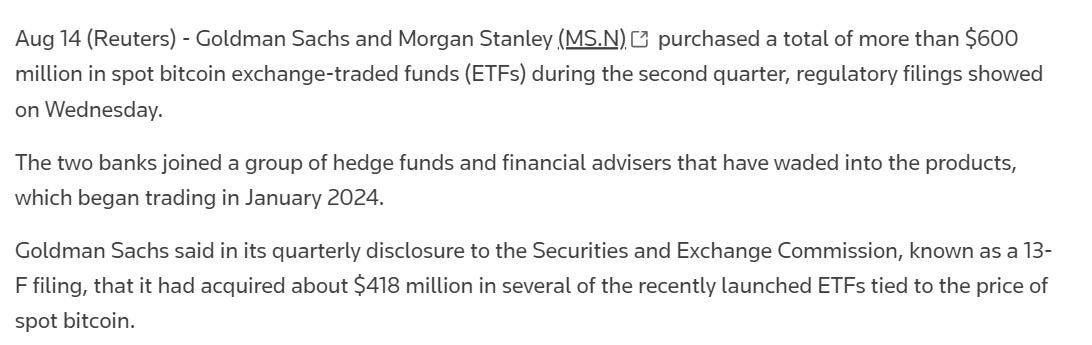

4. Institutions Are Buying Crypto

Big Players: Major institutions like Goldman Sachs and Morgan Stanley are heavily invested in Bitcoin ETFs, with Goldman holding nearly $500 million.

Growing Interest: Despite market dips, institutions are holding onto their Bitcoin and even increasing their stakes, signaling strong demand and confidence in crypto’s future.

5. Historical Trends: Q3 vs. Q4

Q3 Struggles: Historically, the third quarter has been the worst for crypto, with low activity as traders go on summer vacations.

Q4 Surge: However, Q4, particularly October and November, is usually the best time for crypto, with significant price increases just around the corner.

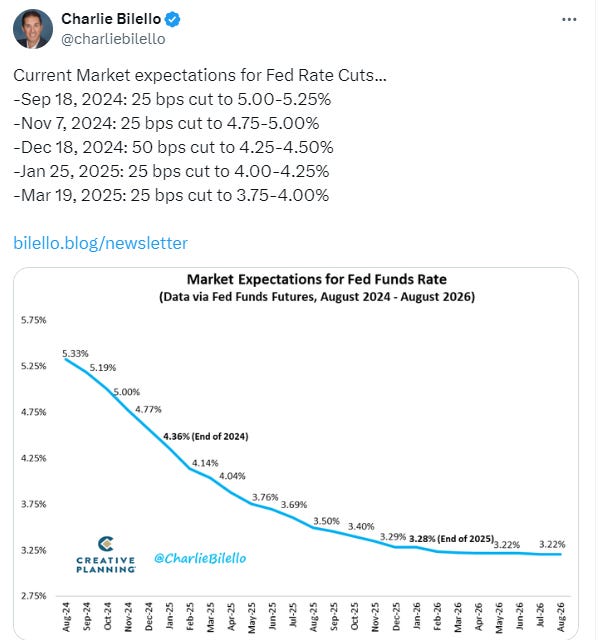

6. Fed Rate Cuts on the Horizon

Impact on Risk Markets: As the Fed is expected to start cutting interest rates soon, risk markets like crypto could see increased investment. Lower rates typically encourage investors to seek higher returns in riskier assets like crypto.

7. Supply and Demand: A Brewing Supply Shock

Bitcoin Supply: With 94% of all Bitcoin already mined, the supply is dwindling while demand is increasing, especially among institutions.

Ethereum Staking: Ethereum is also experiencing a supply shock, with a record amount of ETH being staked, taking it out of circulation.

8. Mass Adoption is Here

Consumer Adoption: Mass adoption is no longer just for institutions. Usdc tap-and-go payments are coming to Apple phones, allowing users to pay for everyday items like coffee with crypto.

Crypto Goes Mainstream: MetaMask’s partnership with Mastercard now enables direct spending from your MetaMask wallet, making crypto even more accessible.

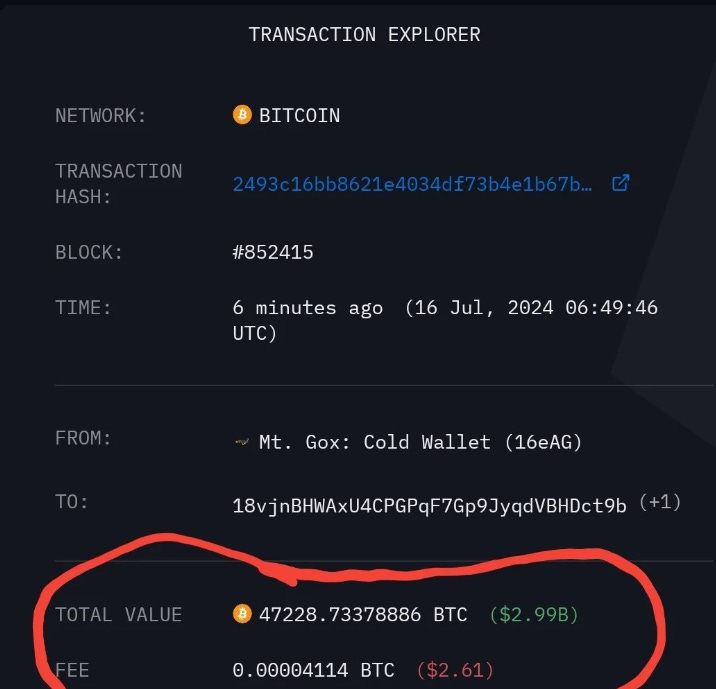

9. Bankruptcy Funds: A New Cash Injection

Mt. Gox and FTX: $18 billion from the bankrupt exchanges Mt. Gox and FTX is set to be paid back to creditors, many of whom are likely to reinvest in crypto. This could provide a significant boost to the market, especially as these funds are coming at the start of a potential bull run.

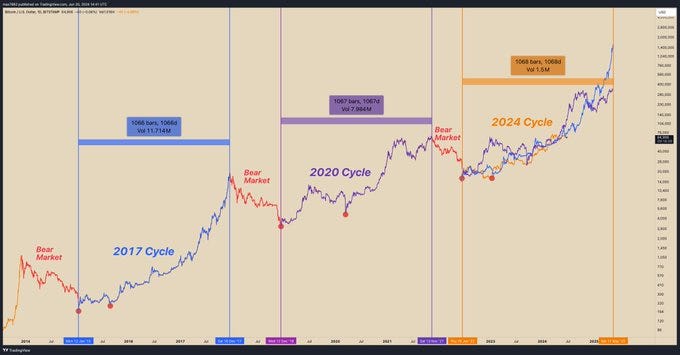

10. Bitcoin’s Cycle: Staying on Track

Not an Accelerated Cycle: Contrary to what some believed, this crypto cycle is not accelerated. Bitcoin’s performance is on par with previous cycles, with similar gains four months after the halving.

Peak Timing: Historically, Bitcoin peaks 16 to 18 months after a halving, and we’re only four months in. This suggests we have another 12 to 14 months of growth ahead.

These ten reasons make me bullish on crypto’s future. If you’ve been through a bull run, you know it can be a wild ride. Corrections and dips are part of the journey, so don’t panic.