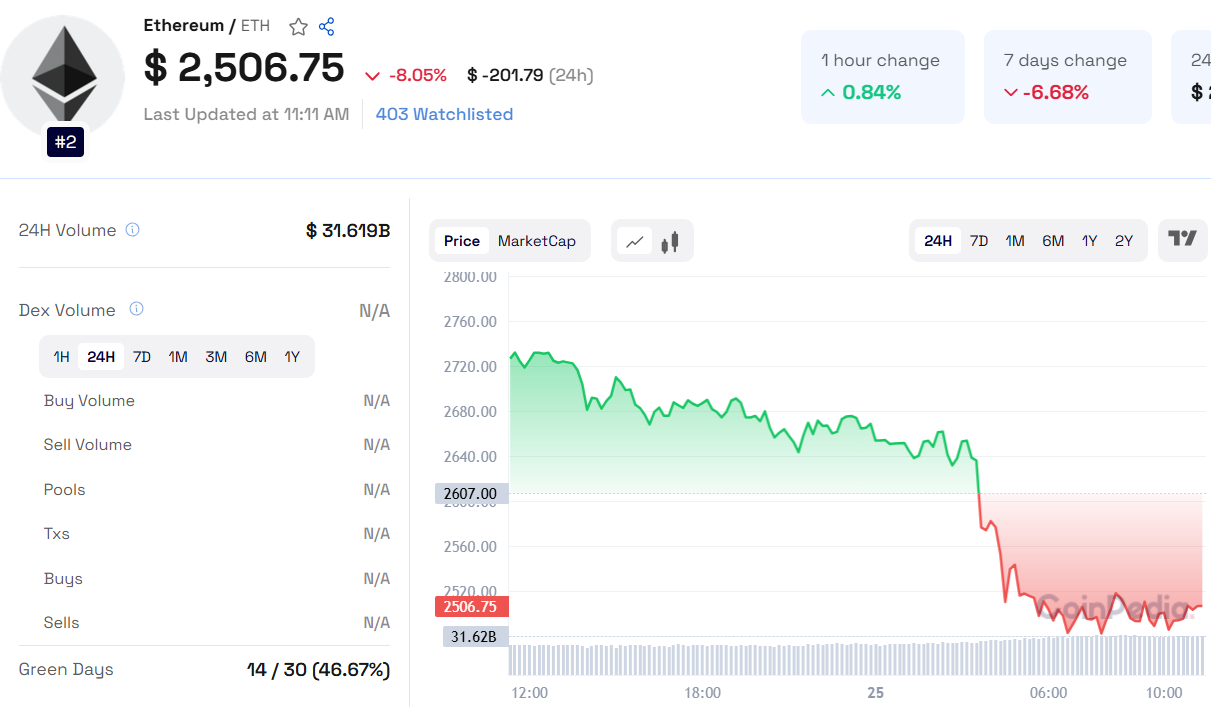

Ethereum (ETH) is experiencing significant downward pressure, recently dropping below $2,500 with a 7.6% decline in the past 24 hours. This follows a rejection from the $2,850 resistance level, leading to fresh lows.

Key Technical Indicators:

ETH is trading below $2,750 and the 100-hourly Simple Moving Average (SMA).

A bearish trend line has formed at $2,600 resistance.

The MACD indicator shows strong bearish momentum.

The RSI remains below 50, indicating weak buying interest.

Read Ethereum Price Prediction 2025 for detailed insights

Market Sentiment and Short Positioning:

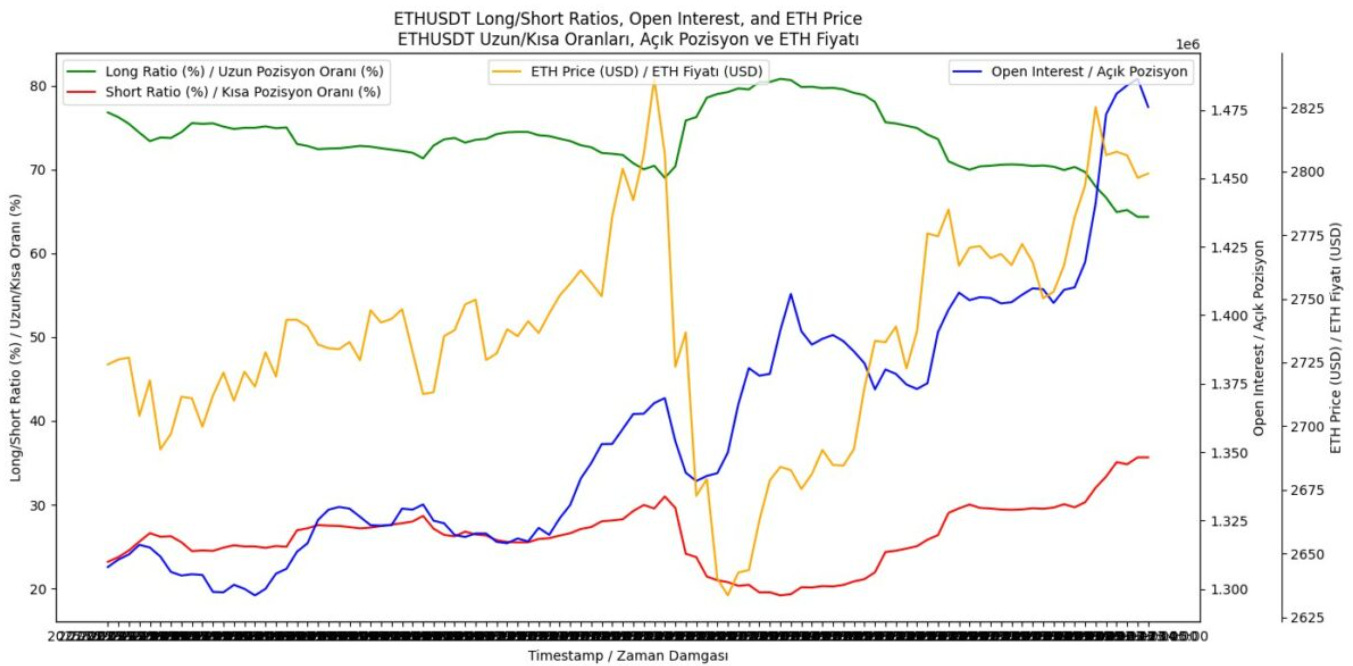

The Short Ratio has risen above 30%, while long positions have dropped below 75%.

Open Interest (OI) is increasing, suggesting traders are betting against Ethereum.

If shorts face a squeeze while OI continues rising, ETH could push above $2,825.

A shift in sentiment and increased long positions could support a move toward $2,800 or higher.

Also Read: Bitcoin Sv Price Prediction 2025, 2026 - 2030

Binance’s Large ETH Transfers:

Binance has been transferring large amounts of ETH to market makers and exchanges.

Transfers range from 1,000 ETH ($2.79M) to 1,520 ETH ($4.25M).

This activity could enhance liquidity or indicate strategic sell-offs, impacting ETH’s price movement.

Pectra Upgrade and Testnet Challenges:

The Pectra upgrade launched on the Holesky testnet but faced finalization issues.

Developers are working on fixes before rolling it out on the Sepolia testnet (expected March 5).

If successful, mainnet activation could happen in April.

Pectra aims to improve scalability, security, and validator staking.

Ethereum’s near-term outlook remains uncertain, with price action dependent on technical levels, Binance’s movements, and the progress of the Pectra upgrade.