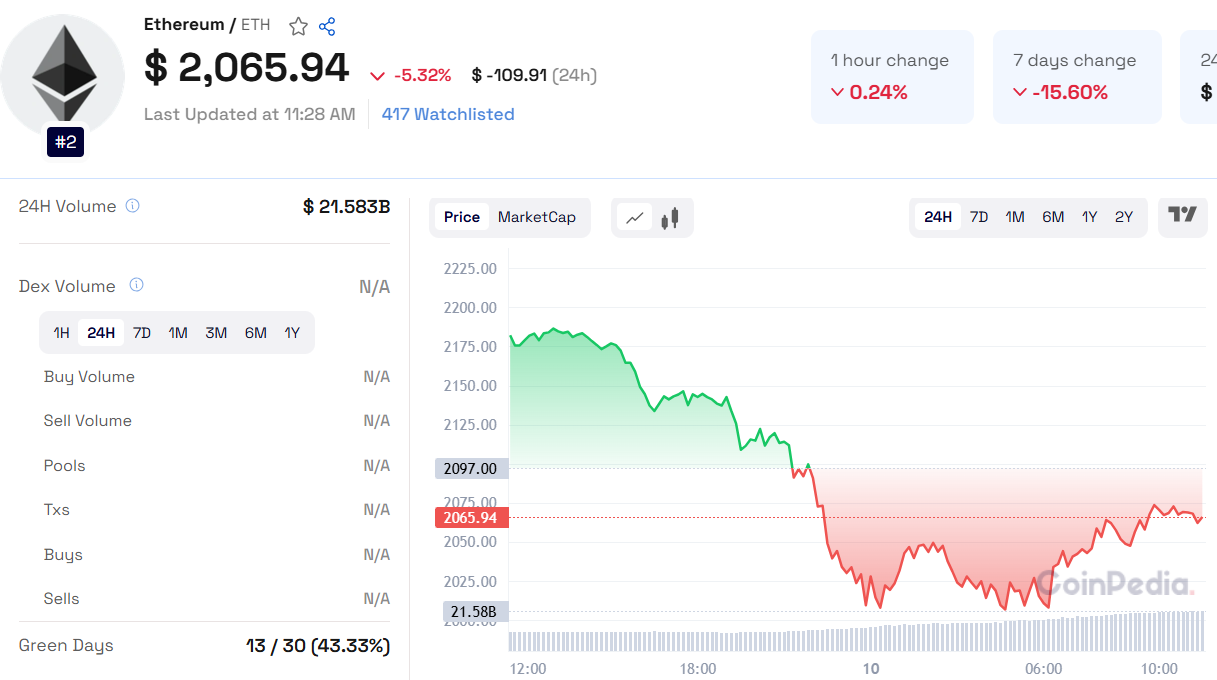

Ethereum (ETH) experienced a sharp decline last week, closing below the critical $2,125 support level and falling nearly 20%. On Monday, ETH traded around $2,051, with bearish momentum indicating a potential retest of the $1,905 support level.

Key Technical Indicators:

RSI: The daily chart’s Relative Strength Index (RSI) is at 35, showing bearish momentum after rejecting its neutral level of 50.

MACD: Bearish crossover last week suggests the continuation of a downtrend.

Price Scenarios:

Bearish Case: If the downtrend continues, ETH could test support at $1,905.

Bullish Case: A recovery above $2,125 might push ETH towards $2,359 resistance.

Read ETH Price Prediction for 2025, 2026, - 2030 for more detailed insights

Historical Performance:

2022 Bear Market: ETH dropped -80% post-FTX collapse but showed resilience with a 53.11% drawdown stabilization at $2,300 in March 2025.

Previous Patterns: ETH endured -70% and -60% drawdowns in 2018 and 2021, both followed by strong recoveries.

Market Catalysts:

2024 Dencun Upgrade & ETF Approvals: Boosted ETH’s recovery and reinforced long-term strength.

Whale Accumulation: Increased confidence during price dips.

Future Projections:

Potential ATH Breakout: If ETH rallies to $3,000-$4,164.

Risk of Drawdown: Regulatory issues or market manipulation could cause a -40% to -50% correction.

Also Read: THORChain Price Prediction 2025, 2026 – 2030

Volatility Insights:

Binance Liquidation Heatmap: Shows trading between $2,050 and $2,250, mirroring historical volatility.

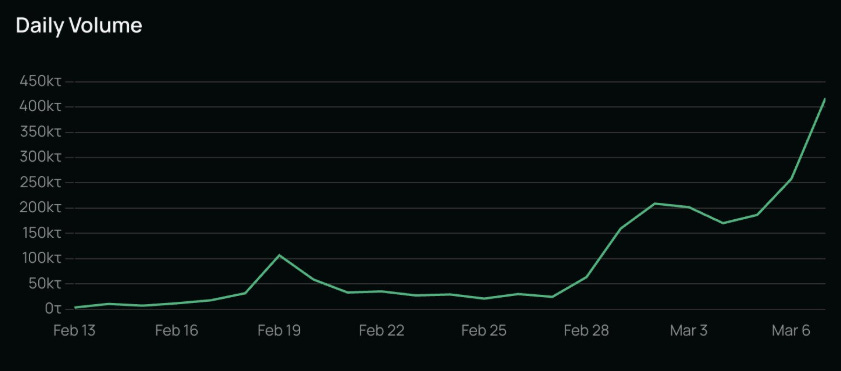

Volume Trends: Between February 13 and March 6, volume surged from 50k to 450k, showing rising investor interest.

Takeaway: Ethereum’s historical resilience and current market behavior suggest potential for a bullish recovery. However, traders should monitor regulatory developments and volume trends to navigate potential volatility.