How Pavel Durov’s Arrest Could Affect Bitcoin?

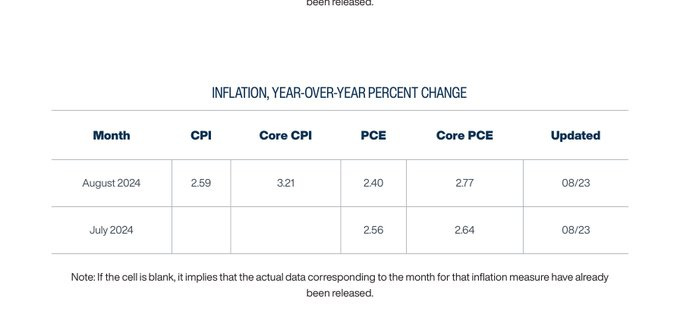

Will the PCE inflation data impact Bitcoin?

Hey Crypto Champs!

Bitcoin jumps past $62K, but is the market’s greed hiding bigger dangers? With low volumes and shockwaves from Durov's arrest, here’s what to watch before the next big move!

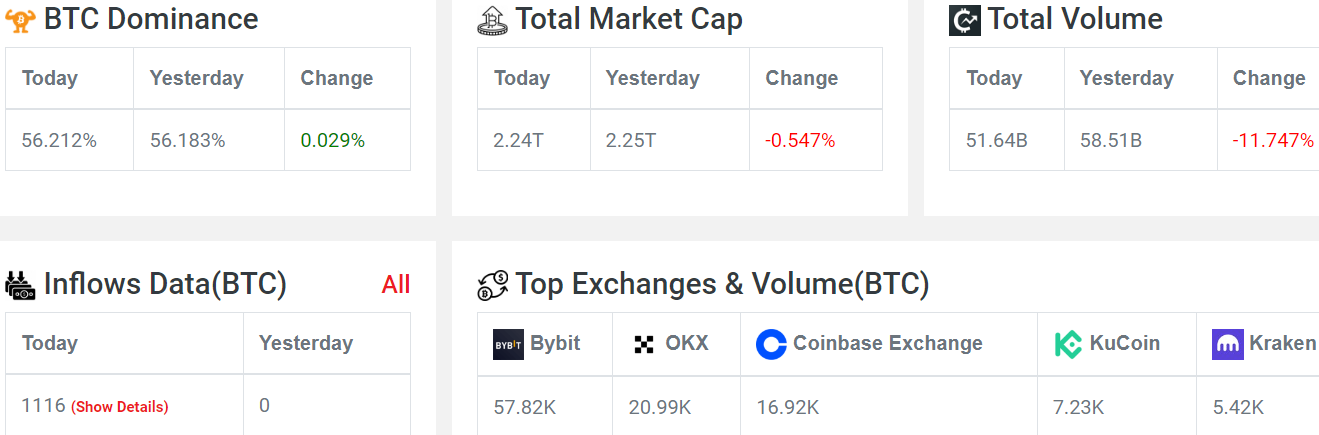

Crypto Market Overview

Bitcoin Dominance: 56.212% (up from 56.183% yesterday)

Total Market Cap: $2.24 trillion (down from $2.25 trillion yesterday)

Total Volume: $51.64 billion (down from $58.51 billion yesterday)

Inflows Data (BTC): 1116 (previously 0)

The Fear and Greed Index has swung back to the "greedy" zone at 55, indicating increased optimism. Historically, peak fear has often marked market bottoms, suggesting potential for a reversal.

Trading Volume remains low, which can indicate accumulation phases or unsustainable rallies. A return to higher volumes might signal stronger market movements.

