Hey, crypto friends!

Here’s a quick update on the market. We’re seeing a major Bitcoin drop, significant liquidations, and geopolitical tensions, leading to another crash. Let’s dive into the details!

Crypto Market Overview

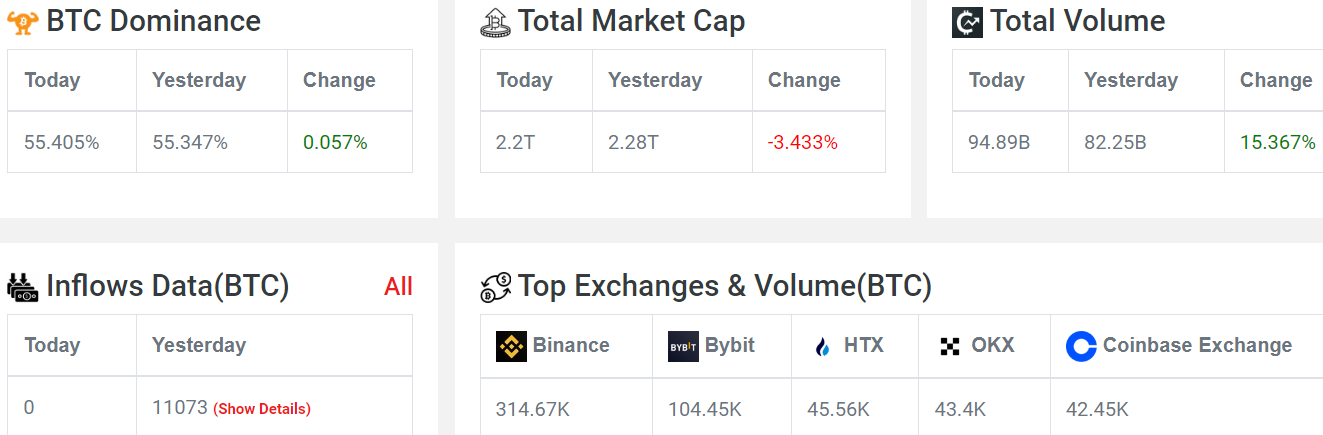

BTC Inflow: About 11,000 BTC has been added to the market recently.

Fear and Greed Index is 37, we might see an increase in market fear. Although there's been a small recovery, Bitcoin (BTC) is down 7%, and Ethereum (ETH) is down 5.13%

Recent Liquidations: In the past 24 hours, around 100,000 traders have been liquidated, with about $300 million in losses.

Bitcoin Price Drop: After a brief recovery, Bitcoin’s price fell sharply from around $65,348 to $62,400, a $3,000 drop within two hours.'

Reasons Behind the Crash

1. US Market Conditions

Stock Market Losses: The total loss in the crypto market has surpassed the losses in the US stock market, with $2.9 trillion wiped out.

S&P 500 Crash: The S&P 500 is experiencing its largest drop since 2022, highlighting serious market concerns.

2. Job Market Issues

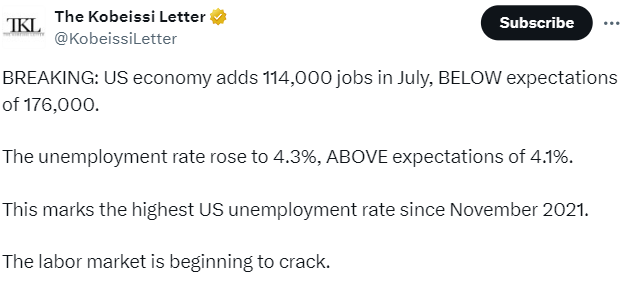

Jobless Claims: Recent data shows more job losses than expected, indicating fewer job opportunities.

Additionally, wage growth has slowed from 3.8% in June to 3.6% in July.

Job Growth: Job growth figures were below expectations, raising concerns about a potential recession.

3. Geopolitical Tensions

Iran and Israel Conflict: The ongoing conflict between Iran and Israel is adding to the market's volatility.

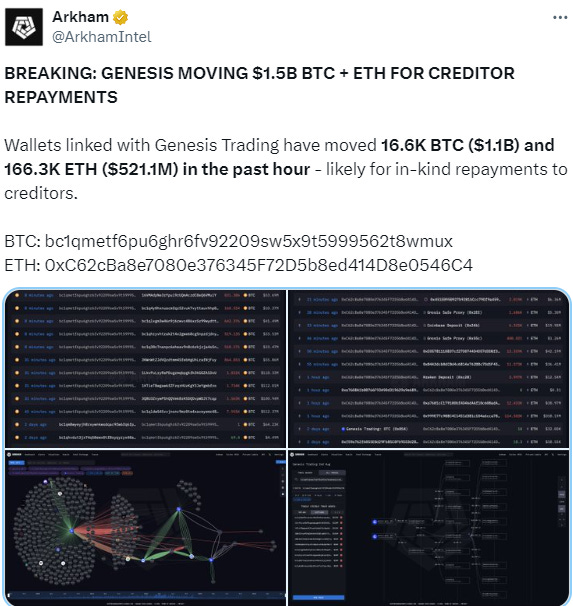

4. Genesis News

Repayment Amount: Genesis is set to repay creditors with around $1.5 billion in Bitcoin and Ethereum.

