Ethereum (ETH) continues to struggle, failing to reclaim key support levels following setbacks in the Pectra testnet upgrade and a significant spike in whale accumulation.

Key Highlights

Price Decline: Ethereum dropped 3% on Friday, extending a 15% loss from Monday. ETH has struggled to reclaim the critical $2,200 level, which marks the lower boundary of a key rectangular channel maintained since August 2024.

Testnet Failure: The decline is partly due to the failure of Ethereum's Holesky testnet to finalize following issues with the Pectra upgrade, raising concerns about network stability.

Futures Liquidations:

Ethereum witnessed $82.26 million in futures liquidations over the past 24 hours.

Liquidations included $55.28 million in long positions and $26.98 million in short positions, indicating heightened market volatility.

Technical Indicators:

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) remain below neutral, signaling dominant bearish momentum.

A failure to break above $2,200 could push ETH towards the next major support level at $1,500.

However, a daily close above $2,850 would invalidate this bearish scenario.

Read: Ethereum Price Prediction 2025, 2026 - 2030 for more insights

Whale Activity: Accumulation or Anticipation?

Significant Purchases: Whale investors acquired 1.10 million ETH, representing approximately 0.92% of Ethereum's circulating supply (120 million ETH).

Accumulation Trend: In January 2025, large holders purchased over 330,000 ETH in a week, signaling potential market anticipation.

Strategic Positioning: This quiet accumulation amid bearish price action could indicate that whales are preparing for a market shift.

Also Read: Hamster Kombat Price Prediction 2025-2030

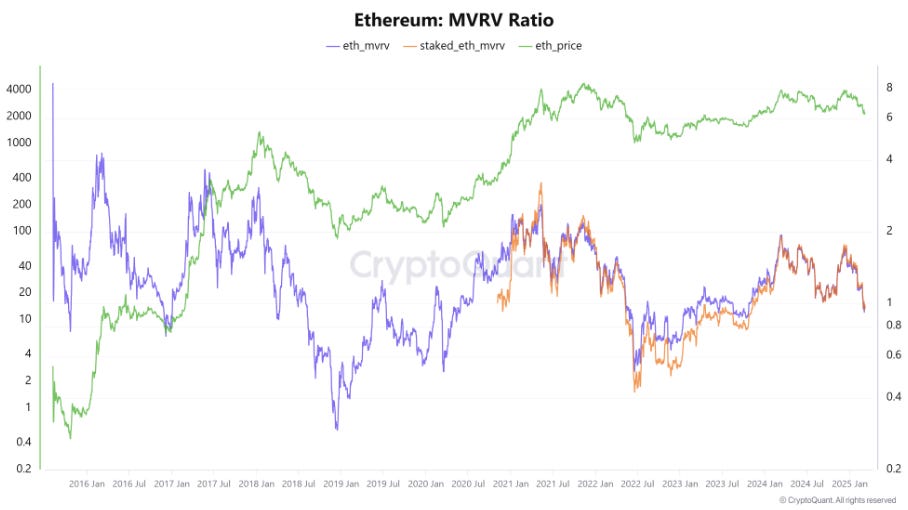

MVRV Ratio Signals Potential Recovery

MVRV Drop: Ethereum’s Market Value to Realized Value (MVRV) ratio fell below 1, showing that the average investor is at a loss.

Historical Context: During previous bull seasons, ETH often rallied when the MVRV ratio dipped below 1, suggesting a possible recovery ahead.

External Factors Boosting Sentiment

Trump's Crypto Reserve: On March 2nd, former President Donald Trump announced a U.S. strategic crypto reserve, expressing his "love" for Ethereum, boosting market sentiment.

White House Crypto Summit: The upcoming summit on March 7 has raised investor expectations of favorable regulatory developments.

Ethereum's Market Position

Stablecoin Dominance: Ethereum continues to dominate the stablecoin market, holding 56% of the total stablecoin value, reinforcing its status as a critical asset in the crypto ecosystem.

While Ethereum faces bearish pressures and technical hurdles, the increase in whale accumulation and external market catalysts suggest a potential recovery. Investors should watch for a break above $2,200 or a potential retest of the $1,500 support.