Hey Crypto Champs!

The crypto scene is buzzing with explosive ETF news, market trends, and the dramatic twists of the upcoming US elections! Stay tuned for the hottest updates and what they mean for your portfolio!

Crypto Market Overview

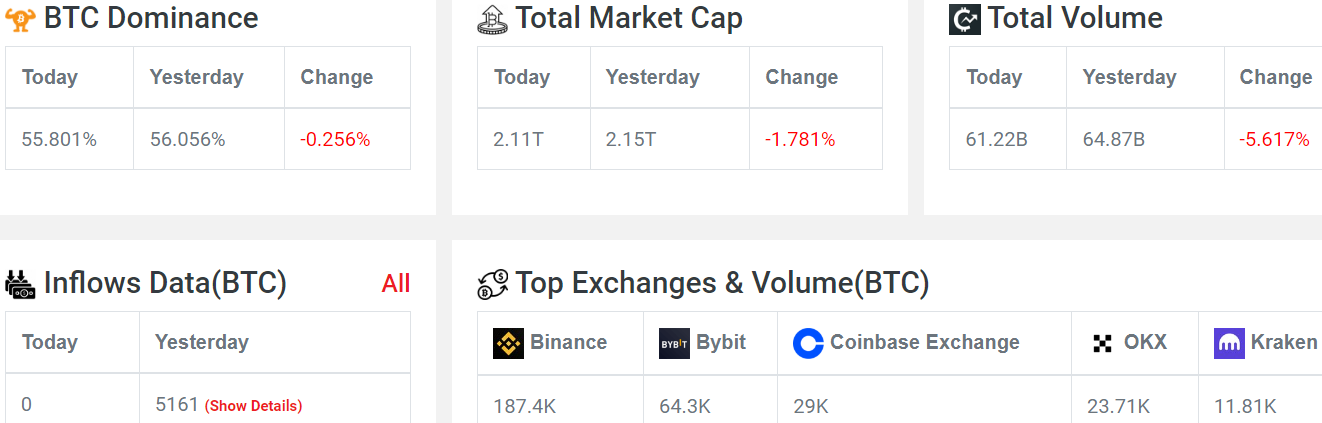

Market Cap: The market cap is down by 1.8%.

Volume: Trading volume is up by 1.5%.

Inflows: No new inflow data has been observed since midnight. However, yesterday we recorded four inflows, totaling 5,161 BTC.

Fear & Greed Index: The index is currently at 26, indicating a state of fear. Just a slight dip could push us back into extreme fear territory.

Sentiment: Over the past hour, market sentiment has leaned towards selling.

Heat Map: Bitcoin (BTC): Down by 2.42%, Ethereum (ETH): Down by 2.75%.

Bitcoin Price Analysis

We observed resistance around the 61,340 level yesterday.

Currently, BTC is hovering near its support zone, with the next support level around 57,000.

Resistance remains near the 61,231 level.

ETF Insights

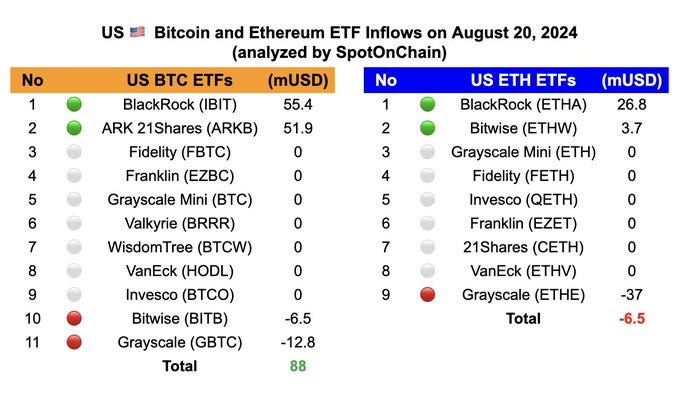

On the 20th, BlackRock and Ark Invest made significant purchases. BlackRock bought $55.5 million worth of assets, while Ark Invest purchased $51.9 million. On the other hand, Bitwise continued to sell, marking the second consecutive day of selling from their side. Grayscale also continued its selling trend.

The net outlook is positive for Ethereum’s ETF, which has seen minimal volume in recent days. However, BlackRock made a notable purchase of $26.8 million, while Grayscale sold $37 million, resulting in a net negative impact.

Mt. Gox Update

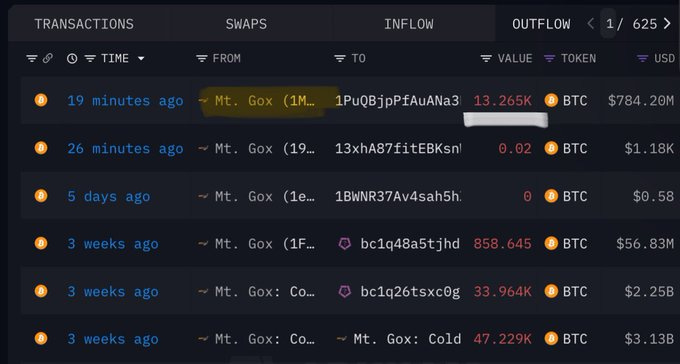

Mt. Gox recently transferred 13,265 BTC,leading to a 3% price drop, as Bitcoin lost $2,000 in hours. They still hold 46,164 BTC.

