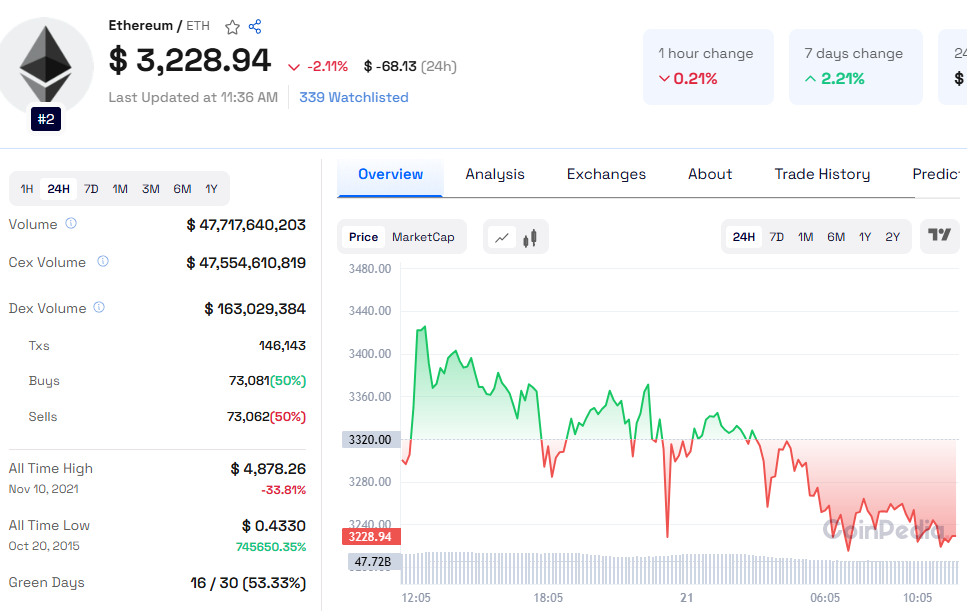

Ethereum (ETH) recently retested its 200-day EMA at $3,125 after a sharp 7% drop. By Monday, Ethereum price today recovered to $3,276, signaling potential for a rebound. Here's what lies ahead for Ether price trends.

Key Support and Resistance Levels

200-Day EMA at $3,125: This is a crucial support level. If Ethereum holds above this, it could rebound toward $3,730, a key daily resistance level.

Psychological Support at $3,000: If ETH closes below $3,125, further declines toward $3,000 are possible.

Read detailed Ethereum Price Prediction 2050 for more insights

Technical Indicators Signal Mixed Momentum

RSI Indicator

Current Reading: 46 (below the neutral level of 50)

Trend: Pointing upward, indicating weakening bearish momentum.

MACD Indicator

Status: Approaching a bullish crossover.

Actionable Insight: A bullish crossover, where the MACD line moves above the signal line, could confirm an uptrend.

Ethereum vs. Bitcoin: A Declining Ratio

On Sunday, Ethereum’s value against Bitcoin dropped to 0.03 BTC, the lowest since March 2021.

In 2022, ETH/BTC peaked at 0.08 BTC. This marks a nearly 50% decline over the past year.

Bitcoin, meanwhile, continues to dominate the market, hitting a record high above $109,000 earlier this week, delivering a staggering 160% return over the past year compared to Ethereum’s 40% gain.

Also Read: Toncoin Price Prediction 2025, 2026 – 2030

Institutional Interest in Ethereum

Despite underperforming recently, Ethereum remains a favorite among institutional investors.

World Liberty Financial: A crypto lending platform promoted by former U.S. President Donald Trump and his sons, has recently accumulated ETH.

ETF Advantage: Ethereum is the only cryptocurrency besides Bitcoin to have an ETF, enhancing its institutional appeal.

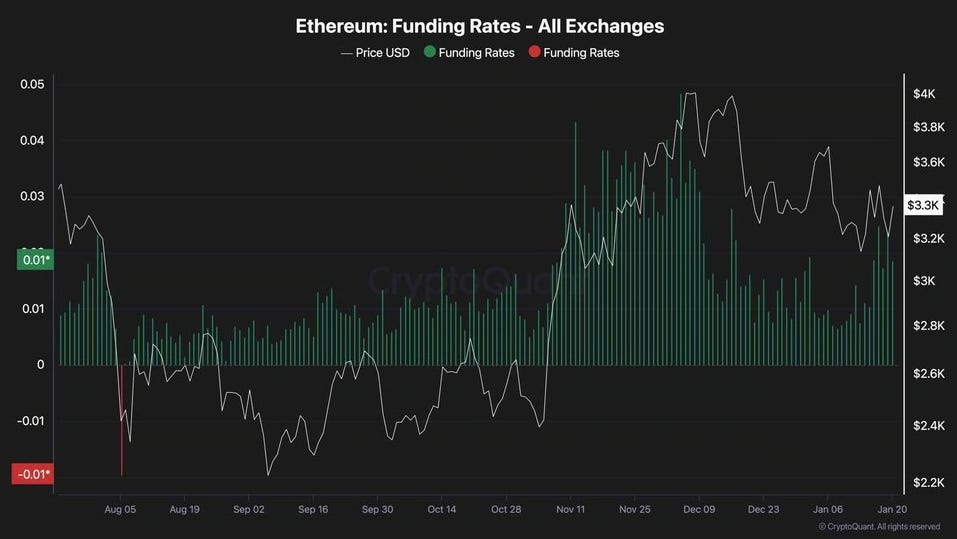

Funding Rates and Market Sentiment

Funding Rates: A key market sentiment indicator recently declined, reflecting reduced bullish sentiment.

Recent Spike: Funding rates have shown sharp increases, suggesting renewed optimism and growing long positions.

For Ethereum to break above the critical $3,500 resistance level, it requires sustained bullish momentum and higher funding rates to indicate market confidence.

Ethereum Price Prediction: What Lies Ahead?

Short-Term Outlook: If ETH maintains support above $3,125, it could target $3,730 in the coming days.

Long-Term Outlook: Analysts remain optimistic about Ethereum price predictions for 2025 and 2030, given its strong institutional backing and unique value proposition in the blockchain space.

Key Takeaways

ETH All-Time High: Ethereum’s all-time high remains at $4,878, achieved in 2021.

Current Value: At $3,276, ETH is nearly 30% below its peak but shows potential for recovery.

Will Ethereum Go Up? A bullish breakout above $3,500 could set the stage for a sustained uptrend.

Ethereum faces challenges reclaiming dominance against Bitcoin but retains strong fundamentals. Key levels to watch are $3,125 and $3,500, with funding rates and MACD indicators offering insights. Institutional interest keeps ETH promising for long-term growth.