Market Reaction: This news has contributed to Bitcoin’s recent price drop.

Comparison with Mt. Gox: Similar to the Mt. Gox situation, where investors held onto their assets, it’s likely many will keep their Bitcoin in anticipation of a market recovery over the next year or two.

Analyst Insights:

Lark Davis predicts 140 days of price fluctuation in the $60K–$70K range as institutions and whales accumulate Bitcoin while weak hands capitulate. Stay strong; intensity is rising!

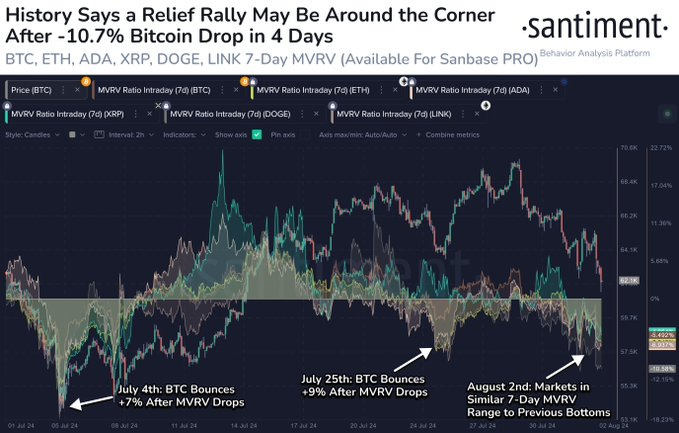

Crypto analyst Santiment reports a market retracement, with traders predicting sub-$50K Bitcoin. However, low 7-day average returns for top cryptocurrencies like BTC, ETH, and ADA increase bounce probabilities significantly.

$280M Outflow Hits US BTC-Spot ETFs

Influence of the US Economy: Recent data from Lookonchain showed US BTC-spot ETF flows highlight the impact of the US economy on the cryptocurrency market.

Significant Outflows:

The Grayscale Bitcoin Trust (GBTC) experienced net outflows of $49.9 million.

The Fidelity Wise Origin Bitcoin Fund (FBTC) saw net outflows of $104.1 million.

The ARK 21Shares Bitcoin ETF (ARKB) reported net outflows of $87.7 million.

The Bitwise Bitcoin ETF (BITB) faced net outflows of $29.4 million.

Net Outflows Overview: Excluding the iShares Bitcoin Trust (IBIT), the total net outflows from the US BTC-spot ETF market amounted to $280.2 million.

Trump’s Shocking Proposal!

Donald Trump proposed addressing our $35 trillion debt by issuing a "crypto check" or perhaps a little Bitcoin.

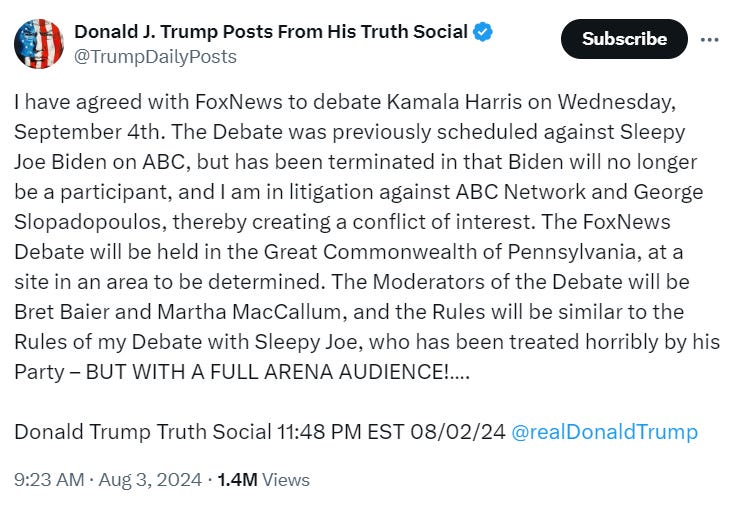

Additionally, Trump will debate Kamala Harris on September 4th at a venue in Pennsylvania. This debate replaces his earlier scheduled matchup with Joe Biden, which was canceled due to legal conflicts with ABC.

Crypto markets are in turmoil due to US economic issues, job market concerns, geopolitical tensions, and major outflows from Bitcoin ETFs.

Stay cautious, monitor market trends, and invest wisely.