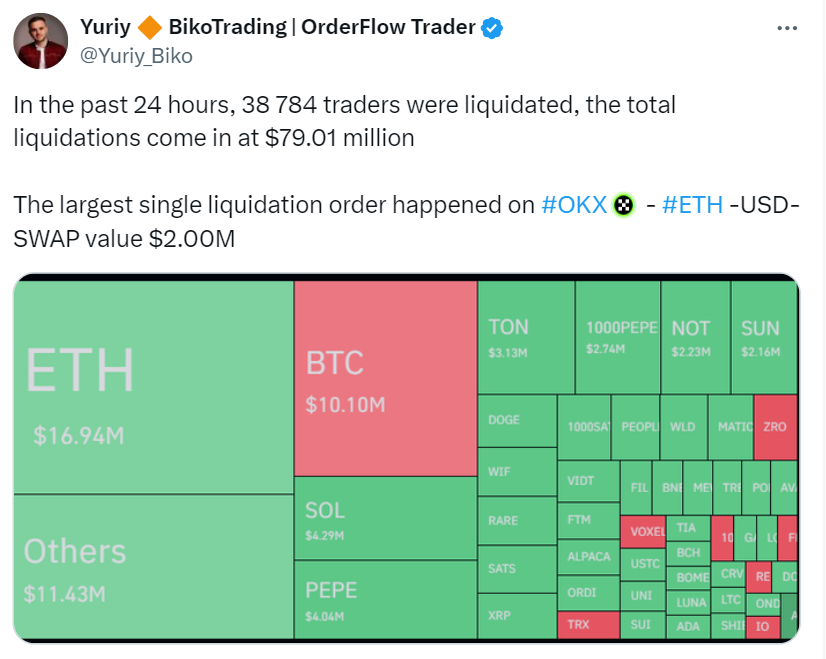

Liquidations and Market Ratios

Liquidations: $80 million in the past 24 hours, predominantly affecting long positions.

Volume: Overall volume down by 14% to $90 billion, indicating low market liquidity.

Long/Short Ratio: Balanced at 50.6% long vs. 49.4% short, suggesting potential for breakout signals if the market consolidates.

Bitcoin Price Analysis

Bitcoin Price: Currently around $63,781, with a 0.32% decrease in the last 24 hours. Despite reduced trading volume, experts predict potential highs between $68,000 and $71,000.

Cathie Wood’s Bullish Outlook: ARK Invest’s CEO expects Bitcoin to reach between $650,000 and $1.5 million by 2030, driven by its extensive network and security features.

Ali Martinez’s Analysis: Bitcoin showed a 7% increase last week and may continue its upward trend, though the timing of the golden cross and increased reserves on exchanges create market uncertainty.

