Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has gained nearly 43% year-to-date (YTD) in 2024. However, it has underperformed compared to Bitcoin (BTC), which has skyrocketed by over 115% during the same period. Despite this, Ethereum's future looks promising, with analysts projecting significant price gains in 2025.

Let’s dive into ETH price prediction, key factors influencing its growth, and why ETH could reclaim its position as the top-performing altcoin.

Ethereum Price Today vs. Bitcoin’s Rally

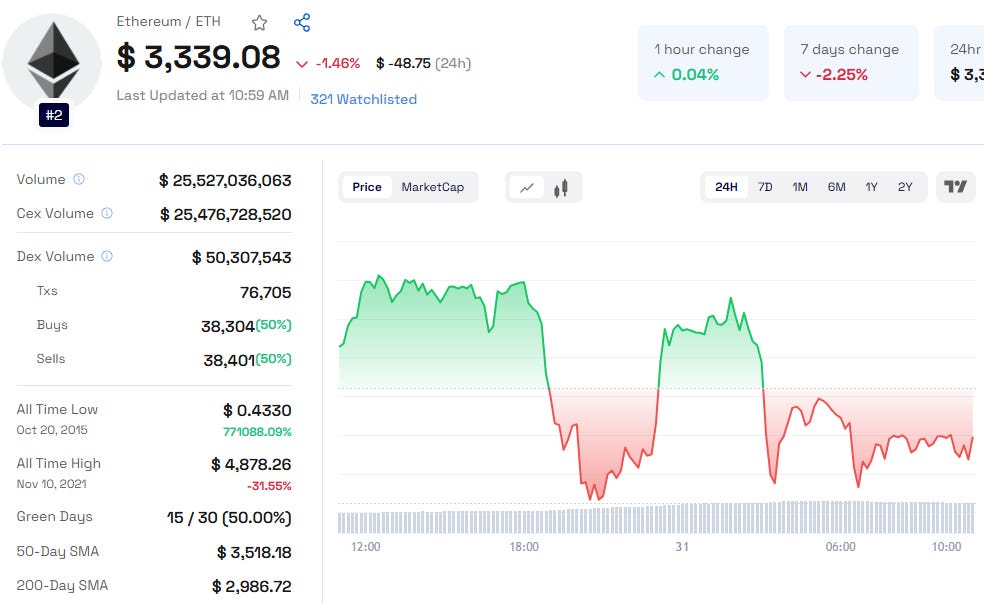

As of now, Ethereum’s price stands at $3,345, down 0.7% in the past 24 hours. While ETH has grown steadily, it lags behind Bitcoin, which surged to an ATH of $106,000 in 2024. Bitcoin’s long-term holder base dropped from 70% to 62.3% this year, signaling profit-taking during BTC’s euphoric rally.

In contrast, Ethereum's long-term holders have increased significantly. Data from IntoTheBlock shows 75.1% of Ethereum wallets held tokens for over a year as of December 2024, up from 59% in January—a remarkable 27% jump.

Bullish Patterns Signal ETH Price Surge

Several technical analysts predict a bullish phase for Ethereum in Q1 2025:

Crypto Bullet: Identifies a bullish pennant pattern on Ethereum’s daily chart, forecasting a potential breakout to $6,000 by March 2025.

Anup Dhungana: Highlights an inverse head-and-shoulders pattern on the weekly chart, suggesting ETH could soar to $8,000 by May 2025. However, he warns of a possible dip to $2,800 before the rally.

Key Takeaway: Ethereum is showing strong technical setups for significant growth in 2025.

Regulatory Tailwinds and Institutional Adoption

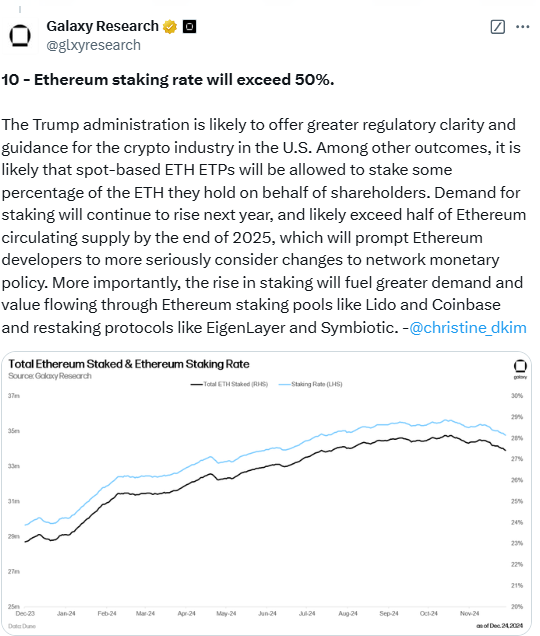

The regulatory landscape is expected to shift in favor of cryptocurrencies under a potential Trump administration in 2025. Pro-crypto policies, such as allowing staking-based spot ETFs, could drive demand for ETH.

Galaxy Research: Projects Ethereum’s staking rate to surpass 50% in 2025, creating a supply crunch that could push prices above $5,500.

Wall Street Adoption: Ethereum is backed by major players like BlackRock, with tokenized investment products already in circulation.

Info Box:

Ethereum Staking: Expected to exceed 50% of circulating supply by 2025.

ETH/BTC Pair: Predicted to close 2025 trading above 0.06, up from current lows of 0.03.

Ethereum vs. Competitors: Will ETH Maintain Its Dominance?

Alternative Layer-1 blockchains like Solana (SOL) and SUI have outperformed Ethereum in 2024. However, Ethereum remains the dominant chain for DeFi, with over 55% of the total USD value locked in DeFi smart contracts, according to DeFi Llama.

Also Read: SEI Price Prediction 2025, 2026 – 2030

Ethereum Price Predictions: 2024, 2025, and Beyond

2024: Ethereum ended 2024 at $3,345, showing steady growth despite BTC’s massive rally.

2025: Analysts predict ETH could reach between $5,500 and $8,000, with a bullish trend expected in Q1 2025.

2030: Long-term forecasts suggest Ethereum will continue growing, driven by institutional adoption and DeFi dominance.

Will Ethereum Go Up in 2025?

The answer appears to be yes. With technical patterns, increasing staking rates, and favorable regulatory conditions, Ethereum is poised for significant price gains. While competition from Layer-1 blockchains remains strong, Ethereum's established position as the leading smart contract platform gives it a clear edge.

Stay tuned for the latest ETH news and updates on Ethereum price predictions for 2025 and beyond!