Hey, Degens!

Bitcoin's at $56K, and the market’s in extreme fear. But is this the perfect time to buy or just another dip?"

Current Market Overview

Market Decline: As of now, the crypto market cap has dropped by 1.1%, and trading volume has decreased by 1.3% since midnight.

Fear and Greed Index: The index is now deep in the extreme fear zone. This sentiment usually kicks in earlier, but it took a bit longer this time.

Bitcoin and Ethereum: The heat map shows Bitcoin down by 1.01% and Ethereum price down by 0.98%. Bitcoin is hovering around $56,662 after approaching $55,000 last night.

Volume Concerns: The main issue is the lack of trading volume for Bitcoin, but the critical question is, why this volume drop?

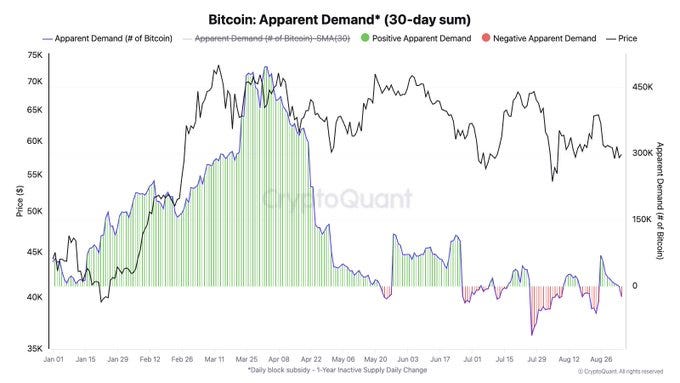

According to the Head Researcher at CryptoQuant, Bitcoin's price drop is due to a lack of demand growth. Valuation metrics are currently bearish, reflecting a decline in demand.

Tyr Capital's Prediction: Ed Hindi, CIO of Tyr Capital, believes a Federal Reserve rate cut and a strong US economy could push Bitcoin above $60,000 by the end of September, surprising bearish traders.

Positive Market Sentiment: Some traders expect Bitcoin to form a bullish pattern with a "higher high and higher low," signaling potential recovery if it breaks key resistance levels.

Short Position Impact: If Bitcoin crosses back above $60,000, it could wipe out over $584 million in short positions, showing strong upward momentum.

Key Resistance Levels: Traders, like Matthew Hyland, stress that Bitcoin needs to bounce above $65,000 to confirm the continuation of the uptrend that began in August.

Arthur Hayes' Prediction: BitMEX co-founder Arthur Hayes predicts Bitcoin could drop by 12%, possibly falling below $50,000 over the weekend. He’s taken a short position, betting on a further decline.

Broader Market Downturn: Major cryptocurrencies like Ethereum (-2.23%), Solana coin (-2.82%), and XRP (-2.19%) also declined alongside Bitcoin.

Liquidation Surge: Over the last 24 hours, $94.26 million in liquidations occurred, mostly from long bets on rising Bitcoin prices. Bitcoin long bets accounted for $36.71 million, nearly 40% of total liquidations.

Key Factors Impacting the Market

US Economic Data: Recent economic data from the US has been negative, which is a major factor affecting the market. More important data is expected soon, and it could drive the market either way—towards recovery or further decline.

Recession Talks: With all the current financial data pointing down, there’s increasing discussion about a potential recession in the US.

Market Manipulation vs. Genuine Issues

Manipulation During Negative News: A strange phenomenon often occurs when the news cycle turns negative. Large institutions start selling, contributing to the negative sentiment.

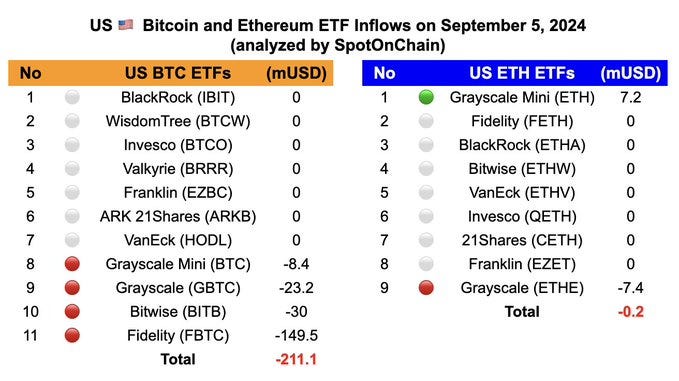

For instance, BlackRock has not made any significant purchases in the past week and recently sold $149 million in assets. Fidelity, Bitwise, and Grayscale have also been selling, pushing the market down further.

The Role of Recession Talk

Temporary Impact: Discussions around a recession typically resolve within 10-15 days. After that, we usually see positive job data, which shifts market sentiment.

This is why even during extreme fear, recovery is often around the corner. History shows that fear presents a buying opportunity.

Opportunities Amidst Fear

Buy Opportunities: The current extreme fear levels could indicate good buying opportunities.

People were ready to buy at higher prices, but now fear is holding them back. This fear is often manipulated to keep prices low.

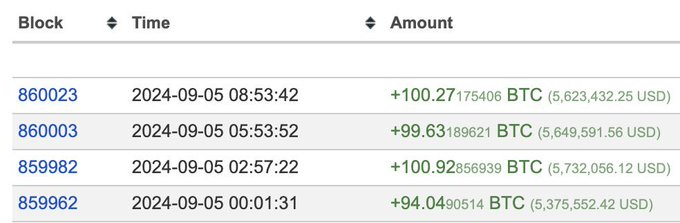

While you're feeling fearful, Mr. 100 keeps stacking up more Bitcoin.

ETF Data and Future Prospects

Minimal Buying Activity: ETF buying has been relatively quiet, with more sales than purchases.

However, once Grayscale’s data is fully processed, we may see some positive movement. Remember, market cycles tend to recover, and the core fundamentals of cryptocurrencies remain intact. The issue is more about the US market’s influence on crypto.

Final Thoughts

If Bitcoin drops below $56K, expect heightened fear, potential further declines (possibly below $50K), increased liquidations, and more bearish sentiment.

It’s important to remember that extreme fear and panic often set the stage for market recoveries. When you see fear-driven selling and manipulation, it could be an opportunity to buy. The crypto market itself isn’t broken—external factors like US economic conditions and sentiment are what’s influencing prices.