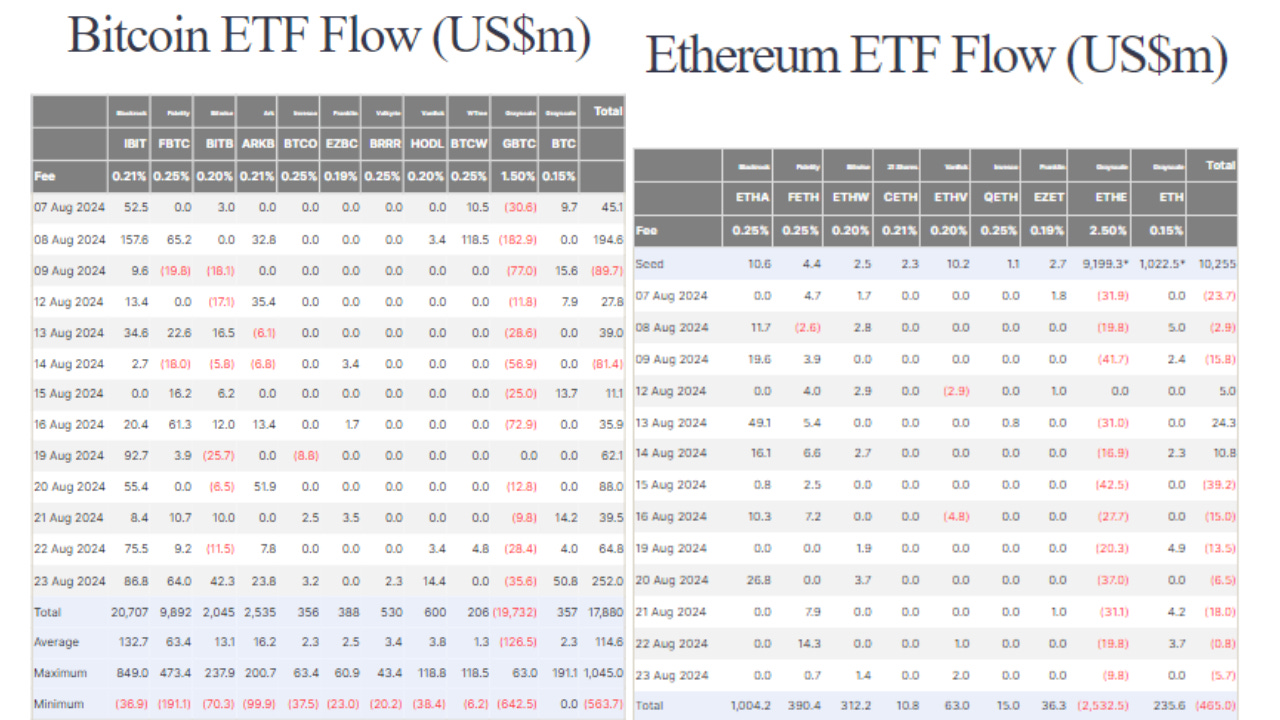

ETF Inflows and Outflows

Largest Net Inflows: $252 million on Friday, with BlackRock’s IBIT leading at $87 million.

Other Significant Inflows: Fidelity’s FBTC ($64 million), Grayscale’s BTC Mini Trust ($50 million), Bitwise’s BITB ($42 million).

Notable Outflows: Grayscale’s GBTC (-$35 million), with spot Ether ETFs experiencing a seven-day streak of outflows totaling almost $99 million.

Key Upcoming Events

US PCE Inflation Data: Market estimates predict a slight increase to 0.2% for July, up from 0.1% in June. Core PCE is expected to remain steady but could rise to 2.7% year-over-year. This data will influence the Federal Reserve’s decision on potential rate cuts.

Revised GDP Data: The second revision of Q2 US GDP data, scheduled for August 29, will offer insights into the US economic health and impact stock and crypto markets.

Telegram CEO Pavel Durov was arrested

Pavel Durov's Arrest: Telegram CEO Pavel Durov was arrested by French authorities at Le Bourget airport on charges including fraud, facilitating terrorism, organized crime, cyberbullying, and drug trafficking.

Telegram's Response: Telegram questioned the legitimacy of the arrest, arguing that the app complies with European regulations and that the charges against Durov are baseless.

Impact on Toncoin: Following the arrest, Toncoin, the native token of Telegram's blockchain (TON), dropped over 20%, losing $2.7 billion in market cap.

Community Support: The crypto community rallied behind Durov, with several TON-based projects showing solidarity through profile picture changes and trending hashtags like #FREEDUROV and #FreePavel.

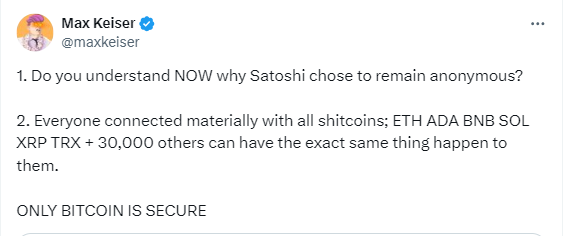

Max Keiser’s Bitcoin Warning

Max Keiser has expressed concerns about Bitcoin’s vulnerability following the arrest of Pavel Durov, the Telegram founder. Keiser believes Bitcoin is the only truly secure cryptocurrency and views altcoins like XRP and ADA as more susceptible to legal challenges.

This has reignited debates about the future of Bitcoin and potential risks if Satoshi Nakamoto’s identity were uncovered.

Market Outlook

Recent crypto market gains are influenced by Federal Reserve dovishness. However, upcoming PCE data and Fed remarks could either strengthen the rally or introduce instability. Notably, analyst Benjamin Cowen expects Bitcoin dominance to continue rising against altcoins before a reversal anticipated in 2025.

Pavel Durov’s arrest has caused a 20% drop in TONcoin, but Bitcoin remains relatively stable. However, upcoming PCE data and potential Fed rate cuts could introduce volatility and affect Bitcoin’s rally and short-term gains.