Whales Are Buying ETH: Can Ethereum Price Breaks Past $2,000?

Ethereum investors increase buying pressure despite weak prices

Ethereum (ETH) saw $25.06 million in futures liquidations in the past 24 hours, per Coinglass data. Longs accounted for $17.13 million, while shorts totaled $7.93 million.

ETH is currently testing a key support level near a descending trendline. A bounce could lead to a retest of the $2,070 resistance, but a breakdown could push ETH toward $1,800 or even $1,500.

Technical indicators like the Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are testing their moving averages. A drop below these levels may trigger increased bearish momentum. A daily close under $1,500 could invalidate bullish sentiment and drive ETH toward the $1,000 psychological level.

Read Ethereum Price Prediction for more detailed insights

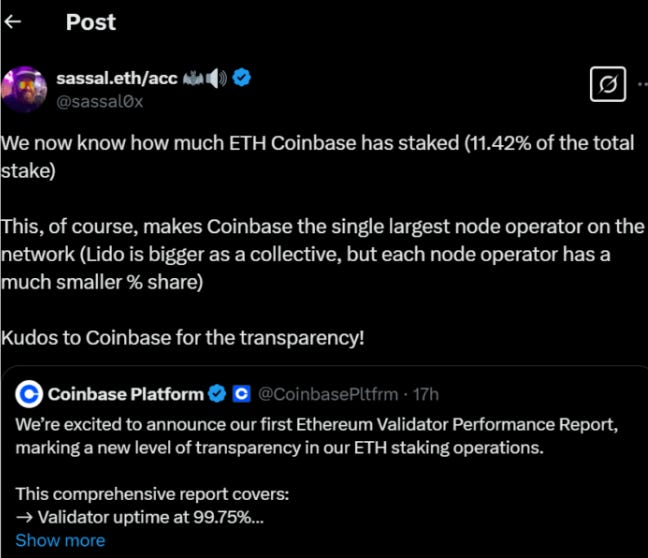

Coinbase’s Growing Staking Dominance

Coinbase has emerged as Ethereum’s largest node operator, holding 3.84 million ETH (~$6.8 billion), controlling 11.42% of all staked ETH. While Lido remains dominant in staking, no single entity within Lido has as much influence as Coinbase. The exchange assures decentralization by distributing validators across multiple regions, maintaining 99.75% uptime.

Also Read: Filecoin Price Prediction 2025, 2026 – 2030

Whale Activity & Market Sentiment

Lookonchain data reveals that whales withdrew 14,217 ETH (~$29M) from Binance, depositing it into Aave before borrowing $12M USDT and distributing it to exchanges—often a sign of upcoming market moves.

ETH supply on exchanges hit a 10-year low of 8.71M ETH, per Santiment, reflecting increased investor confidence. Accumulation addresses added 4.77M ETH YTD, with 45% of that growth occurring after ETH fell below $2,000 in March.

Pectra Upgrade: A Potential Catalyst

Ethereum’s upcoming Pectra upgrade will introduce features like transaction batching, ERC-20 gas fee payments, and staking enhancements. Following its testnet deployment on Hoodi this Wednesday, a mainnet launch could follow in 30 days, potentially influencing ETH’s price.