Hey There, Crypto Peeps!

Bitcoin tumbles 2.6% as investors brace for the Fed’s first rate cut in years, while Trump survives a shocking second assassination attempt, sending shockwaves through the crypto market.

Crypto Market Analysis

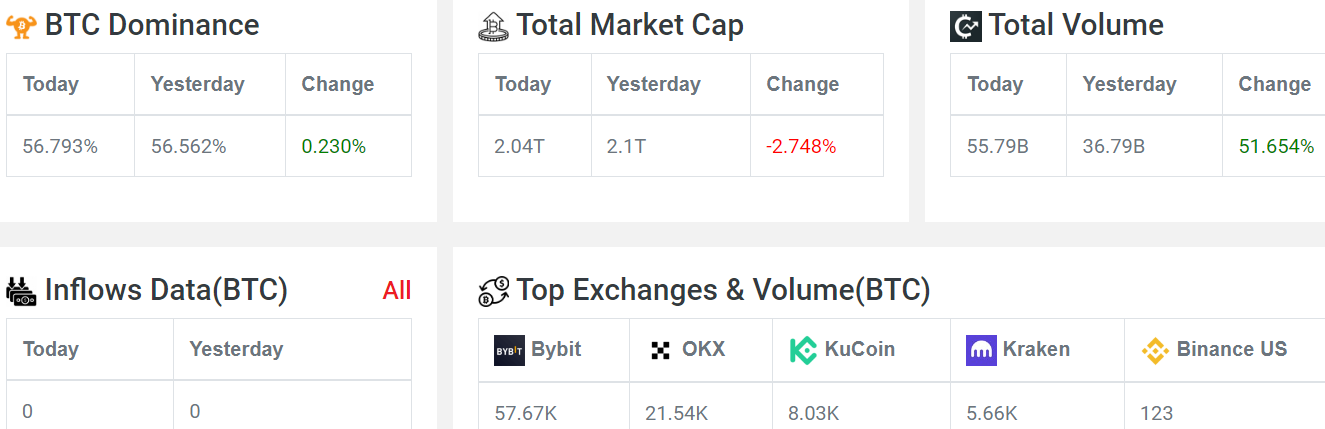

Market Cap: Down by 3.5%.

Volume: Up by 31.9% due to the new week starting.

No major data was recorded from midnight until now, or even yesterday.

Fear & Greed Index: Fear levels have dipped to 39, showing the market sentiment is leaning towards a sell-off.

In the last hour, sentiment has shifted towards "sell," with a sharp decline visible.

Bitcoin (BTC): Down by 3.52%.

ETH price: Down by 7.01%.

FOMC Meeting and Rate Cut

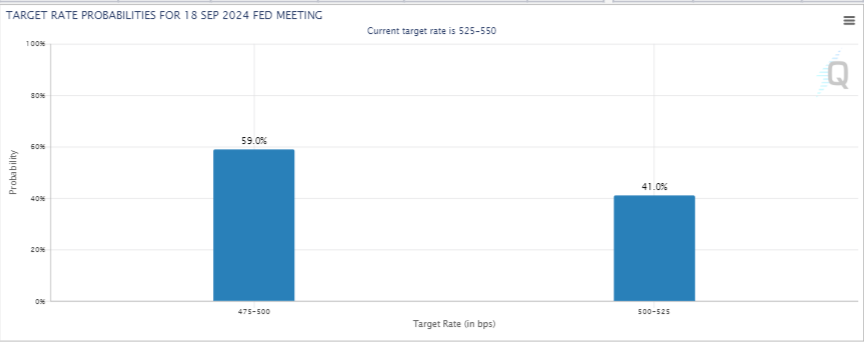

The upcoming FOMC meeting on the 18th is expected to decide on a rate cut in the US, and sentiments are rapidly changing.

Initially, there was a 99.9% chance of a rate cut, with expectations for a 25 BPS cut, but now predictions suggest a 50 BPS cut.

The chances for a 50 BPS cut have jumped from 17% to 58%, making this a highly critical event.

Impact on the Market

A rate cut is generally seen as a positive sign, leading to market rallies. However, if the cut is 50 BPS instead of 25 BPS, Bitcoin’s price could rise sharply.

Conversely, if no rate cut happens or it’s lower than expected, the crypto market may witness a dip.

Bank of England Interest Rate Decision: The Bank of England will announce its next interest rate decision on September 19, following a recent cut from 5.25% to 5% on August 1. This was the first reduction since 2021’s tightening cycle began.

Focus on Inflation: Monetary policy members are monitoring inflation persistence, even after reaching target levels, to guide future decisions.

Bank of Japan’s Upcoming Decision: On September 19, the Bank of Japan will also announce its interest rate decision. The meeting is significant as the bank has maintained a long-standing tightening policy, with negative interest rates and yield curve control.

This week is expected to be highly volatile due to this event, so traders should exercise caution.

Trump’s Assassination Attempt and Bitcoin Impact

Second Assassination Attempt on Trump: Over the weekend, former U.S. President Donald Trump survived another assassination attempt at his West Palm Beach golf course, which had a short-term effect on Bitcoin’s price movement.

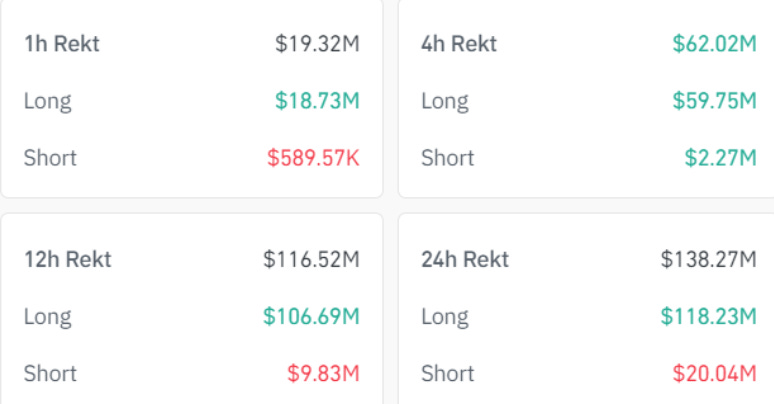

Impact on Bitcoin: News of the assassination attempt caused a sharp 3% drop in Bitcoin’s price, from $60,313 to $58,627, as market uncertainty increased.

Crypto Market Liquidations: The price drop led to liquidations worth $116.52 million, with $106.52 million coming from long trades. Over 49,000 traders were affected by the market chaos in the last 24 hours.

Trump’s Influence on Crypto: Trump's political stance on supporting cryptocurrency growth and regulations led many in the crypto community to link the price decline to his potential role in shaping the industry’s future.

Political Leaders Condemn Violence: President Joe Biden, Vice President Kamala Harris, and leaders from across the political spectrum condemned the assassination attempt, calling for an end to such violent acts.

The first US rate cut in over four years usually benefits cryptocurrencies by easing financial conditions. While Bitcoin has recently dipped, uncertainty around the Fed’s decisions and upcoming projections will be crucial in determining its future movement.