Is Bitcoin going to hit $50,000

Bitcoin's Price Drop Explained Insights into Miner Activities and Price Liquidations

Hey there, crypto enthusiasts!

If you've been keeping an eye on Bitcoin lately, you've probably noticed it's been on a bit of a wild ride.

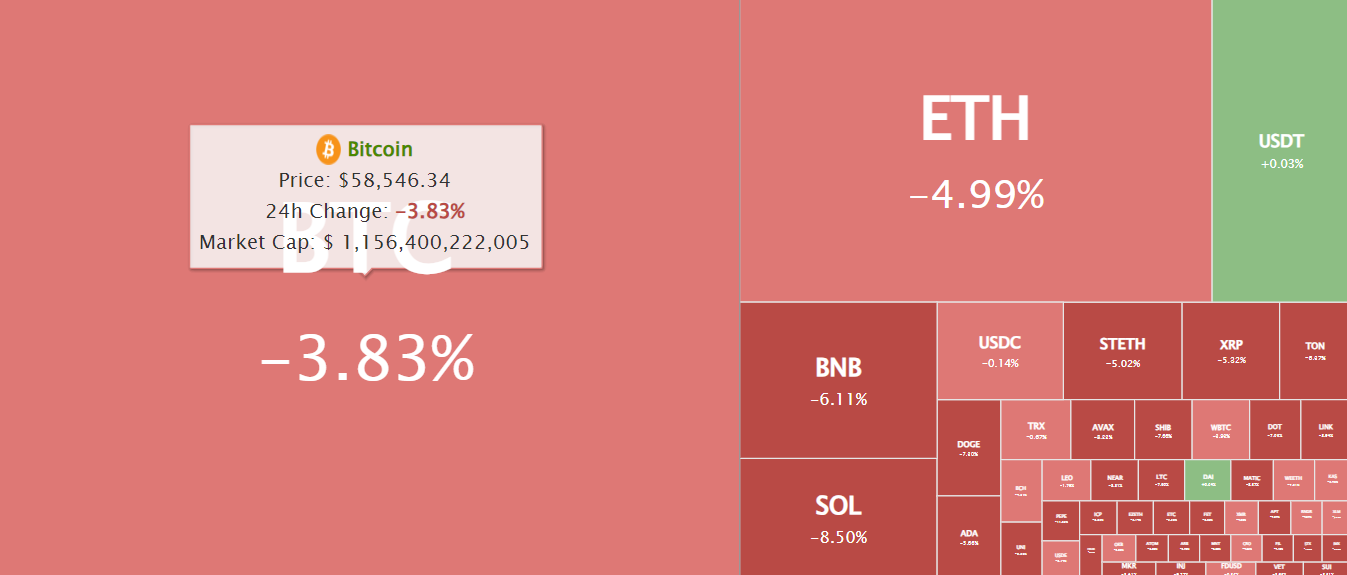

Just recently, Bitcoin dipped below $58,000, marking its lowest point in the past two months. So, what's causing all this turbulence?

The Mt. Gox Factor

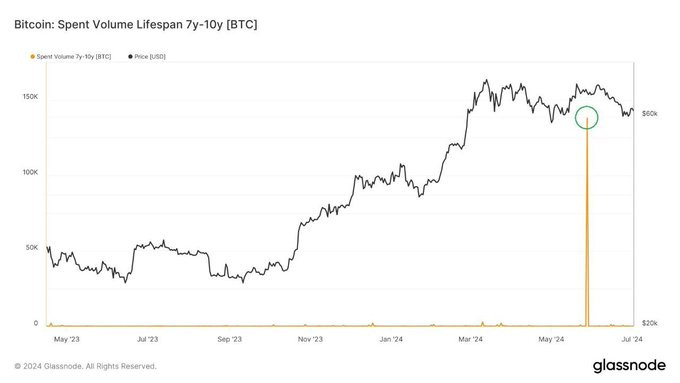

Remember Mt. Gox? That's the crypto exchange that went belly-up back in 2014, way before Bitcoin hit its stride. Now, after years of legal battles and waiting, they're sitting on around $9 billion worth of Bitcoin, which they could start cashing out soon.

Imagine waiting a decade and seeing your investment shoot up almost 100 times in value! But, here’s the catch: when they start selling off those Bitcoins, it could flood the market and push prices down further.

Miners Doing Their Thing

Then there are the miners – those folks who validate transactions and keep the Bitcoin network running.

