Hey There Crypto Folks!

Bitcoin’s price dips below $60,000, signaling a bearish market trend. Telegram CEO Pavel Durov’s recent controversy raises concerns as a potential ‘black swan event,’ while Nvidia’s Q2 earnings impress.

Crypto Market Overview

BTC Dominance Drop: Bitcoin’s market dominance fell slightly to 55.989%, down from 56.178%. This 0.189% decrease hints at a growing interest in altcoins & stablecoins.

Market Cap Boost: The total cryptocurrency market cap rose by 0.989%, climbing from $2.08 trillion to $2.1 trillion.

Volume Decline: Total trading volume dropped sharply by 6.639%, from $88.24 billion to $82.38 billion.

BTC Inflows Drop: Bitcoin saw a significant drop in inflows, with only 1,249 BTC entering the market today compared to 2,793 BTC yesterday.

Bitcoin Price Analysis

Current Price: Bitcoin has fallen below $60,000, trading at $59,811. This drop highlights the bearish trend in the market.

Resistance Levels: Bitcoin faces resistance around $63,900. A critical support level is near $55K-$54K. If Bitcoin can hold above $59,000, the next resistance is around $62K.

End-of-Month Target: To end August on a positive note, Bitcoin needs to close above $64,300, requiring a 7% rally from its current price.

Nvidia Q2 Earnings Report

Strong Performance: Nvidia’s Q2 earnings exceeded expectations with EPS of $0.68 and revenue hitting $30 billion—a 122% annual growth, fueled by buzz around the Blackwell chips.

Stock Reaction: Despite stellar earnings, Nvidia’s stock fell by 2.10% to $125.61 and dropped another 6.81% in after-hours trading.

Crypto Impact: Anticipation of Nvidia’s earnings caused a surge in AI-related cryptocurrencies, but top tokens like Near Protocol (NEAR) and Artificial Superintelligence (FET) declined following the report, mirroring Nvidia’s stock and Bitcoin movements.

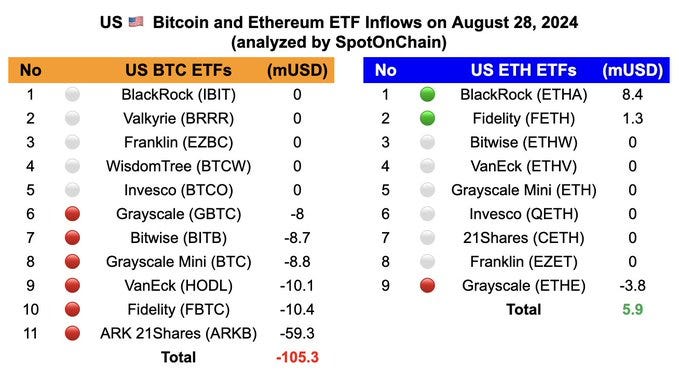

ETF Activity

Bitcoin ETF

Overall Outflow: Bitcoin spot ETFs experienced a total outflow of $105 million, reflecting a cautious stance from investors.

Notable Withdrawals: Significant outflows included $59.27 million from ARKB, $8.77 million from BTC Mini ETF, and $7.98 million from GBTC.

Ethereum ETF

Net Inflow: Ethereum spot ETFs saw a net inflow of $5.84 million, ending a nine-day streak of outflows and suggesting renewed interest.

Key Movements: Inflows were recorded for BlackRock’s ETHA ($8.40 million) and Fidelity’s FETH ($1.26 million), while Grayscale’s ETHE saw an outflow of $3.81 million.

SEC's Action Against OpenSea

Wells Notice: The SEC has issued a Wells Notice to OpenSea, indicating potential legal action over NFTs that may be classified as securities.

OpenSea’s Response: CEO Devin Finzer expressed concern, arguing that NFTs should be considered creative goods rather than financial securities. He warned of the potential harm from excessive regulation.

Crypto Community Reaction: The SEC’s aggressive stance is raising alarms in the crypto community, with concerns about stifling innovation and impacting creators.

Controversy Surrounding Telegram’s Pavel Durov

Legal Troubles: Telegram founder Pavel Durov is under formal investigation in France, with bail set at $5.56 million. He is required to report to the police twice a week.

Black Swan Event: Lasse Clausen from 1kx has labeled the situation as a potential "Black Swan event," suggesting it could lead to significant market disruption if Telegram’s legal issues worsen.

Despite recent outflows, US ETFs remain top performers globally. Bitcoin, now at $59,680 with 57.21% dominance, may test $56K before a potential rally. Despite the crash alert, Bitcoin has modestly risen by 0.8%, and uncertainty around Telegram's impact on Toncoin persists.