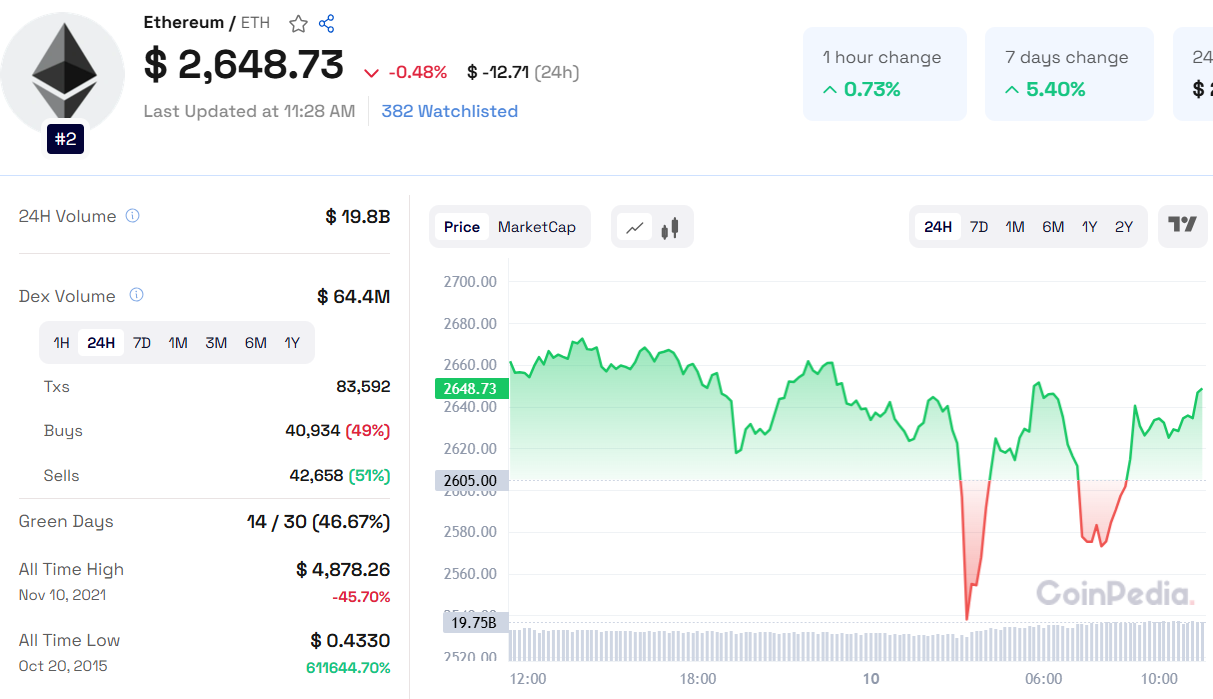

Ethereum (ETH) has been facing significant downward pressure, dropping below the crucial $3,000 mark and showing a strong bearish trend. Currently trading around $2,584, ETH has seen a sharp 13.87% decline since early February, followed by a 9% drop last week.

Critical Support Levels for Ethereum

Ethereum is teetering close to key support levels. If ETH falls below $2,359, the next major support could be around $1,905. On the upside, a recovery above $3,000 could signal a potential reversal of the current bearish trend.

Technical Indicators Point to Bearish Momentum

RSI: At 29, Ethereum is currently in oversold territory, indicating strong bearish momentum.

MACD: The ongoing bearish crossover suggests further downside risk in the near term.

Read Ethereum Price Prediction 2030 for more insights

Hedge Funds Bet Against Ethereum

Ethereum is facing a record short interest, with CME futures contracts at an all-time high of 11,342 contracts. Since November 2024, short positions have surged by 500%, reflecting growing bearish sentiment in the market.

Bitcoin vs Ethereum: A Stark Comparison

While Bitcoin has surged by 100% since early 2024, Ethereum has only managed a 3.5% increase, fueling pessimism among traders.

ETH Accumulation Hints at Potential Rebound

Despite the negative sentiment, long-term investors are accumulating ETH. On February 7, ETH accumulation reached a record 330,705 ETH (~$886M), marking a significant bullish sign.

Ethereum’s Pectra Upgrade: A Potential Bullish Catalyst

The upcoming Pectra upgrade (April 2025), which includes EIP-7702 for wallet functionality and EIP-7251 for staking limits, could spark a potential bullish rally.

Also Read: Internet Computer Price Prediction 2030

Ethereum Price Prediction: 2025 and Beyond

Short-Term Outlook: ETH may dip to $1,900 if bearish trends persist.

Long-Term Outlook: With strong accumulation and the Pectra upgrade, ETH has the potential to retest its all-time highs by 2030.

While Ethereum faces short-term risks, long-term fundamentals remain strong. Keep an eye on key support levels and upcoming upgrades for a clearer market outlook.