Hey, crypto fans! 🚀

Big changes are on the horizon for the crypto market. From Ethereum ETFs launching to bullish XRP signals, the next few weeks could be a game-changer. Here’s what you need to know and why you should stay tuned.

Market Overview

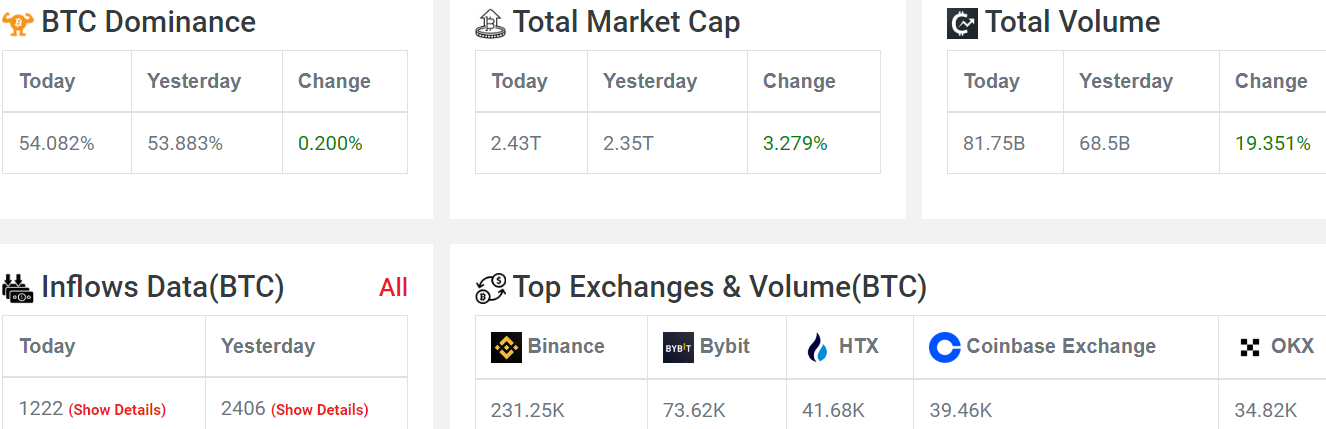

Bitcoin Dominance: 54.082%, up by 0.200% from yesterday.

Market Cap: $2.43 trillion, a 3.279% increase.

Total Trading Volume: $81.75 billion, up 19.351%.

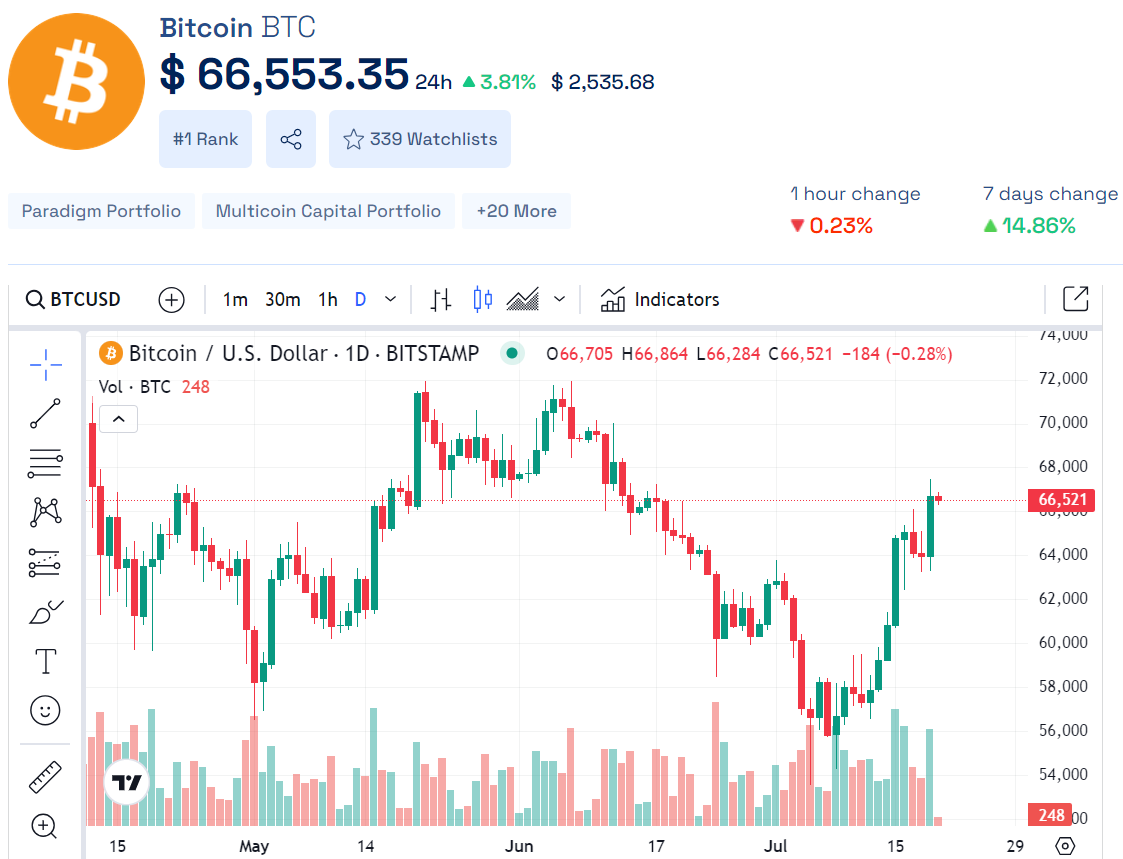

Bitcoin Price: $66,554, a 3.49% rise in 24 hours.

