How Will Inflation Data Impact Crypto Market?

What’s Next for Bitcoin After the Inflation Data?

Hey Degens!

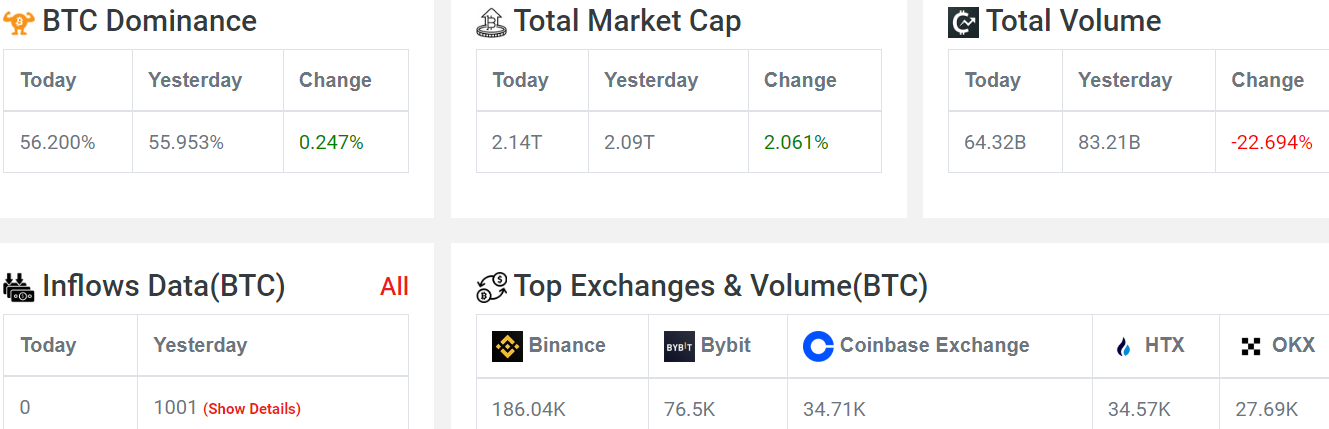

Bitcoin's dominance and market cap are on the rise, but trading volume has dipped. Today, all eyes are on the crucial US inflation data impacting crypto and stocks.

Crypto Market Overview

Today, Bitcoin’s dominance is at 56.175%, up from 55.996% yesterday. That’s a nice little increase of 0.179%!

The total market cap for all cryptocurrencies has risen to $2.14 trillion. This is a good jump from $2.09 trillion yesterday, showing a 2.072% increase.

However, trading volume has dropped to $64.6 billion, down from $83.46 billion yesterday. That’s quite a decrease of 22.592%. t

Today, there are no new inflows for Bitcoin, while yesterday saw 1,001 inflows. It’s a bit quiet on that front today.

Market Sentiment: The fear and greed index shows extreme fear in the market

Resistance Levels: The $62,000 to $63,000 range is pivotal for Bitcoin.

Hash Ribbons Signal: A buy signal from the hash ribbons indicates potential upward price movement in the coming months.

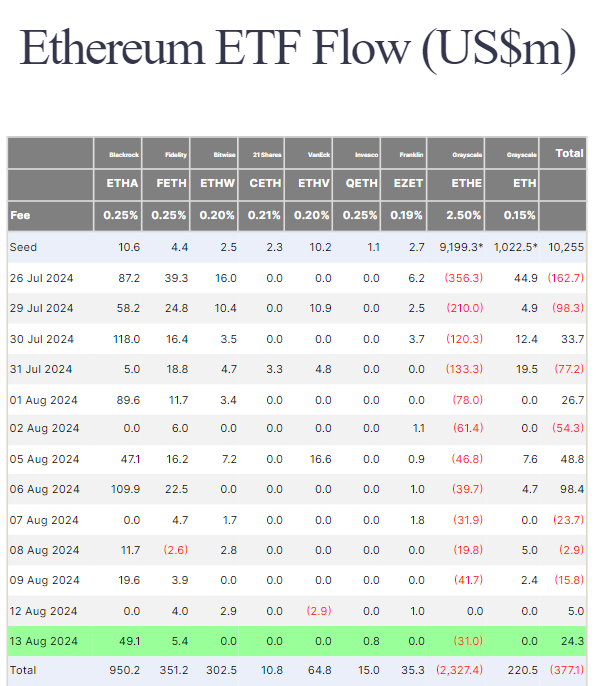

3. Ethereum ETF Movements

Total Net Inflow of Ethereum Spot ETFs: $24.3412 million.

Grayscale ETF (ETHE): Had an outflow of $31.01 million.

BlackRock ETF (ETHA): Enjoyed a solid inflow of $49.1244 million.

Fidelity ETF (FETH): Reported a smaller inflow of $5.4132 million.

4. Bitcoin ETF Movements

Total Bitcoin Spot ETF Inflow: $38.9442 million.

