Ethereum (ETH), the second-largest cryptocurrency, is recovering as traders and whales show growing interest. Can ETH surpass key levels and achieve significant milestones soon? Here’s a detailed analysis.

Current Ethereum Price Trends

Price Recovery: Ethereum price today shows signs of recovery from the $3,160 low, surpassing resistance levels at $3,200 and $3,220.

Key Support Levels: ETH has strong support near $3,250 and $3,220. A break below these levels may push the price toward $3,160 or even $3,000.

Major Resistance Zones: On the upside, Ethereum is battling resistance at $3,320 and $3,450. Clearing $3,450 could pave the way for a rally toward $3,500 and beyond.

Read detailed ETH Price Prediction 2030 for more insights

Key Technical Indicators to Watch

Fibonacci Retracement: The 50% Fibonacci retracement level at $3,450 remains critical for ETH's upward momentum.

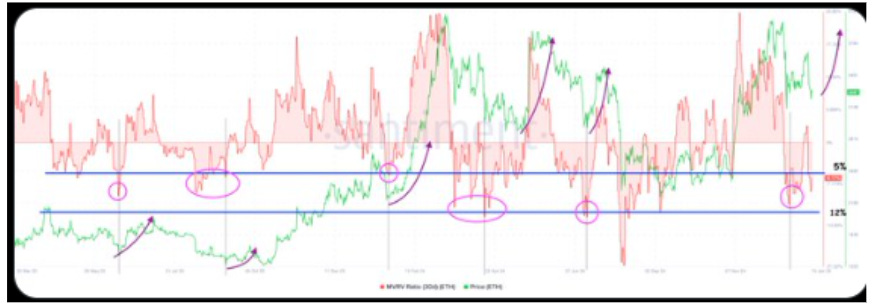

MVRV Ratio: The 30-day Market Value to Realized Value (MVRV) ratio indicates oversold conditions, a bullish signal historically linked to whale accumulation.

Inverted Head-and-Shoulders Pattern: Analysts are observing this bullish pattern, with a target of $4,506 if confirmed.

Also Read: AMP Price Prediction 2025, 2026 – 2030

Whale Activity and Accumulation

Recent Ethereum news today highlights increasing whale activity near the $3,000 support level. When whales accumulate during oversold phases, prices often rebound significantly. This trend is evident in past ETH price recoveries, adding optimism for a potential rally.

Long-Term Ethereum Price Prediction

Short-Term Forecast

If Ethereum maintains support above $3,200 and clears the $3,450 resistance, ETH could target $3,720 in the near term.

Ethereum Price Prediction 2025

Experts predict Ethereum could surpass $6,000 by Q1 2025, driven by:

Strong Technical Indicators: Upward channel patterns and bullish configurations.

Key Support Level: $2,800, which serves as a robust foundation for growth.

Ethereum Price Prediction 2030

Long-term Ethereum forecasts suggest ETH could hit new all-time highs, potentially surpassing $10,000 as blockchain adoption grows.

Factors Driving Ethereum’s Growth

Institutional Interest: Increasing adoption of Ethereum for DeFi, NFTs, and enterprise applications.

Supply Dynamics: The shift to Ethereum 2.0 has reduced ETH issuance, creating scarcity.

Market Sentiment: Bullish signals from whales and on-chain data indicate rising confidence.

What Traders Should Watch

For those asking, “Will Ethereum go up?” the current signs are encouraging. Traders should focus on:

Key Levels: Monitor $3,320 resistance and $3,000 support.

Whale Activity: Increased buying indicates potential recovery.

Macro Trends: Adoption, institutional demand, and market sentiment play a critical role.

Ethereum remains a strong contender in the crypto market, with bullish signals indicating potential growth. While immediate price action depends on breaking key resistance levels, the long-term outlook for Ethereum price remains optimistic. As ETH aligns with strong fundamentals, it could surpass $6,000 by 2025 and aim for even higher milestones by 2030.