Hey Degens!

Bitcoin could be on the brink of a massive 20% drop, with analysts warning that the upcoming Fed rate decision might shake up the entire crypto market!⬇️

Current Market Overview

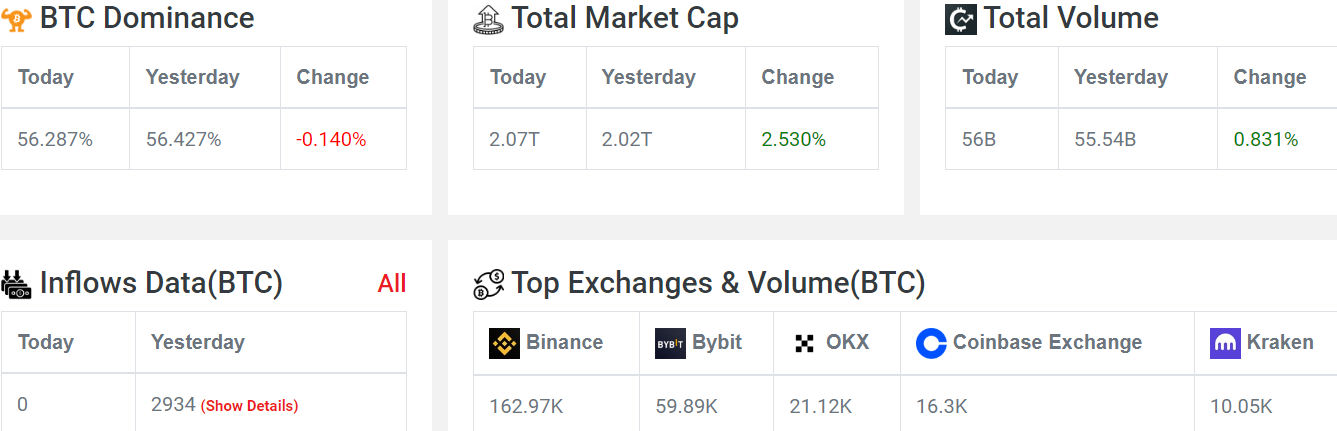

Crypto Market Volume: The total crypto market volume over the last 24 hours is $56 billion, a 0.80 percent increase.

DeFi Volume: The volume in DeFi stands at $2.94 billion, which is 5.25 percent of the total crypto market volume.

Stablecoins: Stablecoins make up $51.84 billion, or 92.56 percent of the total crypto market volume.

Bitcoin Dominance: Bitcoin’s dominance is at 56.28 percent, down by 0.15 percent over the day.

Bitcoin’s Recent Surge

August Performance: Since early August, Bitcoin has climbed over 32%. This surge is largely driven by traders anticipating favorable, or dovish, comments from the Federal Reserve.

Current Status: Bitcoin is currently trading at $58,954, reflecting a 2.38% increase in just one day. It’s breaking out of a Falling Wedge pattern, with a potential target of $61,156.

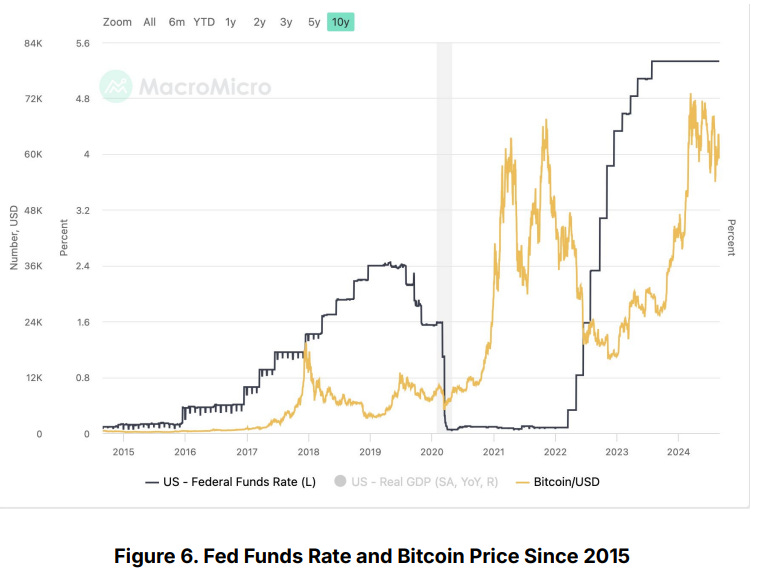

Impact of Potential Rate Cuts

The Federal Reserve's upcoming meeting on September 17-18 is expected to lead to an interest rate cut. Analysts are divided on the impact:

A 25 basis point cut could signal the beginning of a typical easing cycle, leading to long-term price appreciation for Bitcoin as liquidity increases and recession fears ease.

A 50 basis point cut might cause an immediate price spike but could be followed by a correction due to heightened recession concerns.

Analysts' Caution: Bitfinex analysts suggest that a rate cut could trigger a 15-20 percent decline in Bitcoin's value.

They predict a bottoming out between $40,000 and $50,000. This estimate is based on historical patterns, where the peak returns reduce by 60-70 percent each cycle. However, this prediction could change depending on macroeconomic conditions.

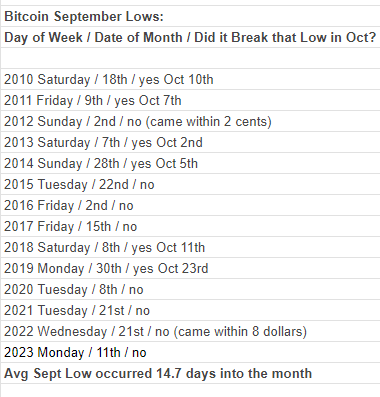

September: A Historically Volatile Month

Average Return: Historically, September has been tough for Bitcoin, with an average return of -4.78 percent.

Typical Decline: The month usually sees a peak-to-trough decline of around 24.6 percent.

Market Sentiment: Analysts, including Eric Crown, believe that if Bitcoin is to experience a downturn, it’s most likely to happen in the first half of September.

As September unfolds, Bitcoin traders should prepare for high volatility. The Federal Reserve’s rate cuts could push Bitcoin to $40,000 or beyond, but the unpredictable market and upcoming events could lead to surprising outcomes. Stay alert!