Hey friends!

Bitcoin just crossed $66,000, sparking buzz about an impending bull run. But is this the start of something big, or should we hold our horses? Let’s explore!

Crypto Market Overview

Before we get into whether the bull run has started, let’s take a quick look at the current state of the market:

Market Cap: The total crypto market cap has seen a 1.6% increase.

Trading Volume: Trading volume is down by 8.3%, showing some hesitation.

Bitcoin Inflows: No significant inflows were recorded in the past 12 hours, but yesterday we saw two inflows totaling 2,098 BTC.

Fear and Greed Index: The market sentiment is currently sitting at 64 (Greed), which is a significant jump from previous months.

This data shows that the market is turning optimistic, but let’s not get ahead of ourselves just yet.

Most Coins Are in the Green

The cryptocurrency market is looking lively, with most coins, including stablecoins, showing positive growth. Bitcoin has increased by 2.03%, while Ethereum has surged by 3.13%. Many altcoins are experiencing double-digit gains, contributing to the upbeat mood.

Ethereum's Current Price and Risks: Ethereum's price is currently below $4,000. This reflects uncertainty about its future development, as well as its potential for higher returns compared to Bitcoin. However, it also comes with increased risks.

Ethereum Price Prediction: Standard Chartered estimates that Ethereum could be valued between $26,000 and $35,000. However, for ETH to reach this range, Bitcoin must first hit $175,000.

Also Read: Solana Price Prediction 2024 & 2030: Will SOL Price Reclaim $200 This Q3?

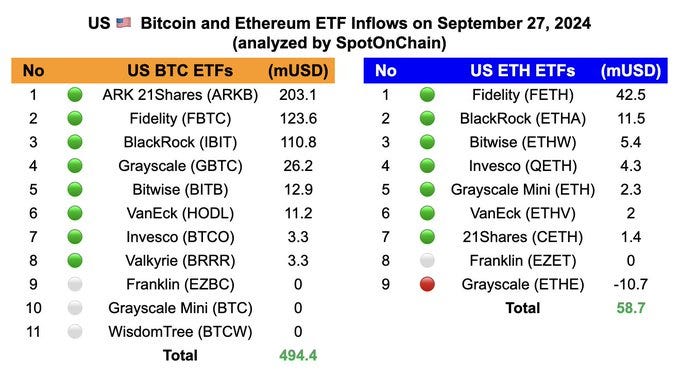

ETF Activity

Massive ETF Purchases: On September 24, BlackRock bought 98.9 million BTC, followed by another 184 million BTC the next day. This brought their total purchases to around $365 million.

Impact of Institutional Buyers: Other big players like Fidelity and Ark Invest are also buying significant amounts of BTC. This surge in institutional buying is driving market sentiment towards a more bullish outlook.

So, Is the Bull Run Really Here?

Let’s be honest—the market does look promising, but it's still in the early phase of what could become a bull run. For a true, confirmed bull run, we need to see some key developments:

Breaking the All-Time High: Bitcoin needs to surpass its all-time high of $69,000 on a monthly chart to signal a strong bull run.

Sustained Buying Momentum: To maintain a bull trend, there must be ongoing buying activity and upward market momentum.

Overcoming Resistance: Bitcoin must break through current resistance levels to confirm a steady upward trend.

RSI and Price Levels: Currently trading above $66,000, According to analyst Josh of Crypto World, Bitcoin's Relative Strength Index (RSI) is entering the overbought zone, indicating potential resistance ahead.

Next Resistance Level: If Bitcoin breaks the key resistance at $68,000, it could aim for new all-time highs between $73,000 and $74,000. However, if it struggles to break this level initially, a temporary pullback to around $64,000 to $63,000 may occur.

Until these things happen, it’s safer to say we’re still in the initial phase of the bull run. The market could still reverse, but once these markers are hit, we’ll be off to the races.

Final Thoughts

Bitcoin's price is nearing the $67,000 to $68,000 resistance level. While bullish trends create excitement for a potential bull run, cautious investors should stay alert for possible pullbacks until Bitcoin breaks its all-time high on a monthly scale.

Let me know your thoughts in the comments! Do you think the bull run has started, or are we still in the waiting game?