Hey crypto enthusiasts!

We're in a strong bull market, mirroring past cycles. No rate cut yet suggests further gains ahead. This means Bitcoin and crypto could see more upside in the coming weeks.

Crypto Market Overview

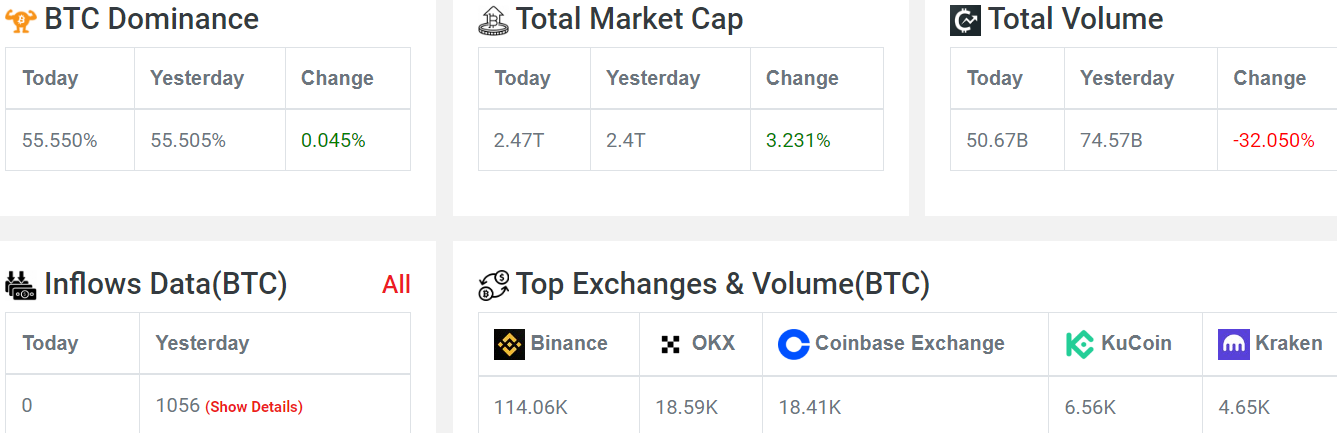

Market Cap and Volume

Market Cap: Up by 2.3%.

Volume: Surprisingly down by 30.3%. Typically, we see volume increase at the start of a new week, but the recent Trump Bitcoin conference over the weekend seems to have affected this pattern.

Inflows: No new data since midnight. Yesterday, we saw an inflow of 1056 BTC.

Fear and Greed Index: Moving towards extreme greed, now at 74.

Sentiments: The sentiment in the last hour has been mostly bullish.