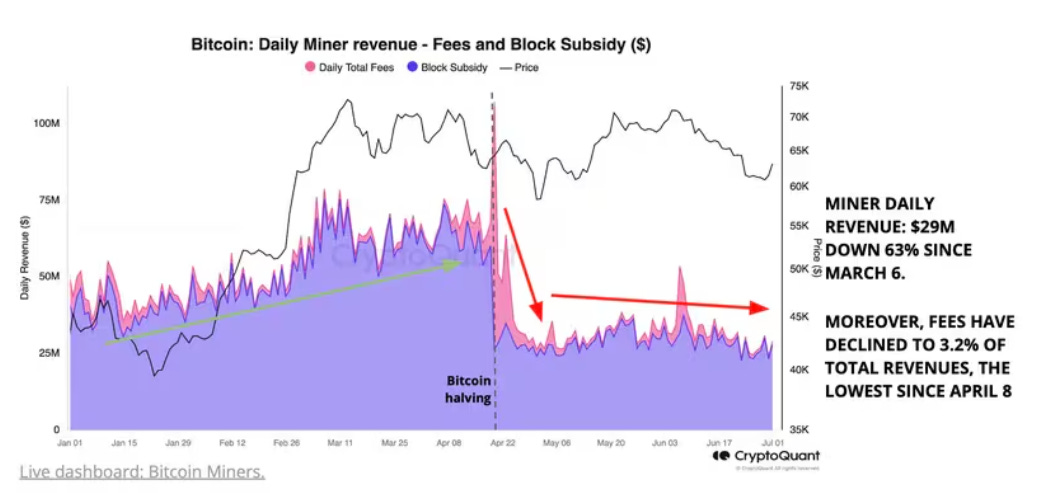

Recently, Bitcoin miners have been making headlines by offloading over $150 million worth of BTC across multiple exchanges. This surge in selling activity follows a sharp decline in their daily revenues, plummeting from $79 million to just $29 million post the latest Bitcoin halving event.

But why the rush to sell? Since the halving, miners' daily earnings have taken a significant hit. To keep their operations running smoothly and cover essential costs, they've had no choice but to liquidate a portion of their Bitcoin holdings.

Liquidations and Market Waves

The market's been reacting pretty strongly to all this. Just in the last day, over $231.9 million in long positions got wiped out – that’s a big deal! It's triggered more selling as people scramble to cut their losses or take advantage of lower prices. This kind of chain reaction can send Bitcoin prices spiraling, as we've seen recently.

What's Next?

Looking forward, the pressing question revolves around Bitcoin's trajectory amidst several impactful factors. As Mt. Gox repayments draw closer and miners continue to sell off, the crypto market faces significant influence. Additionally, the German government's involvement in Bitcoin transfers adds another layer of complexity.

Chair Jerome Powell of the U.S. Federal Reserve has indicated a cautious approach, suggesting the need for more evidence before considering interest rate cuts. This stance has tempered market optimism, with expectations for a September rate reduction now standing around 65% according to CME Group’s FedWatch Tool.

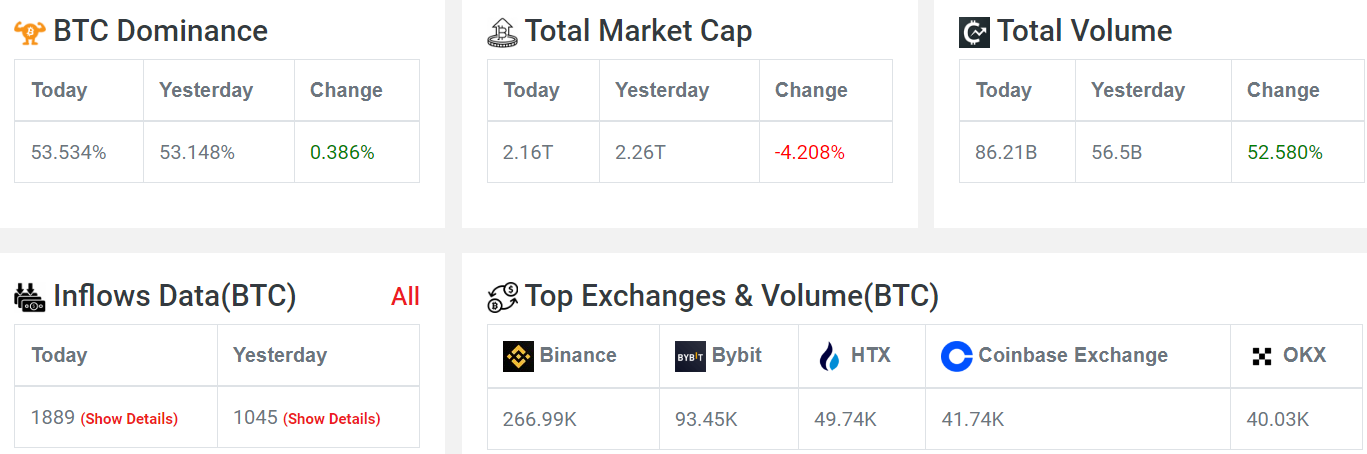

Market volatility has been evident with frequent reversals on exchanges leading to liquidations and downturns. Bitcoin's dominance at 53.52% in the crypto market remains a critical indicator of its resilience amidst these challenging conditions.

the market's in a bit of a holding pattern. It's not just about Bitcoin's price right now; it’s about how these big moves will shape its future. Keep an eye on those support levels around $57,000 – they could be crucial in determining whether Bitcoin bounces back or faces more turbulence.