Ethereum (ETH) is showing signs of strength after managing to hold above the critical $1,725 support level. After briefly dipping to $1,746, the price rebounded and moved above $1,770, regaining the 100-hourly Simple Moving Average.

This recovery brought ETH close to the $1,800 resistance level. Although it tested the 50% Fibonacci retracement level of the recent drop from $1,857 to $1,746, ETH was rejected near $1,800. It now faces another hurdle — a bearish trendline forming near $1,815.

Resistance Levels to Watch

Ethereum faces immediate resistance near the $1,800 and $1,820 levels. If the bulls manage a strong push, a breakout above $1,850 could lead to further gains. Key targets in the short term include:

$1,920: A potential short-term target

$2,000: A major psychological and technical level

Many analysts see this structure as a setup for a bullish breakout, making the current Ethereum price prediction cautiously optimistic.

Whales and Institutions Are Back

Recent on-chain data shows a shift in sentiment among large holders. Ethereum whale wallets (holding 10K–100K ETH) increased their collective holdings by 149,000 ETH in the past week. These whales are aiming to push ETH closer to their average cost basis near $2,000.

Institutional interest is also rising. Ethereum investment products saw net inflows of $183 million last week, ending an eight-week outflow streak. Notably, US spot Ether ETFs contributed $157.1 million to that total.

Also Read: Tron Price Prediction 2025, 2026 – 2030

Investors Holding Strong

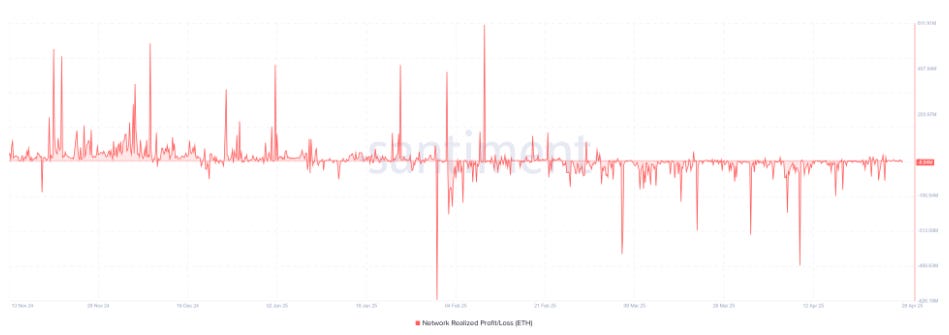

Despite the price rise, Ethereum’s Network Realized Profit/Loss remains low. This suggests that most investors are not taking profits yet, anticipating more upside in the near future.

With strong whale accumulation and growing institutional inflows, Ethereum appears to be gearing up for a possible breakout — and $2,000 could be the next big milestone.