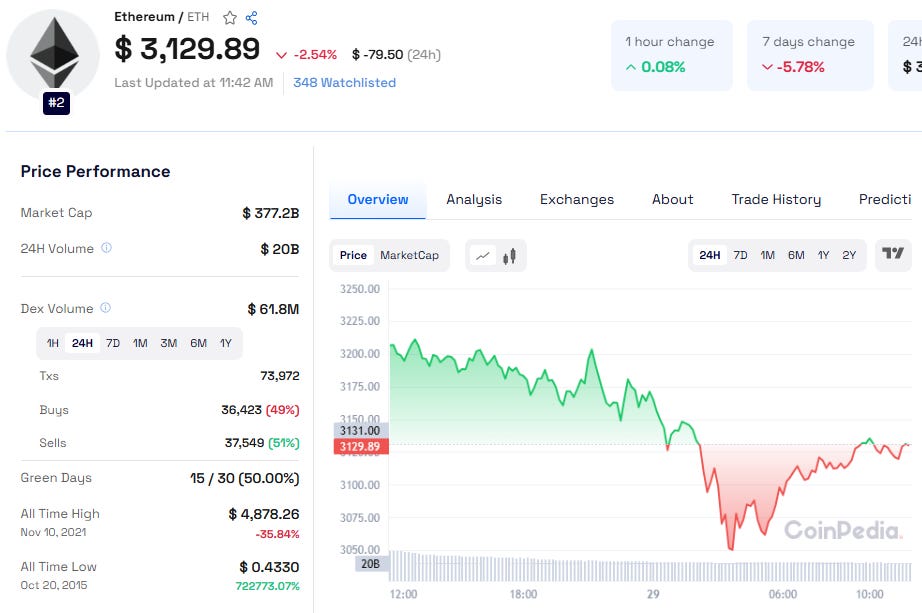

Ethereum (ETH) has been facing downward pressure, dropping 7.3% since Sunday and closing below its crucial 200-day Exponential Moving Average (EMA) at $3,135 on Tuesday. As of Wednesday, Ethereum is attempting to reclaim this level, retesting its 200-day EMA.

Key Technical Levels and Market Trends

Ethereum’s price movement is at a critical juncture. If ETH fails to regain support at the 200-day EMA, a further decline could see it test the psychological support of $3,000. A close below this level might push the price towards its next major daily support at $2,810.

Technical Indicators Signal Bearish Sentiment

Relative Strength Index (RSI): Currently at 41, below the neutral 50 mark, indicating selling pressure.

MACD Indicator: Bearish crossover since Sunday, suggesting a potential downtrend.

On the upside, if Ethereum breaks above $3,135 and establishes support, it could set the stage for a recovery, targeting the next daily resistance at $3,730.

Read Ethereum Price Prediction 2050 for more insights

Ethereum Reserves and Long-Term Outlook

Historical Ethereum reserves provide key insights into market trends:

During the 2017–2018 bull run, reserves peaked as investor interest surged.

A similar rise occurred during the 2020–2021 DeFi boom.

However, since 2021, reserves have steadily declined, with exchange balances reaching historically low levels in 2024.

Why This Matters

A decline in exchange reserves suggests that investors are moving ETH to cold storage or staking, signaling confidence in Ethereum’s long-term value. If demand rises, this supply constraint could drive prices higher.

Also Read: Safemoon Price Prediction 2030

Ethereum Price Prediction: 2025–2030

Short-Term Outlook (2025)

If macroeconomic conditions and institutional adoption improve, Ethereum could see a strong rally in 2025. ETF inflows, network upgrades, and increased enterprise adoption may boost demand.

Long-Term Outlook (2030)

By 2030, Ethereum could challenge its all-time high, fueled by technological advancements, network upgrades, and increased real-world adoption.

Key Factors Driving Ethereum’s Future Growth

1. Technological Advancements

Ethereum 2.0: Post-Merge, Ethereum has reduced energy use by 99.95%, attracting ESG-conscious investors.

Scalability Upgrades: The Pectra upgrade (March/April 2025) will increase blob capacity, while Fusaka (2026) will enhance network throughput with sharding.

Layer 2 Dominance: Platforms like Arbitrum and Optimism now handle ~70% of Ethereum’s DeFi transactions, with TVL exceeding $80 billion.

2. Institutional and Ecosystem Growth

ETF Inflows: U.S.-approved Ethereum ETFs (BlackRock, Fidelity) have attracted $50B+ in net inflows, increasing liquidity.

Enterprise Adoption: JPMorgan’s Onyx and Visa’s USDC integration highlight Ethereum’s role in tokenizing real-world assets (RWAs).

Developer Activity: Over 5,000 monthly active developers contribute to Ethereum, far surpassing competitors like Solana.

Ethereum’s short-term volatility persists, but strong fundamentals fuel long-term potential. Watch technicals, reserves, ETF flows, and adoption trends—if aligned, ETH could skyrocket in the coming years!