Ethereum (ETH), the second-largest cryptocurrency, has faced significant challenges in recent weeks. While Bitcoin hit a new high, Ethereum struggled to recover after dropping below the $3,000 mark. Here’s a detailed breakdown of Ethereum's current market situation and its potential future trajectory.

Ethereum Price Today: Struggles Amid Market Volatility

Last week, Ethereum’s price dropped below the crucial $3,000 support level, causing panic among investors. Although the bulls pushed the price back to $2,900 and beyond, the recovery has been lackluster due to low trading volume. As of today, Ethereum is trading within a consolidation phase, fluctuating between $3,200 (support) and $3,500 (resistance).

Key Levels to Watch:

Support: $3,200, $2,900, and $2,723

Resistance: $3,500, $3,830, and $4,107

Read detailed Ethereum Price Prediction 2050 for more insights

What’s Driving Ethereum’s Price Movement?

1. Bearish Short-Term Structure

Ethereum’s price chart on the daily timeframe shows a bearish trend, with lower highs and lower lows. If the $3,200 support breaks, Ethereum could test $2,723 or even $2,500. However, if the bulls regroup and push the price above the falling resistance line, Ethereum could reclaim $3,830 and potentially $4,107.

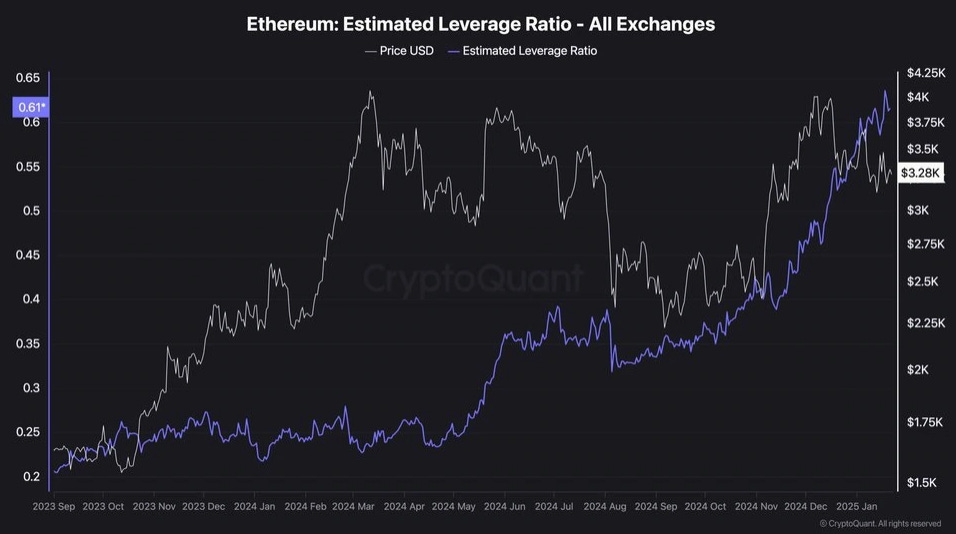

2. Elevated Leverage Ratio

Ethereum’s Estimated Leverage Ratio, which measures leverage in the derivatives market, has been climbing. While this indicates growing market interest, it also increases the risk of sharp price swings, including sudden liquidations.

3. Ethereum Foundation Leadership Challenges

The Ethereum Foundation (EF) faces criticism over centralization concerns and its roadmap prioritizing layer 2 networks. Discussions about creating a “Second Foundation” to address research and development have sparked mixed reactions. While some view this as bullish for Ethereum, others remain skeptical.

Also Read: AMP Price Prediction 2030

Bullish Predictions for Ethereum’s Future

Despite short-term struggles, Ethereum’s long-term outlook remains positive. Crypto analyst Virtual Bacon predicts Ethereum could hit $14,000 by the end of 2025. This bullish Ethereum price prediction is supported by:

Increased ETF inflows

Pro-crypto regulatory policies

A potential altcoin season

By 2030, Ethereum’s price could rise further, driven by innovations in scalability and adoption of decentralized applications (dApps).

Will Ethereum Go Up? Key Factors to Monitor

To determine whether Ethereum will regain momentum, traders should closely watch these indicators:

Price Action: A breakout above $3,500 could signal bullish momentum.

Volume Inflow: Higher trading volumes are essential for a sustained rally.

Leverage Ratio: Sudden changes in leverage could lead to volatility.