Hey there!

Curious about Bitcoin’s latest price movements? Let’s dive into recent trends, the impact of FTX’s liquidation plan, and what’s driving the cryptocurrency market right now. Here's a breakdown!

Bitcoin’s Price Dip: Normal Trend or Concern?

Bitcoin’s price has dropped by 1.55%, currently trading at $62,689.

This is still within the key price zone set since September 30.

Resistance level: $63,500. A break above this could signal a bullish reversal.

Support level: If Bitcoin falls below this zone, it may test the $60,000 mark.

No major events are causing this dip; it appears to be part of normal market fluctuations.

Ethereum is facing challenges today. For insights on what's ahead, check out this month's detailed ETH price prediction to see what could happen next.

FTX Repayment Approved

FTX’s plan to repay creditors has been approved.

The plan allows FTX to repay $16 billion, covering 98% of users with 119% of their account value.

This includes principal and interest for non-government creditors, marking a key step in FTX’s recovery.

Between $14 to $16 billion will be involved in the process.

If this money flows back into the crypto market, it could boost liquidity and have a positive impact.

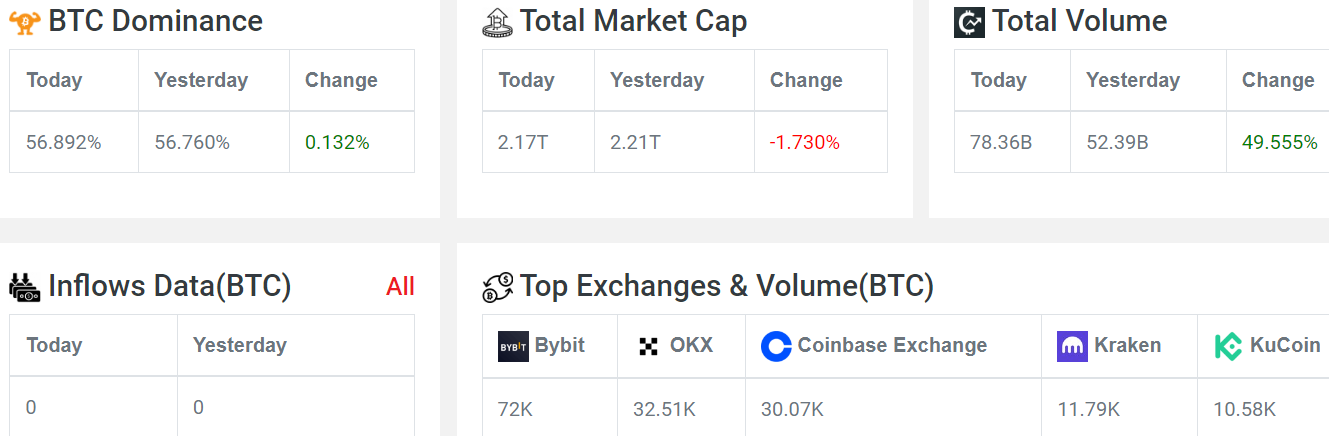

Market Overview

The crypto market is currently down by 1.7% as per Coinpedia Markets.

The Fear and Greed Index stands at a neutral 49, indicating that market sentiment is neither overly optimistic nor pessimistic.

BTC and ETH are both down, with Ethereum seeing a 2.60% decrease.

Also Read: Solana Price Prediction: Will SOL Price Reclaim $200 In 2024?

Satoshi Nakamoto’s Identity to be Revealed?

HBO is releasing a documentary that claims to reveal the identity of Satoshi Nakamoto, the creator of Bitcoin.

This has stirred up significant buzz in the market, with many speculating about who Nakamoto could be.

Some popular guesses include names like Nick Szabo and Len Sassaman, but nothing is confirmed.

Although the documentary may offer some insights, the actual identity is unlikely to be fully disclosed.

Global Market Factors Influencing Bitcoin

The U.S. market has seen a downturn, with S&P 500 down by 0.96% and Nasdaq down by 1.18%.

Rising bond yields in the U.S. have also affected global markets, indirectly impacting Bitcoin prices.

Additionally, Hurricane Milton, currently affecting parts of the U.S., could have a further impact on markets if the situation escalates.

A Positive Outlook for Bitcoin?

Bitcoin and altcoins have pulled back due to expectations of slower U.S. interest rate cuts and a stronger dollar.

Attention is now on the upcoming Fed minutes and inflation data for market direction.

Despite short-term fluctuations, Bitcoin's long-term outlook is still positive.

Documentaries and potential investments from firms like BlackRock could boost interest.

However, it's important to note that predicting when these changes will happen is challenging.