Hey Crypto Folks!!

Stablecoin Supply Surge Signals Bullish Shift! 📈 Bitcoin is at a crossroads—could it plunge to $50K or soar to $67K? 🌟 Find out what’s next for BTC! 🔍

Crypto Market Overview

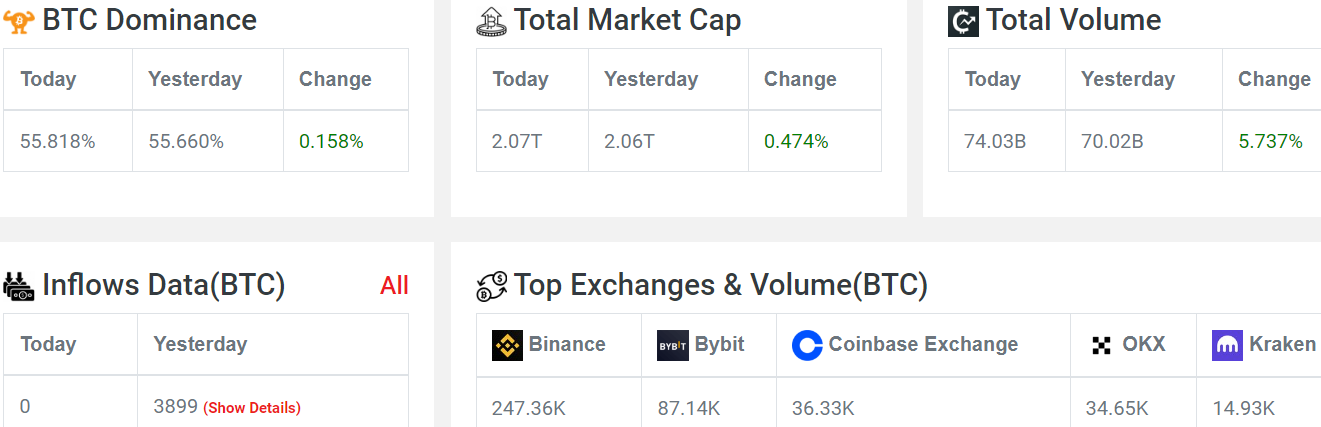

Current Market Snapshot: The market cap is down by 0.92%, and the volume has increased by 7.2%. Unfortunately, there’s no fresh data on inflows since midnight. We saw three inflows yesterday, totaling 3,899 BTC.

Fear & Greed Index: The index is currently at 27, reflecting fear. It was expected to be in extreme fear territory, but it’s just a few points short.

Market Sentiment: The sentiment in the past hour is neutral, with BTC down by 32% and Ethereum down by 2.31%. Overall, the altcoins are also struggling.

Stablecoin Supply Surge: The supply of stablecoins, especially Tether (USDT), has increased significantly since the August 5 crypto crash. On-chain data shows a substantial flow of stablecoins to centralized exchanges, suggesting that investors are buying the dip.

Bitcoin Price Analysis

Current Price: As of now, Bitcoin is priced at $58,286.

Recently, we observed a dip to $56,000, with some exchanges even testing the $55,000 level this week. After that, the market showed some recovery.

Market Behavior: Key factors like CPI data and jobless claims have impacted the market.

Bitcoin has been unable to break the $61,300 resistance due to macroeconomic challenges. After hitting strong resistance, Bitcoin dropped to under $57,000 but has since partially recovered.

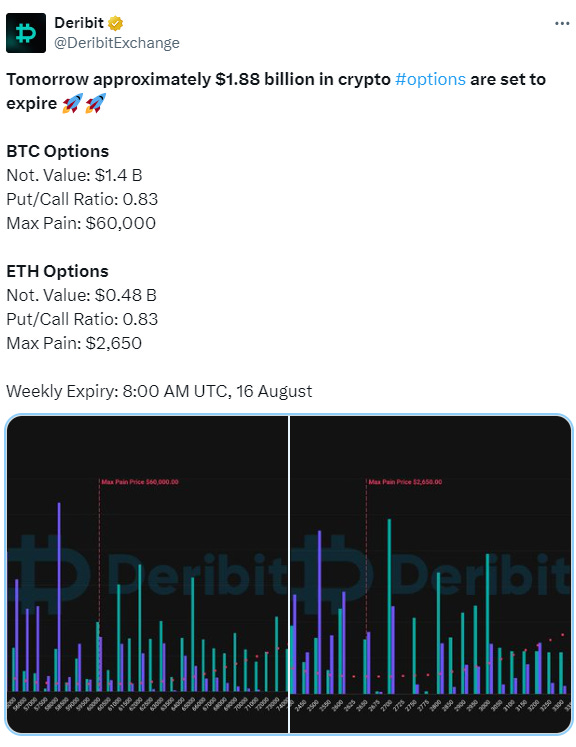

Bitcoin Options Expiry: Today, 24,000 Bitcoin options contracts are expiring with a put-call ratio of 0.83, signaling a close contest between bulls and bears

