Ethereum’s Bull Run Incoming After Massive Fee Drop?

Historical Data Predicts Massive Ethereum Surge in 2025!

Ethereum (ETH) has held firm above $2,500 and recently moved past $2,620, indicating short-term bullish momentum. Breaking a key resistance at $2,700, ETH climbed to $2,720 before testing the 50% Fibonacci retracement level of its recent decline from $2,845 to $2,605.

Resistance and Potential Upside

Current position: ETH is trading above $2,680 and the 100-hour simple moving average.

Resistance levels:

$2,725 – Immediate resistance level.

$2,755 – Key resistance (61.8% Fibonacci retracement level).

$2,820 – Next potential target if ETH surpasses resistance.

$2,880 – Further upside level if momentum continues.

$3,000 – Strong bullish movement could push ETH toward this mark.

Read ETH Price Prediction 2030 for more insights

Support Levels and Downside Risks

If ETH fails to break above $2,755, it could see a pullback. The immediate support lies at $2,700, followed by $2,660. A drop below $2,620 may push the price further down to $2,550 or even $2,500.

Historically, Ethereum has shown strong performance in the latter half of Q1, averaging a 40% gain since 2020. If ETH follows a similar trend, it could reach $3,500 by the end of Q1 2025.

Also Read: XDC Price Prediction 2030

Market Sentiment and Challenges

Mixed trader opinions on Ethereum’s trajectory.

A rising number of altcoins could impact ETH’s market position.

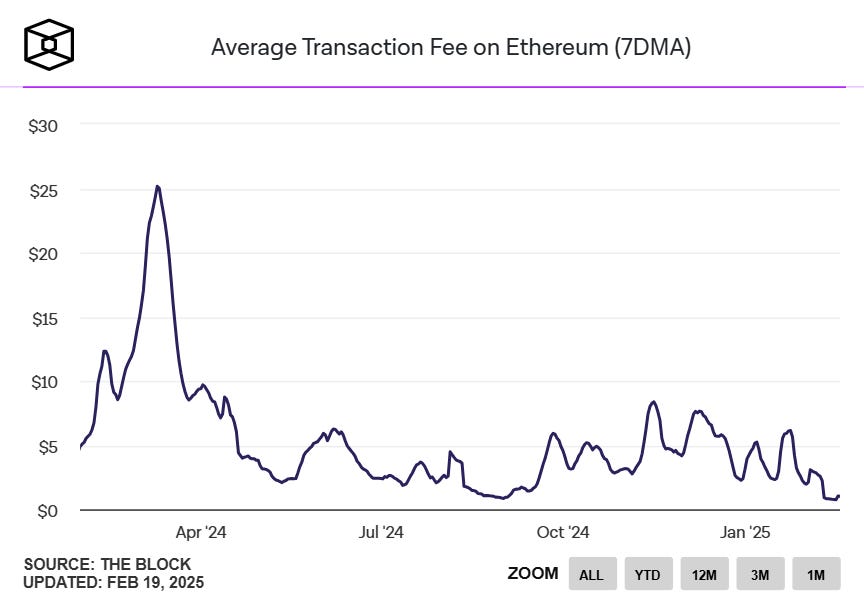

Transaction fees have hit a four-year low, averaging 1.61 Gwei last week.

Weak on-chain demand, with on-chain volume down 46% to $4.19 billion—its lowest since November 2024.

Ethereum's price movement in the coming weeks will be crucial. If it breaks key resistance levels, a strong rally could follow. However, if market demand remains weak, ETH may struggle to sustain gains. Traders should keep an eye on $2,755 for bullish confirmation and $2,620 for downside risks.