Hey friends!

Let’s dive into Bitcoin’s latest trends, explore short- and long-term chart analysis, and uncover key upcoming events, including a massive $16 billion repayment that could shake the market!

Crypto Market Overview

Market Cap: The crypto market cap is currently at $2.1 trillion.

Trading Volume: The trading volume stands at $16.8 billion.

Market Sentiment: The Fear and Greed Index is at 61, indicating a Greed sentiment. Overall, the sentiment over the past hour is neutral.

Bitcoin Performance: Bitcoin (BTC) is down by 2.01% at this time.

Bitcoin Analysis

Key Resistance at $65K-$70K: Bitcoin is struggling to break past the critical $65K-$70K range, with multiple rejections at previous highs. Historically, each failed attempt has led to a significant drop in price, so caution is key.

Crucial 4-Hour and Weekly Signals: A recent 4-hour candle has shifted market sentiment, but we need to see the monthly close above the all-time high for a confirmed upward trend. The weekly chart shows another rejection, which has often led to further declines.

USDT Premium and Bearish Sentiment: USDT trading below parity in China suggests low demand for cryptocurrencies, adding to the overall bearish outlook. This drop in demand could keep Bitcoin under pressure.

Conditions for a New Bull Run: A new Bitcoin bull market will likely require a breakout above $70,000, improved global economic conditions, and increased institutional investment. Without these, the price may remain range-bound.

Ethereum dropped by 2%, now trading around $2,625, likely due to significant selling from Vitalik Buterin’s wallet (0x556) and broader market trends. This move could impact future ETH price predictions.

Similarly, Solana fell by 1% to $156, but its trading volume spiked by 54% to $2.06 billion. Despite the dip, this increased activity may influence future SOL price predictions.

Upcoming Important Events

Key Economic Reports: This week will feature important data, including job claims, PMI data, and job reports coming out on Friday. These will impact market sentiment significantly.

ETF Developments: The situation regarding the BlackRock ETF has improved, with around $494 million in recent buying activity. Last week showed positive trends.

Potential Buying Pressure: If we approach nearly $1 billion in buying pressure and if FTX’s $16 billion repayment occurs, we could see a surge in Bitcoin’s price.

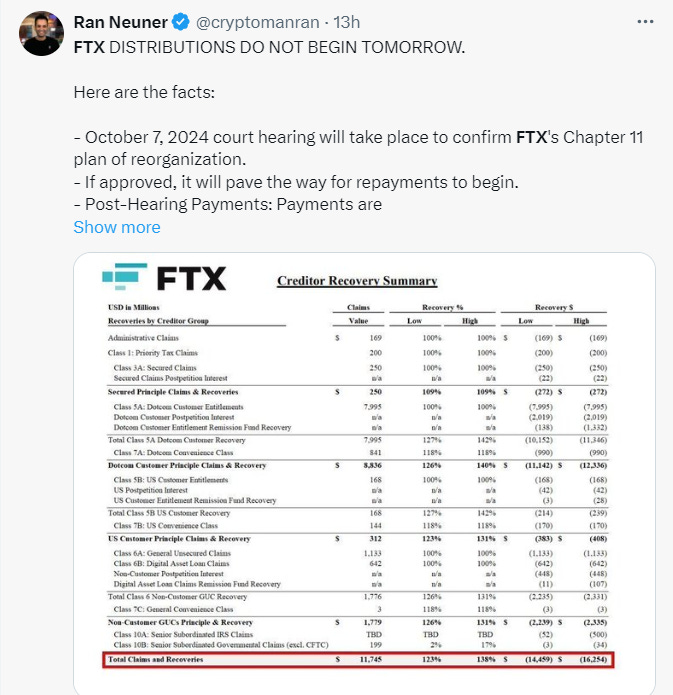

Clarifying the FTX $16 Billion Repayment

Important Dates: The date of October 7th is crucial for confirming whether the repayment plan is approved.

Expected Repayment: It’s anticipated that only 10-15% of the total will be repaid. The belief that this will lead to a major Bitcoin surge is likely misleading.

Misinformation Warning: Some large accounts are sharing unverified information, leading to speculation. It’s essential to base trading decisions on confirmed data.

Final Thoughts

Despite Bitcoin nearing $66,000, a true bull run seems distant. Investor caution, China’s bearish sentiment, and institutional hesitation are keeping the market on edge, awaiting the next breakout.