Is Bitcoin About to Break $68K Soon?

What's Driving Bitcoin Price Up?

Hello friends,

We’ll discuss Bitcoin and the incredibly bullish statements made by BlackRock CEO Larry Fink regarding cryptocurrency. Let’s dive right into it!

Crypto Market Overview

Market Cap: The overall market cap is up by 1.0%.

Volume: Currently, trading volume is up by 11.2%, with a total of $108 billion.

Inflows: As of midnight, there have been no major inflows, but yesterday saw inflows of 2,556 BTC.

Fear and Greed Index: The index is at 73, indicating "Greed." A few days ago, we were at 32, in "Fear." This shift to greed suggests the market is becoming more bullish, but be cautious—these times often lead to shakeouts.

Bitcoin Price Analysis

Current Price: Bitcoin is trading at $67,022 as per Coinpedia Markets.

Resistance: Bitcoin faces resistance at this level, a point where it has been rejected before.

Support: It recently bounced from a strong support level, placing it in a critical zone.

All-Time High: To confirm a bull run, Bitcoin must break its previous all-time high of $69,000.

Analyst Outlook: If Bitcoin maintains its upward trend, further gains are possible, but it needs to close above $69,000 on both weekly and monthly charts to confirm a parabolic rise.

Short-Term Outlook: The market looks bullish, but sustained momentum is needed to push prices higher.

Ethereum Price Analysis

Current Price: Ethereum is at $2,608.48, with a 24-hour dip of 0.31%.

Support: It’s holding near its support level of $2,400.

Uptrend: ETH is showing an upward trend but needs buying pressure to break through the $2,800 resistance. Check the full eth price prediction for what’s coming next!

Solana Price Analysis

Current Price: Solana is at $153.57, with a 1.58% loss in the past 24 hours.

SOL is steadily climbing and approaching the critical $155 resistance level. If it breaks through, we could see further gains. Want to know what happens next? Read the full sol price prediction for insights on its potential!

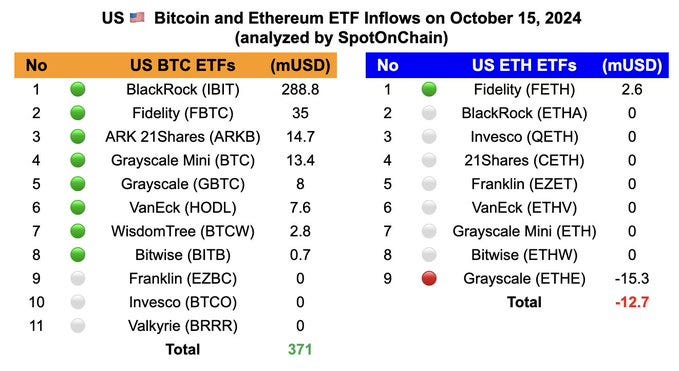

ETF Activity

ETF Purchases: As of October 14th, $555 million worth of ETFs were purchased, and by October 15th, an additional $82.2 million in Bitcoin was bought. In total, 5,567 BTC were purchased, contributing to $373.3 million in net inflows for Bitcoin ETFs.

ETH Outflows: On the flip side, 4,830 ETH were sold, leading to $12.7 million in net outflows for Ethereum ETFs.

Grayscale's Proposal: Grayscale has submitted a proposal to convert its Digital Large Cap Fund, which includes Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, and Avalanche (AVAX), into an exchange-traded fund (ETF).

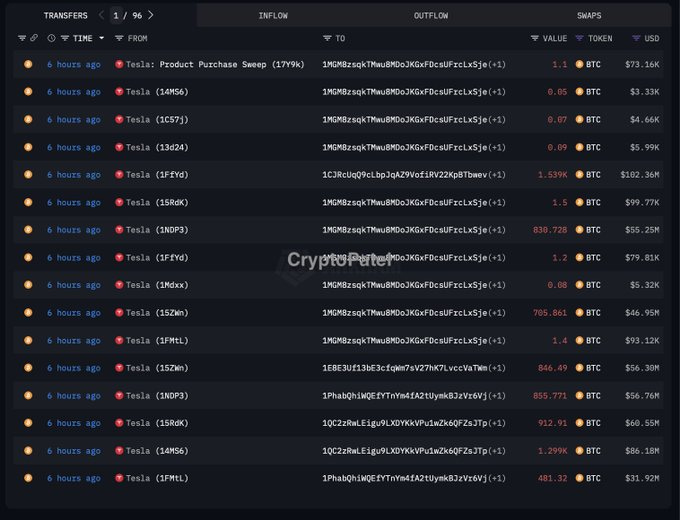

Tesla’s Bitcoin Move: Tesla transferred its entire Bitcoin holdings, worth over $765 million, to unknown wallets, sparking speculation about the company's motives and potential market impacts.

BlackRock CEO’s Bullish Outlook

BlackRock CEO Larry Fink made two significant statements:

Bitcoin as Big as U.S. Housing Market: Fink believes Bitcoin could grow as large as the U.S. housing market, which is valued at over $50 trillion. Currently, Bitcoin’s market cap is around $1.4 trillion, implying a potential 35-40x growth.

Bitcoin is a New Asset Class: Fink stated that Bitcoin is an asset class in itself, comparing it to gold. This is a massive endorsement from the CEO of one of the world’s largest asset managers, and it signals a major shift in institutional interest toward Bitcoin.

The crypto market is showing signs of bullish momentum, but confirmation will come only when Bitcoin breaks key resistance levels on the weekly and monthly timeframes. Stay cautious and avoid overreacting to short-term price movements. Larry Fink's bullish stance on Bitcoin adds to the growing institutional confidence in cryptocurrency.