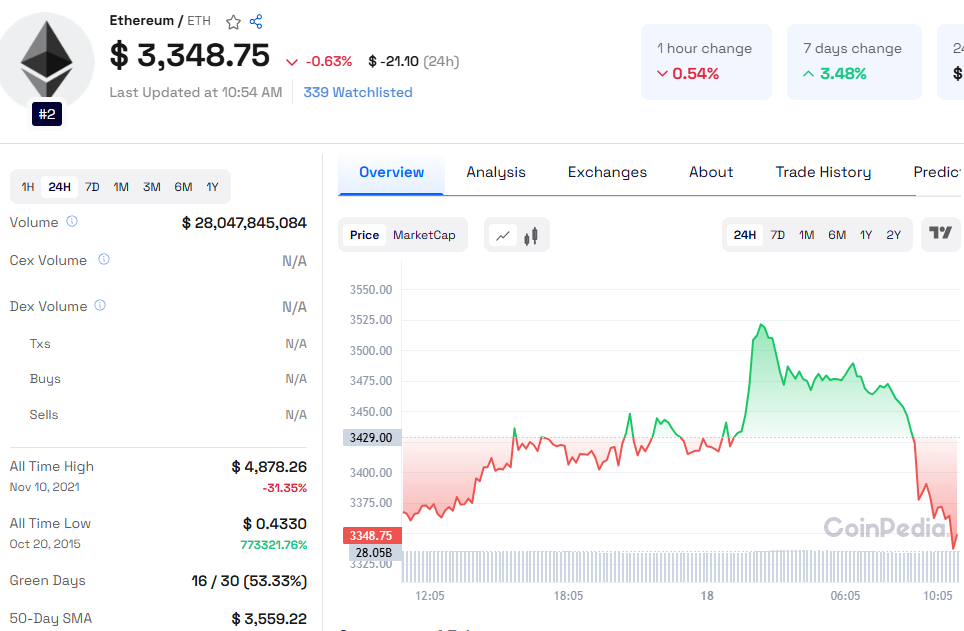

Ethereum’s price today rose by 2%, triggering over $33 million in liquidations in the past 24 hours. This sharp move reflects increasing market activity and optimism around Ethereum’s potential price recovery. Here’s a closer look at the key levels and factors driving Ether price action.

Ethereum Price Surges: Key Chart Patterns

Ethereum is forming the right shoulder of an inverted Head-and-Shoulders pattern, a bullish setup that has been in development since early 2024. However, ETH faces a significant hurdle at the descending trendline resistance that has persisted since December 2023.

Immediate Target: $4,093 resistance level (holding firm for 10 months).

Bullish Potential: A breakout above $4,093 could drive ETH price to $6,000, provided it sustains momentum.

Critical Resistance: ETH all-time high of $4,868, which may limit further upside.

Support Level: ETH must hold above $2,817, as a drop below this would invalidate the bullish outlook.

Bullish Indicators Show Growing Confidence

Technical Indicators

RSI and Stochastic Oscillator: Both are above neutral levels, signaling dominant bullish momentum.

Liquidations: $17.43 million in long positions and $16 million in shorts were liquidated in 24 hours, highlighting strong market activity.

Futures and Options Sentiment

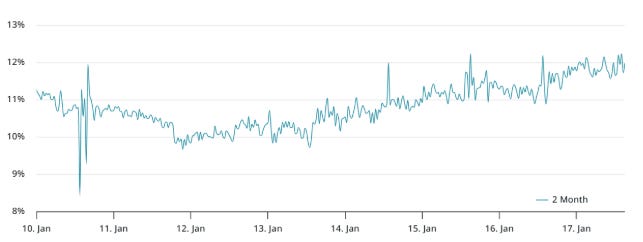

ETH Monthly Futures Premium: Recovered to 12% (up from 10% on Jan. 12), exceeding the neutral range of 5–10%.

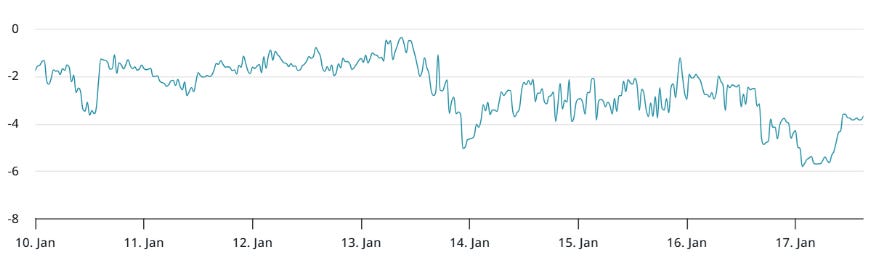

Options 25% Delta Skew: At -4%, indicating bullish sentiment as calls (buy options) gain traction.

Funding Rates

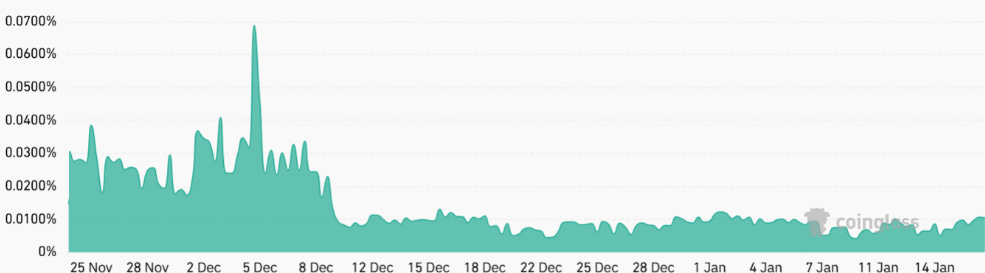

The 8-hour funding rate stands at 0.9% per month, within the neutral range (0.5%–1.9%), suggesting balanced leverage demand between longs and shorts.

Also Read: Ethereum Classic Price Prediction 2030

Macroeconomic Boosts for Ethereum

Ethereum’s recovery aligns with broader macroeconomic optimism:

Inflation Eases: Softer December inflation data has lifted sentiment across financial markets.

Federal Reserve Outlook: Expectations for rate cuts in 2025 favor cryptocurrencies by lowering opportunity costs for risk-on assets.

Institutional Involvement Fuels ETH Sentiment

The involvement of World Liberty Financial, a crypto project tied to US President-elect Donald Trump, has boosted ETH markets. The firm recently purchased ETH, aligning with its broader strategy to support blockchain innovation and digital assets.

Ethereum Price Prediction for 2025 and Beyond

With these developments, Ethereum price prediction for 2025 remains optimistic. If ETH clears $4,093, the next target is $6,000, driven by strong institutional interest and favorable market conditions. Long-term Ethereum price prediction for 2030 also points to sustained growth as adoption expands.

Key Takeaways

📌 Short-Term Target: $4,093

📌 Bullish Breakout: Could push ETH to $6,000

📌 Critical Resistance: ETH all-time high at $4,868

📌 Must-Hold Support: $2,817

Ethereum news today underscores its resilience and potential for growth. Will Ethereum go up? The answer largely depends on breaking key resistance levels and maintaining market confidence.

FAQs

What is the Ethereum price today?

Ethereum is currently up 2%, trading around $3,000.

Will Ethereum go up in 2025?

Ethereum’s price prediction for 2025 is bullish, with a potential rally to $6,000 if it breaks key resistance levels.

What is the ETH all-time high?

Ethereum’s all-time high is $4,868, achieved in November 2021.