Analysts suggest a $12.7 billion cash distribution from FTX in Q4 could potentially ignite a Bitcoin price pump.

US Election and Market Implications

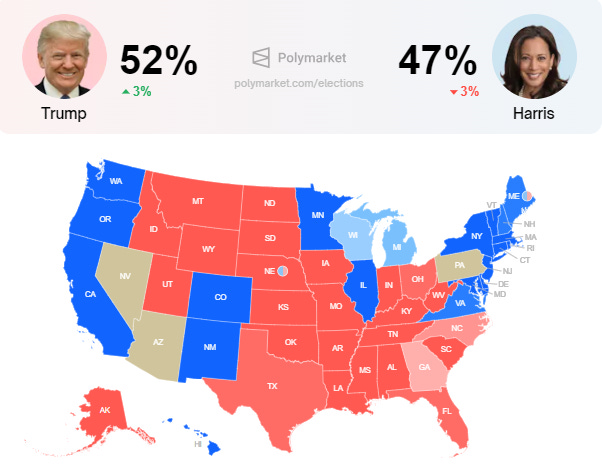

US Election Update: Initially, Kamala Harris was leading, but Trump has recently surged to 52%, while Harris has dropped to 47%. This shift could have significant implications for the crypto market.

Solana ETF Outlook

Brazil Approves Second Solana ETF: The Brazilian Securities and Exchange Commission (CVM) has approved a second Solana ETF, expanding crypto investment options in Brazil.

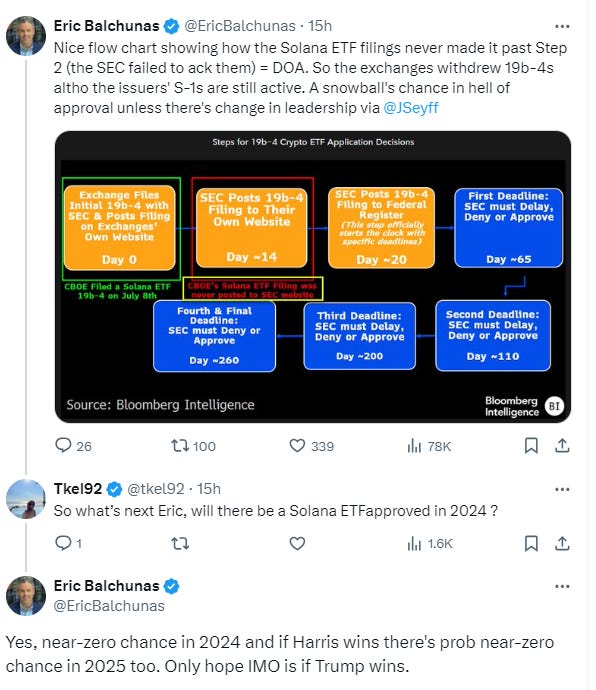

Contrast with U.S. Market: Unlike in Brazil, Solana ETFs in the U.S. face significant challenges due to the SEC’s stance on Solana as a security, leading to the rejection of Solana ETF applications from VanEck and 21Shares by the CBOE.

Lack of Progress: By rejecting the ETF filings, the SEC has effectively stalled any progress on Solana ETFs in the U.S., indicating that approval might not happen soon.

Comparison with Other Cryptos: Lark Davis, is questioning why Solana is being treated differently from Ethereum and XRP, which have been considered non-securities.

Solana ETF: According to ETF analyst Eric, the chances of a Solana ETF in 2024 are slim, especially if Harris wins the election. However, if Trump wins, there’s a higher probability of seeing it sooner.

Donald Trump’s Popularity

Trump's Strategy: His growing popularity is attributed to his connections with well-known market figures, which might be influencing his lead in the polls.

Running Mate's Statement: In a podcast interview, Nicole Shanahan, RFK Jr.'s running mate, mentioned that they are considering two options: continuing the campaign independently or withdrawing to support former President Donald Trump.

Trump's Response: Trump expressed openness to considering a role for RFK Jr. in his administration if Kennedy ends his independent bid and endorses him.

Upcoming Events to Watch

FOMC Meeting Minutes: While these usually don't bring any surprises, today's minutes could hint at a rate cut in September. If such an update comes through, it could have a noticeable impact on the market.

Jobless Claims Data: This is expected tomorrow, and the market could become volatile based on how the data turns out.

August is often shaky for Bitcoin, but recent signs suggest the correction may end soon. A breakout above $61-62K could lead to new all-time highs. Altcoins are showing strong movement, with volatility expected from today’s FOMC minutes and tomorrow’s Fed speech.