Ethereum Options Expiry: Along with Bitcoin, 184,000 Ethereum options are also expiring with a put-call ratio of 0.80.

Death Cross Analysis

Historical Context: The Death Cross pattern usually signals a market downturn. Bitcoin's price has dropped 7.72% since the pattern emerged. Although it often leads to a decline, market behavior can be unpredictable.

Current Status: The risk of further decline remains. We need to see if the Death Cross is invalidated by a candle closing above it. While it doesn’t guarantee a 100% drop, it often precedes lower prices.

ETF Updates

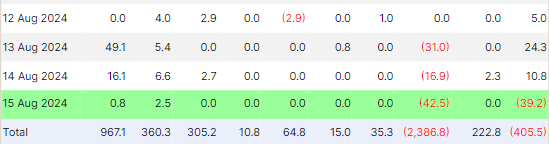

BlackRock Bitcoin ETF: No new purchases by BlackRock were recorded on the 14th-15th. The overall impact has been minimal, showing a net increase of $11.1 million.

Grayscale Mini Bitcoin ETF: The Grayscale mini Bitcoin ETF saw an inflow of $13.7 million. The largest contribution came from Fidelity’s FBTC, which added $16.25 million.

Ethereum ETF: Ethereum ETF volumes are currently low, with a net outflow of $39.2 million. Grayscale has reduced its holdings, and investors withdrew $42.5 million from the Grayscale ETHE ETF.

US Election 2024

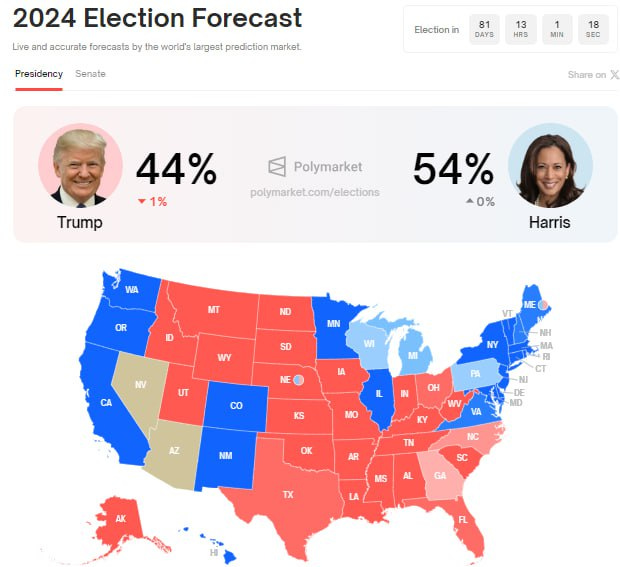

Kamala Harris: Her odds of winning the presidential election have reached a record high of 54% on Polymarket, leading Donald Trump by 10%.

Betting Activity: Donald Trump has $75.6 million in bets supporting his victory, while Kamala Harris has $66.5 million in bets backing her win.

Why is Bitcoin Down? Market Outlook:

Previous Selloffs: The recent decline follows two notable market drops this summer. The first was triggered by a German government agency selling seized bitcoins, and the second by a Bank of Japan rate hike affecting global equity markets.

Today’s selloff does not have a clear catalyst. Despite a strong performance in U.S. equity markets (Nasdaq up 2.4%, S&P 500 up 1.6%), cryptocurrencies continue to fall.

Institutional Adoption: Marathon Digital raised $300 million in convertible debt to purchase over 4,000 bitcoins, and Semler Scientific raised $150 million to buy more Bitcoin.

Despite favorable conditions, such as a strong stock market rally and expectations of a Federal Reserve rate cut, Bitcoin prices have not responded positively.

Trading Strategy

Current Stance: The market often experiences temporary price manipulation, so I recommend waiting for a clearer signal before making any buying or selling decisions.