Ethereum (ETH) is gaining positive momentum again, showing strength after rebounding from the $1,680 support zone. The recent recovery reflects a broader market trend, with ETH closely following Bitcoin's upward movement.

The price steadily climbed above $1,720 and $1,750, reaching a local high of $1,834 before pulling back slightly. At the time of writing, ETH is trading above $1,720 and the 100-hourly Simple Moving Average — a sign that the bulls are still in control.

Resistance Levels to Watch

Ethereum is currently facing resistance near $1,780, where a bearish trend line is forming on the hourly chart. Key levels to monitor include:

Immediate resistance at $1,780 and $1,800

Major breakout level at $1,840

If ETH clears the $1,840 mark, it could trigger further gains toward $1,920 and potentially even $2,000 in the near term. This forms the basis for a cautiously optimistic Ethereum price prediction, with the short-term outlook leaning bullish.

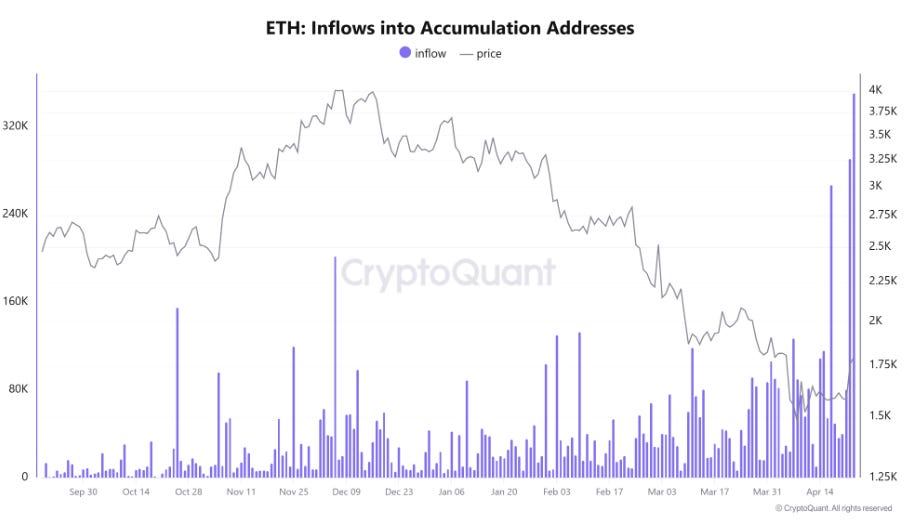

Long-Term Holders Are Accumulating

On-chain data suggests growing confidence among long-term investors. Accumulation addresses—wallets that have never spent ETH—have added over 1.11 million ETH between April 17 and 23. Nearly half of that came right after Tuesday’s price surge.

This marks the largest weekly accumulation in 2025

Indicates strong confidence despite recent volatility

ETH's net taker volume is also turning less negative, signaling seller fatigue. The $1,473 dip on April 11 may now be a solid bottom.

Also Read: Stacks Price Prediction 2025, 2026 – 2030

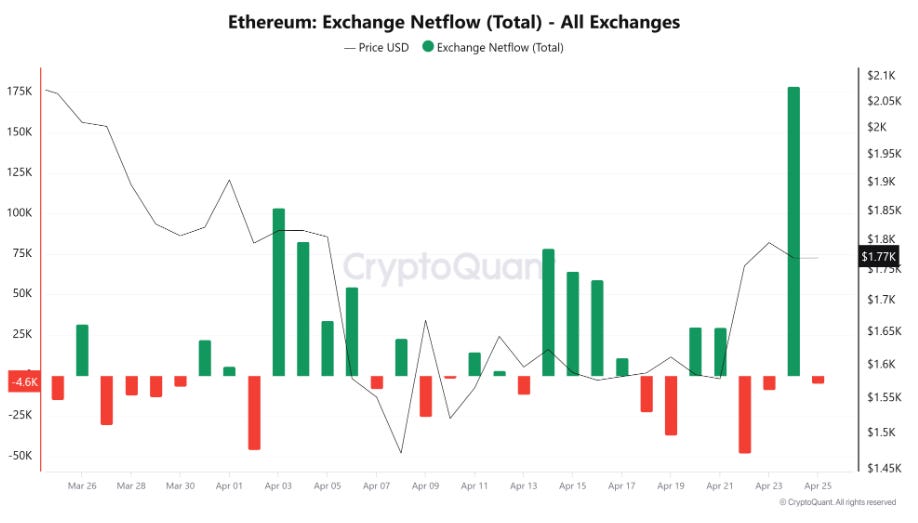

Caution Still in Play

Despite the bullish signals, exchange inflows reached over 178,900 ETH (around $317 million) on Thursday. This suggests some short-term holders are selling into the rally, possibly exiting at breakeven levels after recent losses.

Ethereum’s 10th anniversary on July 30 is expected to boost sentiment with global events and celebrations planned by the Ethereum Foundation.