Hey, crypto enthusiasts!

Bitcoin just plummeted nearly $30,000 in a week, hitting its lowest point since February. What’s next for crypto? Buckle up for the ride!

Crypto Market Overview

Market Cap: The market cap has dropped below $2 trillion after a long time.

Trading Volume: There has been an 89.4% increase in trading volume.

Fear and Greed Index: Currently at 26, indicating fear in the market.

Major Price Drops

Bitcoin: Down 10.86%

Ethereum: Down 11.5%, highlighting a broader sell-off across the cryptocurrency market.

In the last 24 hours, $823 million has been liquidated, affecting 11,206 traders, including myself. If you've been affected, let us know in the comments.

What Happened in Crypto Market?

Middle East Tensions: Rising conflicts involving the US, Israel, and Iran are heightening global uncertainty and impacting market stability.

US Recession Concerns: Fears of a potential US recession are shaking global markets, including India’s Sensex. The Federal Reserve faces pressure to consider emergency measures, like interest rate cuts, to stabilize the economy.

ETF Outflows

Bitcoin ETFs faced significant outflows, totaling $237.4 million on August 2 and $80.4 million for the week.

Ethereum ETFs experienced $54.3 million in daily outflows and $169.4 million for the week, with Grayscale’s ETHE also seeing $61.4 million in outflows.

Political Uncertainty: Kamala Harris’s rising lead over Donald Trump, with a 51% chance of winning the electoral college, is contributing to market jitters. Harris’s campaign has raised over $300 million.

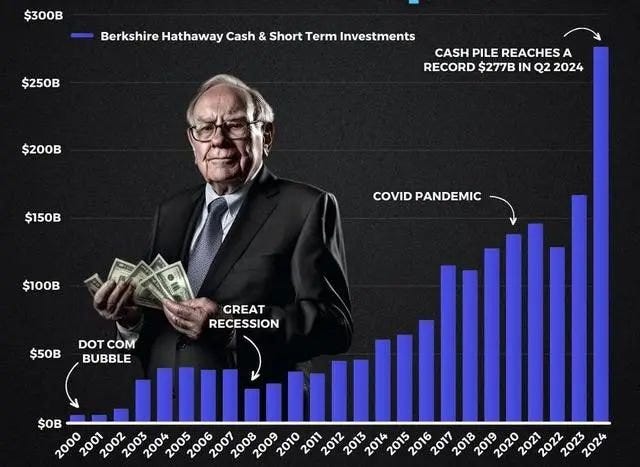

Warren Buffett’s Moves: Warren Buffett’s decision to sell nearly 50% of his stock holdings and hold $280 billion in cash suggests he anticipates further market declines.

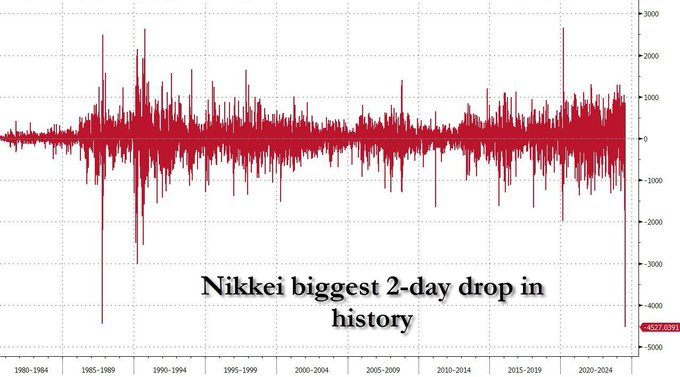

Global Market Correction: The stock market is undergoing a major correction, with severe losses across indices, notably Japan’s Nikkei 225, which is experiencing its largest drop in history.

Massive Crypto Liquidations: Over the past 24 hours, crypto liquidations have exceeded $1 billion as traders sell off long positions in response to sharp price drops.

Weak Job Reports: The latest US nonfarm payrolls report showed only 114,000 jobs added in July, falling short of expectations. The unemployment rate rose to 4.3%, adding to fears of an economic slowdown.

Impact on Risk Assets: The combination of weak job data and rising unemployment is impacting risk assets.

Are We Witnessing the End of Crypto? Experts Weigh In

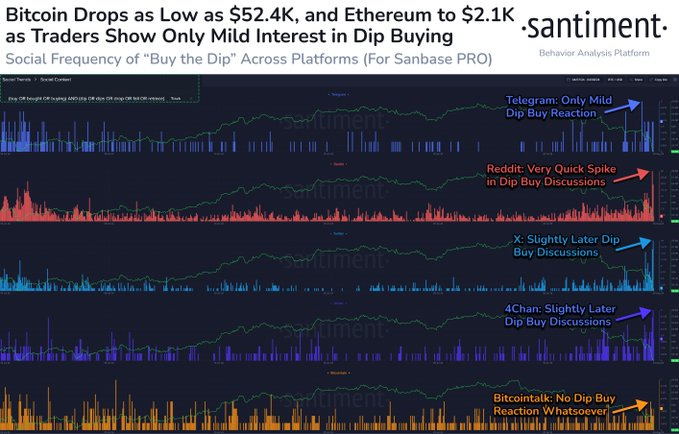

Santiment suggests this may not be the final dip. While buying discussions have increased, they aren't as strong as expected. Expect a bigger reaction as the US markets open, potentially accelerating a rebound.

Robert Kiyosaki remarked that Bitcoin and all markets are crashing, expressing excitement as he prepares to buy more gold, silver, and Bitcoin.

InspoCrypto warns that if Bitcoin fails to hold $51,500, it may drop to $42,600, with potential declines below $30,000 if support fails.

Michaël van de Poppe suggests that current conditions could signal either a V-shaped recovery with Bitcoin and gold as safe havens or Ethereum leading DeFi as a banking alternative.

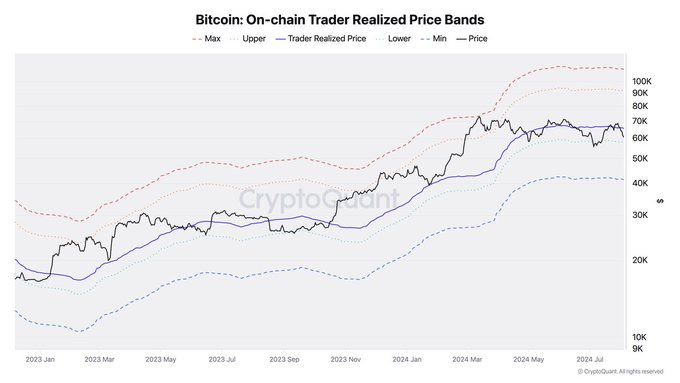

CryptoQuant reports Bitcoin has plunged 16% in 24 hours, falling below $57K support. This drop hints at a possible decline to $40K, with traders facing their worst unrealized profits since November 2022.

My Trading Strategy

Is the bull run over? Not necessarily! A 30% drop can occur even in a rising market. If you have funds available, this might be your perfect buying opportunity. Here are key factors to watch in the coming days:

US Market Opening: Pay attention to how the US markets react when they open.

ETF Volumes: Keep an eye on any significant shifts in ETF volumes.

Stay proactive, and don’t miss the chance to buy the dip!