Ethereum Price: $3,501, up 2.16% in the last day.

Fear and Greed Index: 74, showing strong market optimism.

Bitcoin ETF Flows: $61.06 billion, a 4.372% increase.

What to Expect in the Next Few Weeks

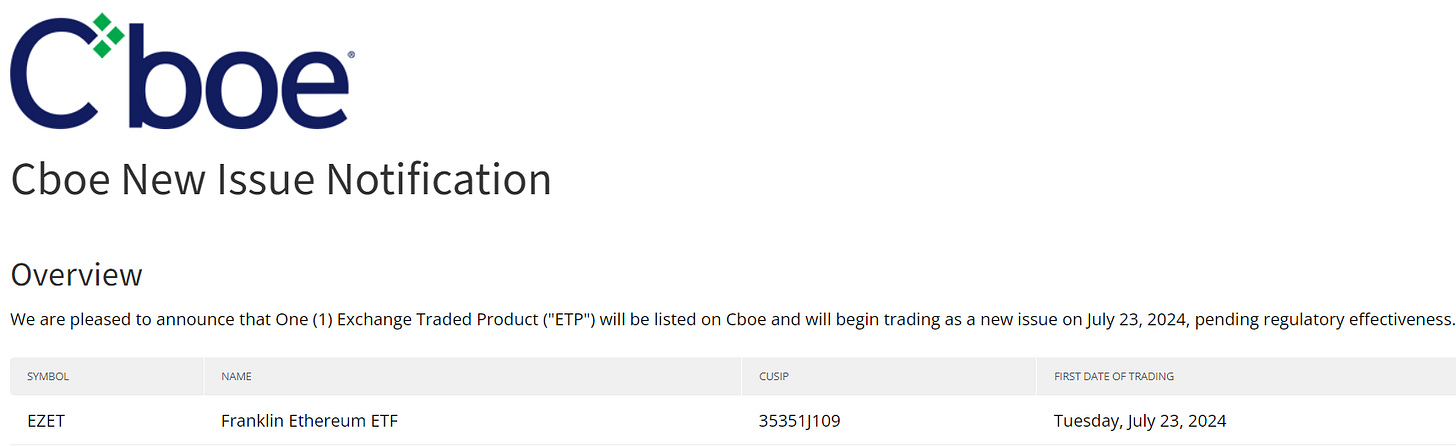

Ethereum ETFs Launch on July 23

Get ready for July 23, 2024! Five major Ethereum ETFs are launching:

VanEck Ethereum Fund

Invesco Galaxy Ethereum ETF

Fidelity Ethereum Fund

21Shares Ethereum ETF

Franklin Templeton Ethereum ETF

This could kick off a major alt season. Remember how Bitcoin ETFs led to big market moves in the past? We might see something similar with Ethereum.

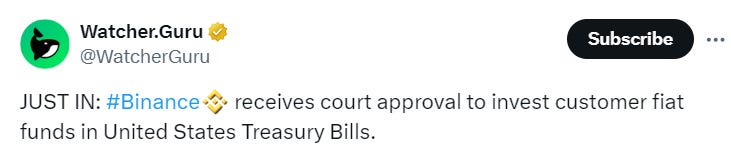

💸 US Treasury Investments and Market Reactions

Binance just got the green light to invest customer funds in US Treasury Bills. This is a bullish sign and shows growing institutional interest in crypto.

BlockTower Capital’s Ari Paul doubts the US will create a Bitcoin strategic reserve soon. He’s laying 10:1 odds against it. This adds to the speculation about Bitcoin and Ethereum’s future.

📉 Bitcoin and Ethereum: Lessons from the Past

When Bitcoin ETFs launched before, there was an initial dip followed by a strong rally. For instance, Bitcoin fell from $50,000 to $40,000 but then soared to new highs. Ethereum might follow a similar path after its ETFs launch.

What to Expect For Ethereum Etf

Ethereum ETFs Launch Soon: Bitwise, Galaxy, and Grayscale predict up to $19.5B in ETH ETF capital. Bitcoin ETFs saw $15.5B in first 5 months.

Discounts & Staking: ETHE’s discount narrows as ETFs near. ETH's staking reduces supply, impacting price sensitivity.

Differences from BTC ETFs: ETH ETFs won’t include staking rewards; Grayscale’s fees are competitive. ETHE investors are less distressed.

Price Sensitivity: Less ETH available due to staking and DeFi; lower inflation rate compared to BTC. Expect a market boost!

🏦 Market Sentiment and Alt Season

There’s a lot of buzz in the crypto world. Ethereum’s ETF approval could spark a big alt season. With several ETFs and lower fees, more investors might jump in, boosting Ethereum’s price.

🕵️♂️ XRP and Altcoins: What’s Happening?

XRP is already showing bullish signs of gains worth 4.38% to rest at $0.5805 today. 🚀 Ripple’s ongoing lawsuit against the SEC underscores the SEC’s struggles under Gensler. Lawyer James Murphy’s criticism of Gary Gensler is rallying XRP supporters. It often leads the way during alt seasons, so keep an eye on it.

What’s Next?

The next few weeks, especially around July 23rd, will be crucial. Watch for initial market reactions and potential dips, which could be great buying opportunities. With the Ethereum ETFs and Binance’s new strategy, we might be on the brink of a major market shift.