Grayscale ETF (GBTC): Faced an outflow of $28.6459 million.

BlackRock ETF (IBIT): Saw a good inflow of $34.5503 million.

Fidelity ETF (FBTC): Recorded an inflow of $22.5639 million.

Key Points to Consider

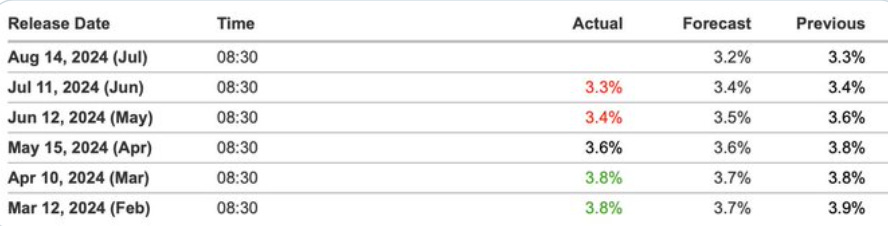

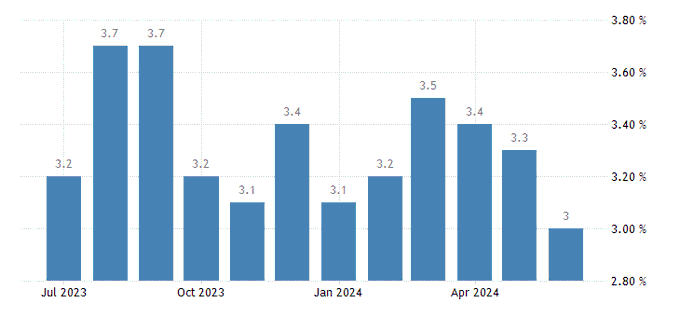

Release Time: US inflation data will be released at 8:30 PM.

Core Inflation Expectations: Analysts anticipate a 0.1% decrease in core inflation year-over-year.

Producer Price Index Insight: Yesterday’s PPI indicated slower wholesale inflation, suggesting overall price stability.

Market Implications: If CPI data is 3% or lower, it could boost market sentiment; conversely, rates of 3.1% or higher may heighten recession fears and lead to market declines.

Positive Outlook: Analysts expect CPI rates to be below projections of 2.6% to 2.9%, which could further support positive market reactions.

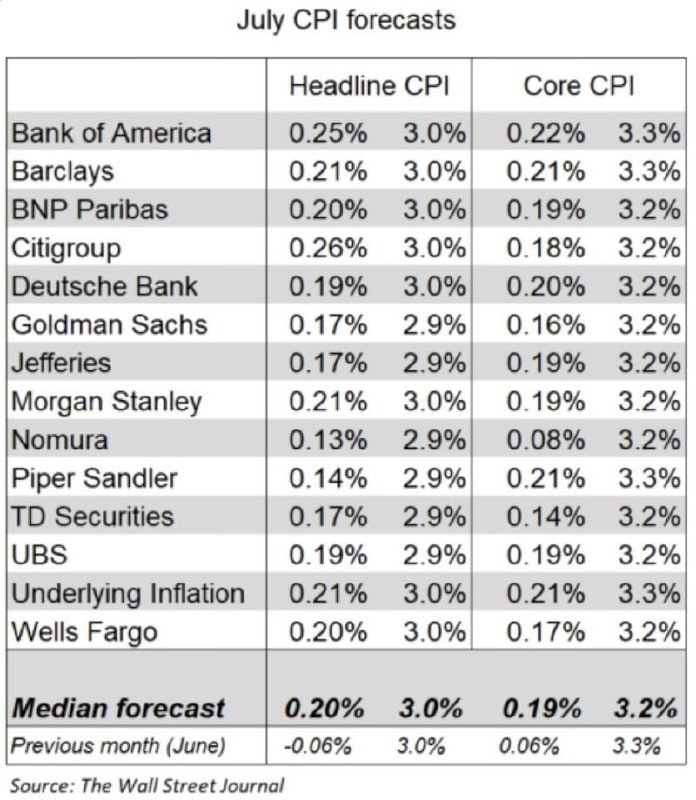

The Wall Street Journal published various institutions' forecasts for the Consumer Price Index (CPI)

Michaël van de Poppe states that Bitcoin's key levels are above $56K, with resistance at $60-61K. A CPI miss could push prices down to $48K if broken.

Inflation may drop below 3%, signaling a slowing economy. This could boost market sentiment and support a September rate cut.

Binance Users' Good News

Binance URL Ban Lifted: The ban on the Binance URL has been removed.

Legal Operations in India: Binance is now legally operating within India.

GST Issues: The platform is actively working to resolve GST-related concerns.

As Bitcoin navigates this critical moment, traders should stay vigilant and optimistic, watching key resistance levels and market signals closely as inflation data unfolds, shaping the crypto landscape ahead.