What's holding Bitcoin back?

From Regulatory Developments to Institutional Moves, Uncover What's Driving Crypto Trends Today

Hey crypto folks! curious about where Bitcoin is heading amidst all the recent buzz? Let's dive into the latest updates in the crypto market and see why Bitcoin just can't sit still!

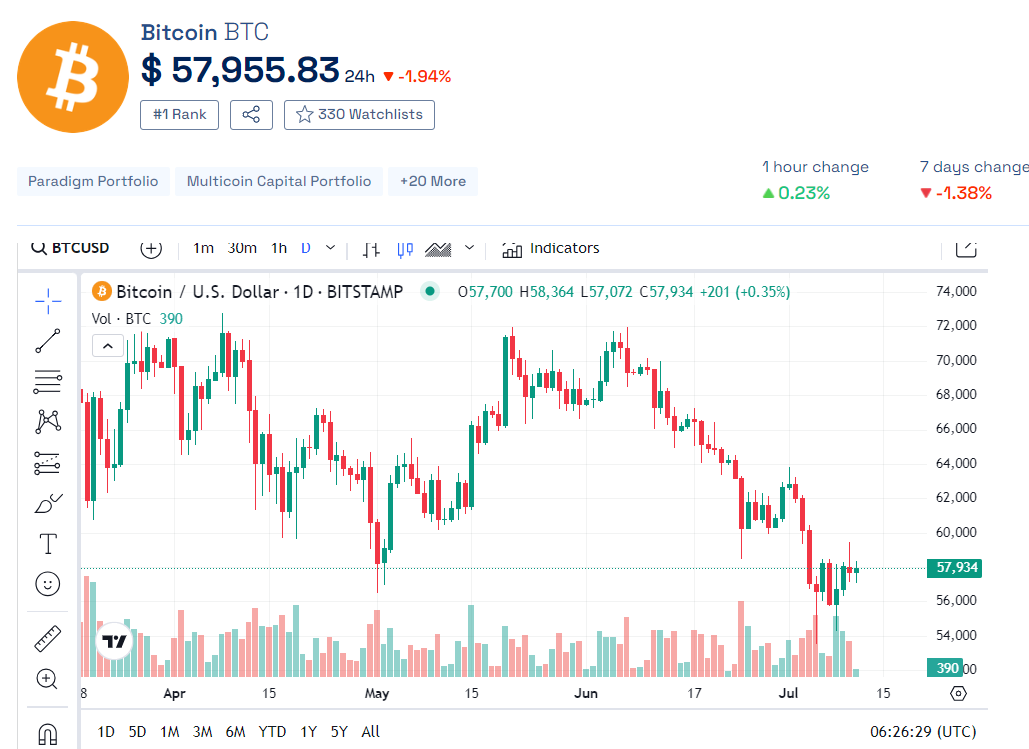

1. Bitcoin Consolidation at Channel Lows

Bitcoin remains at channel lows despite a brief rise. Total crypto market volume over the last 24 hours is $59.14B, with a 10.91% decrease

Federal Reserve Chair Jerome Powell informed Congress that rate cuts are coming, but an increase is unlikely

2. CFTC Chairman's Announcement

CFTC Chairman Rostin Behnam announced an Illinois court ruling confirming Bitcoin and Ethereum as commodities.

The ruling is part of a fraud case involving an unregistered entity.

3. Court Ruling's Impact

The court reaffirmed Bitcoin and Ethereum as commodities under the Commodity Exchange Act.

Behnam noted that 70-80% of the cryptocurrency market does not fall under securities regulation.

4. Congressman Patrick McHenry's Stand

Congressman McHenry advocated for repealing Biden’s veto, preventing regulated financial firms from custodying Bitcoin and crypto.

He emphasized that the U.S. should remain a leading location for deploying capital and developing advanced technologies.

5. Bitcoin Market Reaction

Despite positive news, Bitcoin's price remains under pressure.

Factors include the German government selling seized Bitcoin and the distribution of Mt. Gox Bitcoin.

6. Concerns Over Market Liquidity

Bitcoin is considered illiquid, with most being held by long-term investors.

Large sales by governments or entities can cause significant price drops due to this illiquidity.

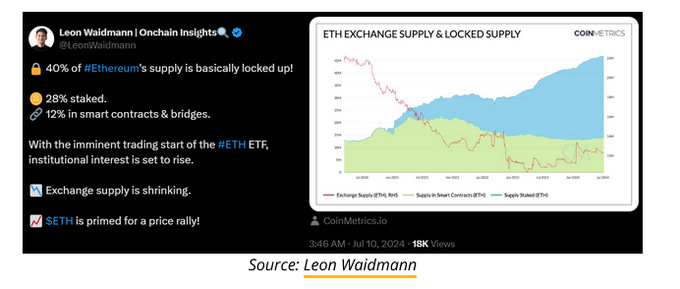

7. Upcoming Spot Ethereum ETF

The Spot Ethereum ETF launch is anticipated around July 18th.

Expected to bring significant inflows, estimated at $15 billion over 1.5 years.

8. Ethereum's Growing Market Potential

Ethereum’s diverse applications (tokenization, stablecoins, DeFi, NFTs) make it attractive to institutional investors.

The ETF could rival or surpass Bitcoin’s ETF in success.

9. Political and Regulatory Landscape

The 2024 Republican Party platform includes protecting crypto rights (mining, self-custody, free transactions).

President Biden’s administration is participating in a Bitcoin and crypto roundtable in DC.

10. 2024 Presidential Election Impact

The presidential election could significantly impact crypto regulation.

A Trump win could lead to major changes, including replacing SEC Chair Gary Gensler with a pro-crypto figure.

11. Institutional Interest in Crypto

Institutional interest is growing, with Goldman Sachs planning three tokenization projects by the end of 2024.

This move is driven by increasing client demand for crypto products.