How Bitcoin price is influenced by the U.S. election?

Will Bitcoin drop if Harris leads the polls?

Hello friends!

It’s Election Day and the results could shake up the crypto market big time. We’re expecting major Bitcoin price swings, though the real impact might take a few days to settle in. Let’s jump into the big factors driving today’s excitement!

Current Market Snapshot

Market Cap: $2.7 trillion (down)

Volume: $10.4 billion (up)

Fear and Greed Index: 70 (Greed)

BTC Current Price: $68,689 (via Coinpedia Markets)

Ethereum Surge: ETH is up over 5.5% in the last 24 hours, reaching around $2,630. For a deeper look into where it might go next, check out the latest ETH price prediction!

Election Day Insights and Historical Context

Past U.S. elections often correlate with high market volatility, but results can take time:

2020: Results confirmed in 4 days.

2016: Results available the next day.

2012: Projected the night of the election.

2000: Results delayed until December 12 due to a close race.

This history shows that although Election Day is today, confirmed results could take anywhere from days to weeks, meaning any immediate price moves might still be speculative.

Market Sentiment Today

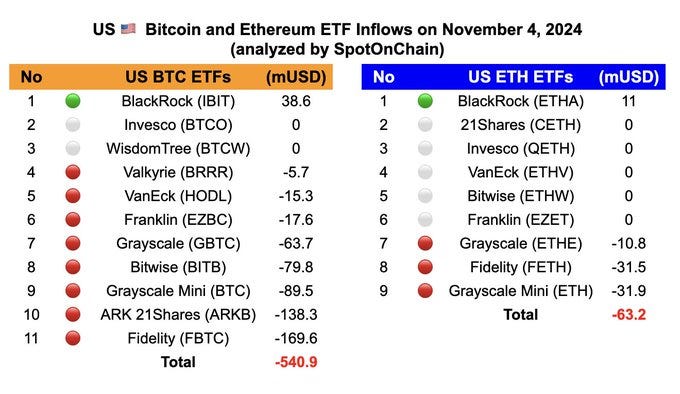

Investor Activity: Most investors are selling, except for BlackRock, which recently invested $38.4 million in crypto assets.

Inflows: No major inflows reported since midnight, hinting at cautious market behavior.

Interest Rate Outlook

The upcoming FOMC meeting on November 7 is a key event. There’s a 98% chance of a 50-basis-point rate cut, which could boost risk assets like Ethereum. Lower rates reduce the appeal of holding U.S. Treasury bonds, making riskier investments like crypto more attractive.

Election Predictions and Crypto Impact

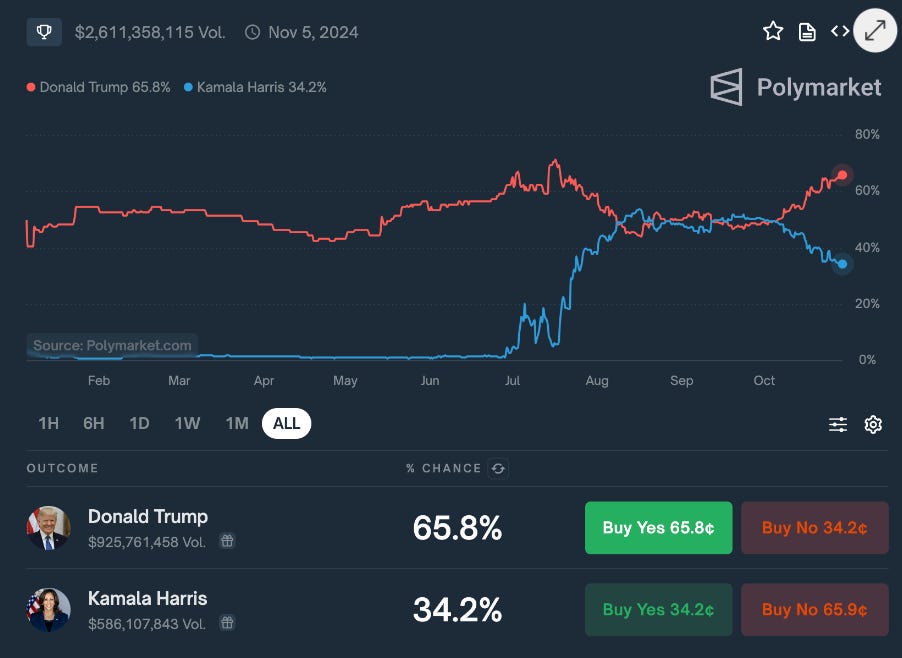

Polymarket markets currently give Trump a 58.3% chance of winning, while Harris has a 41.8% chance, with several states projected to take days or even weeks to complete their counts. This uncertainty contributes to market volatility, and here’s how each outcome might influence cryptocurrency prices:

Trump Victory: A Trump win could see Bitcoin surge above $90,000 before year-end, as he’s viewed as a crypto-friendly candidate likely to support the industry.

Harris Victory: A Harris win may lead to a regulatory environment less favorable to crypto, with Bitcoin potentially dropping to $50,000.

Market Reactions So Far

Leading up to the election, Bitcoin rose sharply, peaking at $73,149 as per Coinpedia Markets on October 30 before gradually declining. Analysts like Gautam Chhugani, Managing Director at Bernstein, expect the election to have a short-term impact on sentiment, with turbulence likely continuing in the immediate aftermath.

Long-Term Outlook

Despite short-term volatility, some experts believe the election’s impact on crypto will be minimal in the long run. Charles Edwards of Capriole Fund and other prominent traders project that Bitcoin could surpass $110,000 regardless of who wins, suggesting the election will only influence how quickly this price movement unfolds.

What to Watch For Today

If Bitcoin trades within the $67,000 to $69,000 range, it may indicate no confirmed results yet. A sudden spike or drop in price could imply an early lead for one of the candidates. Regardless, the market may take several days to react fully as results solidify.

In short, the election outcome could influence cryptocurrency prices in the short term, but the broader crypto trend remains bullish, with long-term forecasts largely unaffected by political shifts. Keep an eye on market movements in the coming days to gauge investor sentiment as election results unfold.