Hey, Crypto Enthusiasts!

Bitcoin's shocking crash has caught many traders off guard, especially with October's bullish expectations. What sparked this sudden dip, and what does it mean for the month ahead? Let’s explore the surprising factors behind this downturn!

What Caused the Market Crash?

Several factors led to the recent market slump:

Market Cap: The total cryptocurrency market cap fell by 3.6%.

Trading Volume: Spiked by 37.6%, suggesting high selling pressure.

Bitcoin Inflows: Over 1,667 BTC flowed into exchanges overnight, with a 3,275 BTC inflow reported the previous day.

Fear and Greed Index: The index dropped to 42, indicating a shift from greed to fear in market sentiment.

Bitcoin and Ethereum Take a Hit

Both Bitcoin and Ethereum experienced notable price declines:

Bitcoin: Fell by 2.59%, now hovering around $61,521.

Ethereum: Dropped a 4.96% drop but held up better than other altcoins, losing 3.8% to trade just above $2,500. Looking ahead, ETH price prediction remains optimistic despite short-term volatility.

Panic as Bitcoin Briefly Dips Below $60,000: Bitcoin's dip below $60,000 caused widespread panic, leading to mass liquidations among traders who were overly bullish.

Middle East Tensions Trigger Bitcoin Sell-Off: Rising tensions between Iran and Israel pushed investors away from risky assets, driving Bitcoin's price down from $64,000 to just above $60,000.

Iranian Missile Attack Fuels Further Decline: The decline worsened after reports of Iran launching missiles at Israel, wiping out Bitcoin’s gains since the U.S. Federal Reserve’s rate cut.

Bitcoin's Correlation with Risk Assets: Bitcoin’s price movement reflected its close relationship with stocks, as the S&P 500 and Nasdaq dropped while safe-haven assets like gold rose by 1%.

Analysts Remain Optimistic for Bitcoin: Despite recent volatility, analysts believe Bitcoin has long-term potential, suggesting it might be undervalued based on key valuation metrics

Also Read: Solana Price Prediction 2024 & 2030: Will SOL Price Reclaim $200 This Q3?

Sentiment Shift: Why the Market Moved Against Expectations

The crypto market is notorious for moving in unexpected directions, often when sentiment is at an extreme. Despite widespread optimism for October, this crash serves as a reminder that market corrections can occur when everyone least expects them.

Geopolitical Tensions Play a Role

The ongoing conflict between Iran and Israel has added a layer of uncertainty to global markets, including cryptocurrencies. The geopolitical situation has created a risk-averse atmosphere, leading to increased volatility.

Mass Liquidations: How Traders Were Affected

In the past 24 hours:

15,493 traders were liquidated.

Over $524 million in positions were wiped out.

The rapid shift from greed to fear has left many traders scrambling to adjust their strategies.

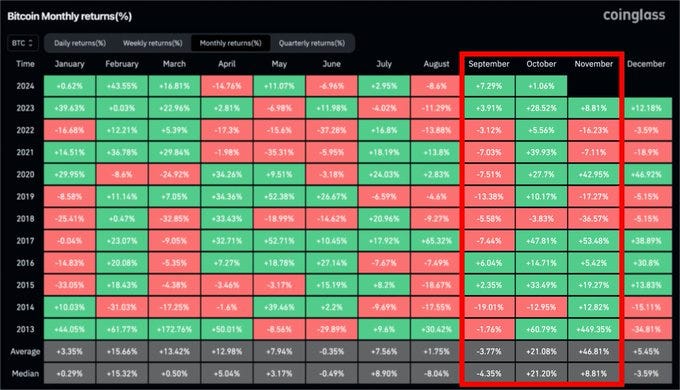

Historical Trends: October’s Rocky Start

Historically, October has a pattern of starting with a market correction. Early-month sell-offs have been common in previous years, followed by a recovery later in the month. This year appears to be following a similar trend.

A Change in October’s Outlook

With the market correcting earlier than expected, the outlook for October has shifted. Initially, we anticipated a dip later in the month, but the early correction could mean a sooner recovery. The key is watching how sentiment evolves in the coming days.

My Plan for the Rest of October

If Bitcoin dips slightly below $60,000 to around $59,200, plan to open a long position. This correction presents an opportunity to enter the market at a lower price, especially with the possibility of a rebound later in the month.

What’s Next for Bitcoin?

While October has started on a red note, it doesn’t mean the month will end the same way. The crypto market has a history of bouncing back, especially after fear takes hold. Rcemain cautiously optimistic that we’ll see some positive momentum before the month ends.

What are your thoughts on Bitcoin’s October performance? Do you think we’ll see a recovery, or is more downside ahead? Let’s discuss in the comments!