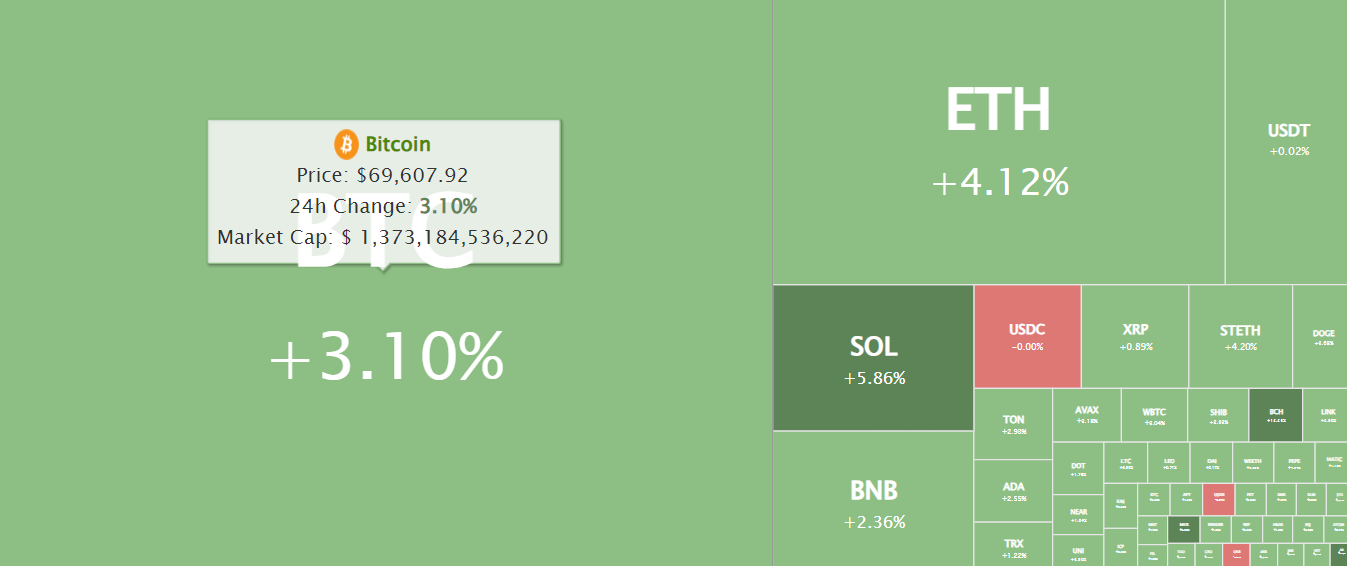

Heat Map Snapshot

Bitcoin (BTC): Up by 3.10 %.

Ethereum (ETH): Up by 4.12%.

Solana (SOL): Reclaimed the 193-194 level. After crashing to $13 at one point, it has bounced back with significant returns.

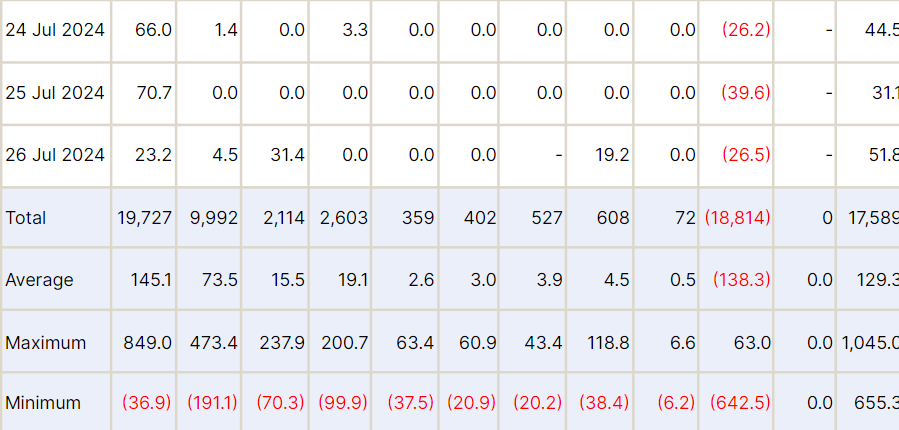

Bitcoin ETF and Market Movements

BlackRock: Bought $23 million worth of Bitcoin.

Fidelity: Bought $4.3 million worth of Bitcoin.

Bitcoin ETF Volume: Declining as attention shifts to Ethereum's ETF.

Ethereum ETF Insights

Grayscale: Major sell-off impacting Ethereum's price.

Other Major Players:

Ark: Bought $47 million worth of Ethereum.

Fidelity: Bought $39.3 million.

Bitwise: Bought $60 million.

The sell-off from Grayscale is expected to slow down, potentially leading to a bullish momentum for Ethereum.

