Ethereum’s 8-Day Bullish Surge: What’s Next for ETH Price?

Ethereum price breaks the support – Forecast today

Hey, Crypto Enthusiasts!

Ethereum (ETH) is seeing intense market action, with recent selling pressure pushing it below key support. Here’s what to watch if you’re tracking Ethereum’s price trends and whale moves!

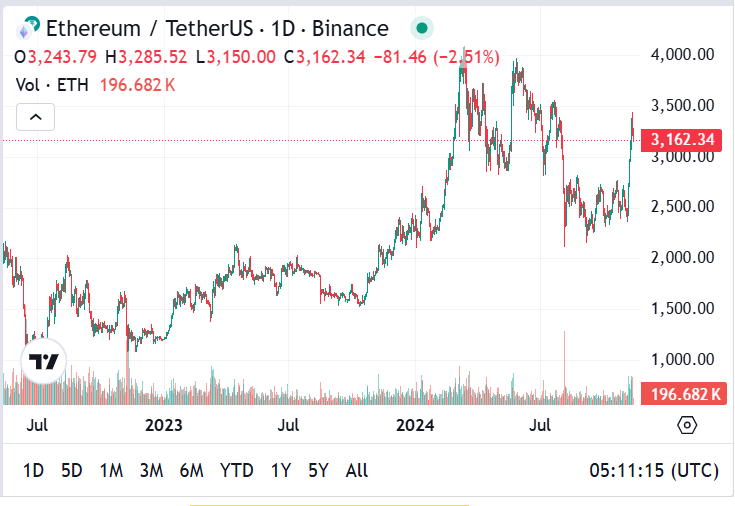

Ethereum Price Analysis

Ethereum recently fell below the $3,262 support level as per Coinpedia Markets, signaling potential bearish momentum.

This move has set ETH on a downward trajectory, with $3,042.50 being the next critical support to watch.

On the flip side, a recovery above $3,262 would shift sentiment back to bullish, with possible targets near $3,530.

If the bullish trend continues, ETH price could target $3,900 in the next few days or weeks.

Ethereum Price Breaks The Support

Support: $3,130

Resistance: $3,350

A rebound from the $3,130 support level could suggest a temporary uptrend or consolidation phase, while a break below this level might indicate further downside risks.

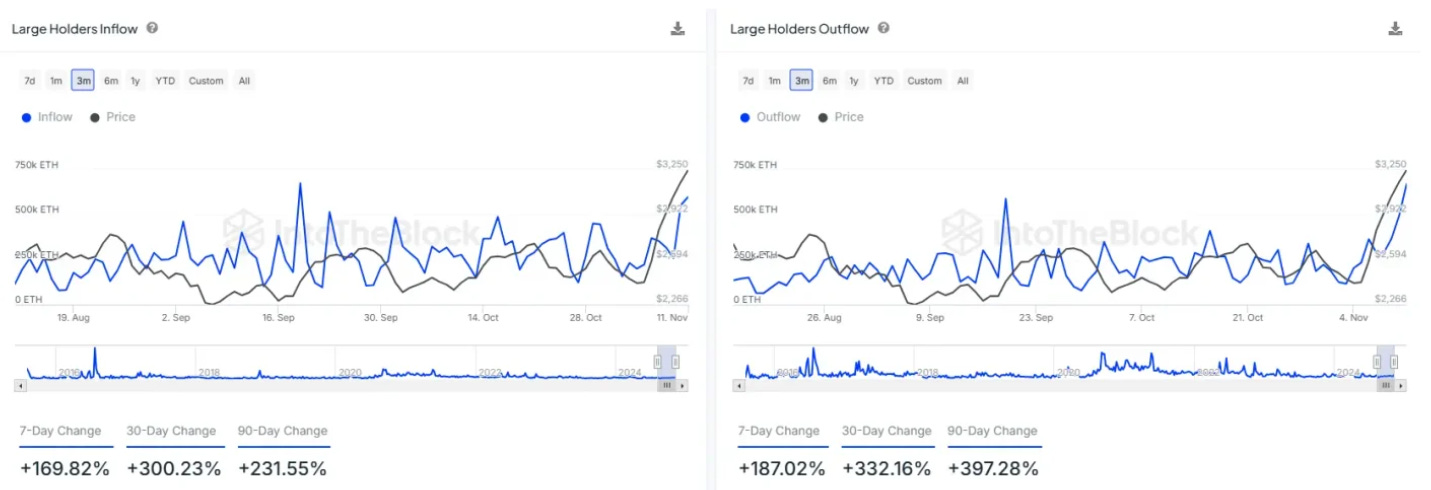

Whale Moves: ETH Inflows and Outflows Signal Bullish Surge

Increased Inflows: In the past 90 days, Ethereum has seen a 231.55% rise in inflows from large holders (often referred to as "whales").

Higher Outflows: Outflows, indicating sell activity among large holders, surged by 397.28%, reflecting a dynamic and possibly opportunistic trading environment.

These moves could signal strategic positioning, as large investors may be preparing for potential gains amid Ethereum’s recent rally.

Weekly Trends: Significant Movements Among Major Investors

Over the last seven days, ETH inflows rose by 169.82%, while outflows increased by 187.02%.

These shifts suggest that big players are actively managing their holdings, potentially looking to capitalize on price changes or to prepare for key resistance levels.

How High Can ETH Price Go?

Bollinger Band Analysis: ETH is currently trading around $3,270, close to its upper Bollinger Band at $3,389. This position suggests possible overbought conditions, which could lead to a short-term pullback.

Key Resistance Level: If ETH price closes above $3,560, traders could interpret this as a “change of character” (ChoCH) pattern, reinforcing a bullish outlook.

Upside Target: A successful break above $3,560 may set ETH on course for $3,900.

Downside Risks: If resistance holds, ETH could turn bearish, potentially revisiting support levels around $3,130, $3,000, and $2,900.

What’s Next For Ether Price?

While Ethereum’s recent price action and whale activity show promising signals, the near-term direction will likely hinge on ETH’s ability to clear resistance levels.

If bullish momentum prevails, ETH price may target the $3,900 area in the coming days or weeks.

However, should bearish pressure increase, investors could see a retest of the lower $3,000 range.

Ethereum is at a pivotal point! With major holders active and key technical levels in play, watching ETH’s support, resistance, and whale moves is crucial for predicting its next price move.