Hey, Crypto Crusaders!

Bitcoin hit a new high at $89,500, yet many portfolios still show losses. Let’s explore why, analyze growth potential, and share key strategies for boosting crypto gains.

Crypto Market Overview

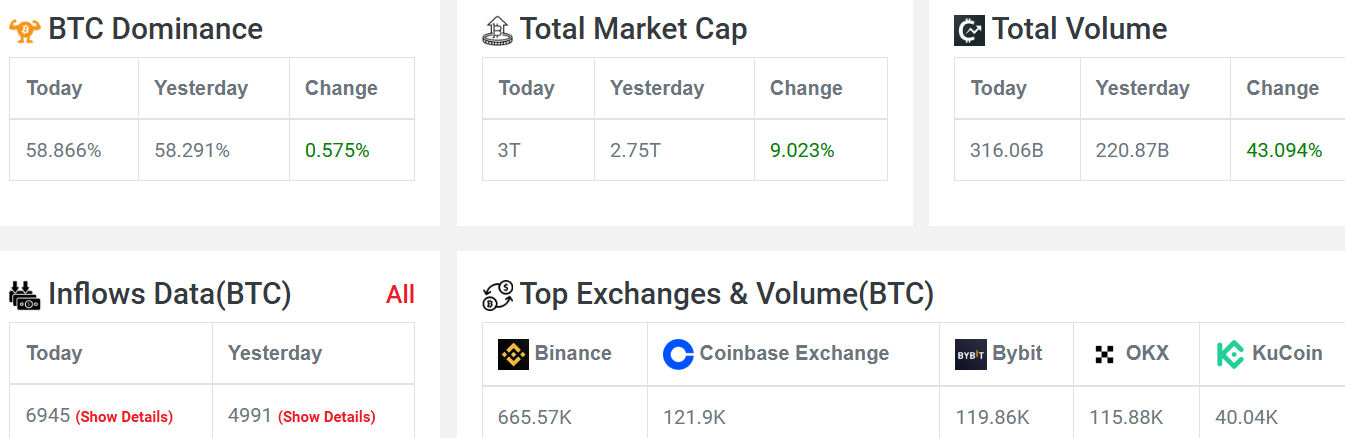

Market Cap: The overall crypto market recently touched the $3 trillion mark, currently hovering at $2.98 trillion as per Coinpedia Markets.

Volume Surge: Crypto trading volume stands at $302 billion, marking a 31% increase over the previous day.

Bitcoin Inflows: There’s strong buying interest, with 4,709 BTC inflow yesterday and 4,991 BTC today, reinforcing the demand for Bitcoin.

Sentiment Check: The Fear & Greed Index has entered the “Extreme Greed” zone, now sitting at 80. This indicates a high-risk buying environment, with many eager to invest in Bitcoin.

Bitcoin’s Current Price and Potential Resistance

Price Movement: Bitcoin’s price is currently around $88,900 to $88,790. Just two months ago, it was at $59,000, reflecting rapid growth.

Resistance Levels: As prices reach these highs, Bitcoin may encounter resistance as some investors take profits. However, it’s uncertain where the next stable level may be.

Addressing Skepticism: Despite consistent skepticism about Bitcoin’s sustainability, the upward trend continues, challenging earlier predictions that Bitcoin would drop to around $12,000.

Portfolio Strategy: Why Bitcoin Should Be a Core Holding

Diversification Advice: Holding altcoins or even meme coins can add variety, but Bitcoin should make up a significant portion of any crypto portfolio. Its resilience and historical growth provide a foundation that can stabilize a portfolio.

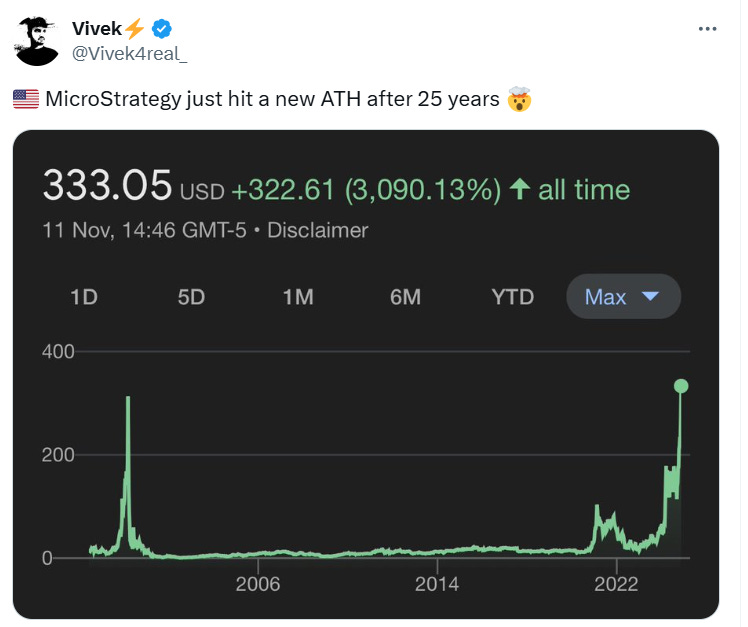

Learning from MicroStrategy: MicroStrategy’s consistent Bitcoin investments illustrate a strategic approach. Their CEO, Michael Saylor, advocates for dollar-cost averaging (DCA), a reliable method for long-term investors to benefit from market dips without trying to “time” the market.

Altcoins Worth Watching

Solana (SOL): Solana recently touched $226 and shows potential to soon set a new all-time high.

Ethereum (ETH): Trading at $3,348, still below its all-time high of $4,891, suggesting room for growth. As Ethereum price gains momentum, it could target resistance around $3,500, potentially offering attractive returns as the market continues to expand.

Big Players in the Market: BlackRock and MicroStrategy

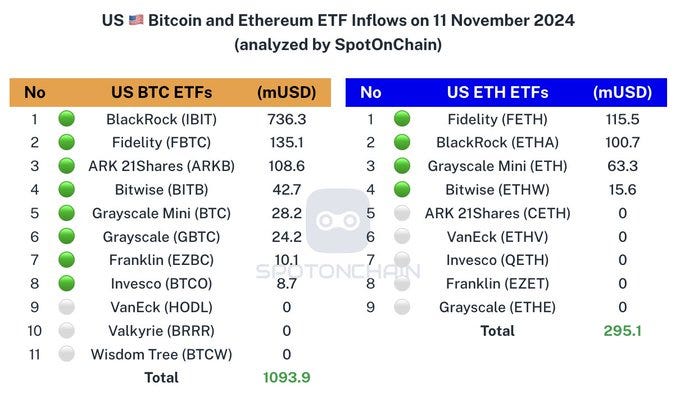

BlackRock’s Interest: While the latest figures are still incoming, preliminary data indicates that BlackRock has made significant buy orders, totaling around $357 million. This could signal rising institutional interest in crypto.

MicroStrategy’s Bitcoin Commitment: Recently, MicroStrategy bought 7,446 BTC, bringing its average buy price to $42,777. Their profits are up about 17% from this purchase alone, showcasing the potential rewards of strategic DCA investing.

Key Takeaways for Crypto Investors

Follow a DCA Strategy: Dollar-cost averaging remains a solid strategy for crypto investments, particularly for assets like Bitcoin.

Avoid Using Emergency Funds: Crypto is a volatile market, so avoid dipping into emergency funds to make investments. Build your portfolio gradually.

Trust Credible Sources: Elon Musk and Larry Fink both support the long-term value of digital assets. Relying on credible endorsements and strategic advice can help you make sound decisions.