Upcoming Week's Key Events

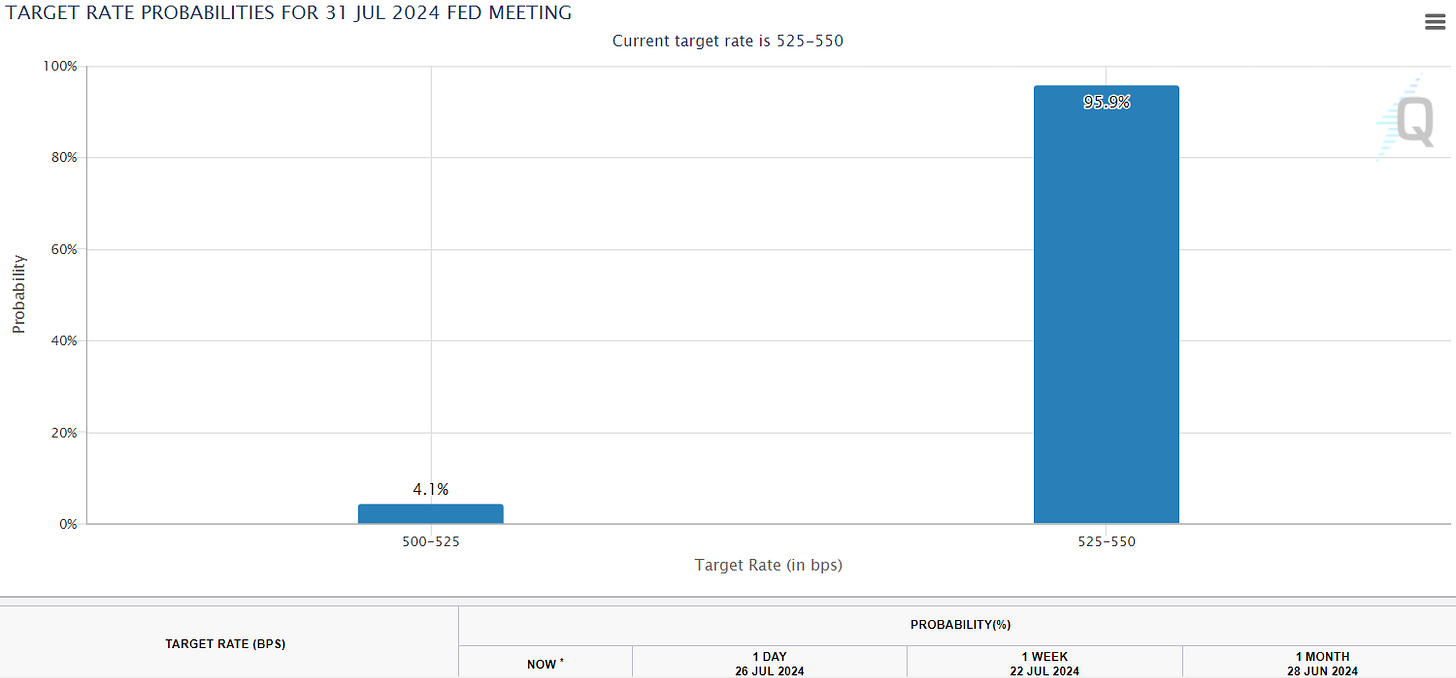

FOMC Meeting

Dates: July 30-31.

Expectations: No rate cuts anticipated, but any unexpected decision could drastically impact the stock and crypto markets.

Impact: Powell’s statements post-FOMC meeting will be crucial.

Earnings Reports: Major companies' reports could influence market movements.

Bitcoin's Current Status and Support Levels

Current Price: $69,652

Support Levels: Immediate support at $68,320 and the next at $67,800.

Importance: Closing above $70,000 could signal a significant bullish trend. Historically, such closures have led to massive price rallies.

Trump's Bitcoin Conference Speech

Historical Significance: Trump is the first American President to address a Bitcoin event in Nashville, expressing strong support for crypto.

Government Holdings: He announced a plan to keep 100% of the Bitcoin currently held by the US government, which is about 210,000 BTC or 1% of the total supply.

America First Approach: He aims for the U.S. to lead in Bitcoin and cryptocurrency technology.

Critique of Opponents: Trump criticizes the current administration for being anti-crypto.

Commitment to Crypto: Promises to make the U.S. the crypto capital of the world with a favorable regulatory environment.

Regulatory Changes: Plans to fire SEC Chair Gary Gensler and create a Presidential Advisory Council for cryptocurrency.

Opposition to CBDC: He opposes the establishment of a Central Bank Digital Currency (CBDC).

Economic Plan: Pledges policies to lead to an economic boom, contrasting with the current administration's approach.

Ending Inflation: Commits to quickly ending inflation, which he describes as a “stealth taxation.”

Energy Independence: Promises to restore U.S. energy independence to support Bitcoin mining.

Final Commitment: Reaffirms his dedication to being a pro-innovation and pro-Bitcoin president.

Companies and Pension Funds: Many companies and pension funds are adding Bitcoin to their treasuries, reinforcing the bullish sentiment.

Billionaire Support: High-profile investors continue to show confidence in Bitcoin, adding to the market's optimism.

The crypto market is experiencing strong bullish momentum, driven by rising prices and heightened institutional interest.

With significant upcoming events and Trump's pro-Bitcoin position, regulatory changes and increased investments are on the horizon.

This positive sentiment is fostering optimism, indicating a bright future for Bitcoin and the broader cryptocurrency industry.