Hey Crypto Champs!

Bitcoin Breakout Alert! 🚀 Is Bitcoin on the verge of a massive bull run? With Fed's dovish stance, job growth woes, and a volatile political landscape, major moves are on the horizon. Let’s dive into the latest updates!

Crypto Market Overview

Market Cap: Currently up by 1.7%.

Volume: Showing an increase of 10.5%.

Fear & Greed Index: At 39, indicating a fearful market sentiment.

Current Sentiments: Predominantly bullish.

Heatmap: BTC is up by 2.40%, Ethereum by 1.20%.

Bitcoin Technical Analysis

Current Resistance: Bitcoin faces resistance around $61,300.

Support Levels: Current support is confirmed at $59,200 and $57,000.

“Bitcoin seems poised for a breakout. The recent Fed minutes, which had a very dovish tone, were released just a few hours ago,” said the pseudonymous crypto trader Sykodelic.

Markus Thielen, head of research at 10x Research, noted that the Fed’s minutes make a September rate cut almost certain. He highlighted that most FOMC members supported this cut, with some even considering a July reduction as viable.

Upcoming Bitcoin Movements: Significant price shifts in Bitcoin are anticipated around the September FOMC rate cut and the November U.S. elections.

Job Growth Decline: A recent drop of 81,000 jobs over the past year could influence the U.S. economic outlook and impact potential rate cuts.

Rate Cuts and Bitcoin: Speculation of a September rate cut is fueling bullish expectations for Bitcoin, as lower interest rates typically lead investors to riskier assets.

Q4 Market Outlook: Analysts predict an explosive Q4 for U.S. with Fed Chair Jerome Powell’s dovish stance potentially boosting stocks and Bitcoin.

Token Insights

Tron (TRX): Recently, Tron saw a significant price pump. The token’s price has approached its 2021 all-time high. The rise is attributed to the popularity of meme developer platforms on Tron.

BNB (Binance Coin): Similar to Tron, BNB is experiencing increased hype due to new meme developer platforms. The price of BNB has risen by 1.2%, but there’s still not enough volume compared to Solana.

ETF Update

Bitcoin ETF Inflows: Bitcoin ETFs saw consistent inflows for the 5th consecutive day, totaling $236.6 million, despite Grayscale’s ongoing selling streak.

Key Purchases: BlackRock bought $8.4 million, Bitwise acquired $10 million, and Fidelity purchased $10.7 million in Bitcoin ETFs.

Ethereum ETF Outflows: Ethereum ETFs experienced outflows for the 5th straight day, with a total outflow of $92.2 million, marking the longest streak since their launch.

Market Contrast: While Bitcoin ETFs are attracting investments, Ethereum ETFs are seeing significant withdrawals.

Political Impact on Crypto

2024 Presidential Election:

Donald Trump: Currently leading with 53%

Kamala Harris: At 46%. Reports suggest her team is discussing extending policies for the crypto industry. Harris’s support could impact market perceptions positively if she shows strong backing for crypto.

El Salvador’s Bold Move

El Salvador is launching a program to educate and certify 80,000 public servants in Bitcoin as part of its integration into governance.

Training Module Introduction: A new Bitcoin module will be added at the Higher School of Innovation in Public Administration (ESIAP), established by President Nayib Bukele in 2021, to train civil servants.

High Standards in Bitcoin Knowledge: Stacy Herbert, Director of the National Bitcoin Office, emphasized that this initiative aims to set a high standard of Bitcoin knowledge among civil servants, promoting excellence in the country.

Robert Kiyosaki’s Bold Prediction

Robert Kiyosaki Warns of U.S. Debt Crisis: The “Rich Dad Poor Dad” author urges investing in gold, silver, and Bitcoin to protect against economic uncertainty.

U.S. Debt at a Staggering $35 Trillion: Kiyosaki compares this debt to 31,688 years in seconds, highlighting the rapid accumulation—$1 trillion every 100 days.

Debt’s Impact on Citizens: With national debt approaching $35 trillion, every American owes about $100,000, raising concerns about long-term economic stability.

Predictions for Financial Markets: Kiyosaki forecasts a major economic crash followed by a bull market, with Bitcoin potentially reaching $10 million per coin.

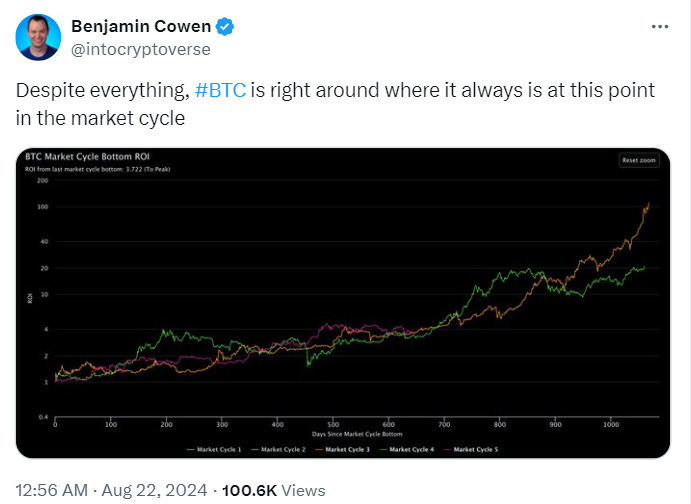

Bitcoin is poised for significant movement, with a possible bull run or decline ahead. Analyst Benjamin Cowen forecasts a parabolic rise, and Powell's upcoming speech may support this outlook. Stay updated on market trends and developments to navigate the crypto space effectively.