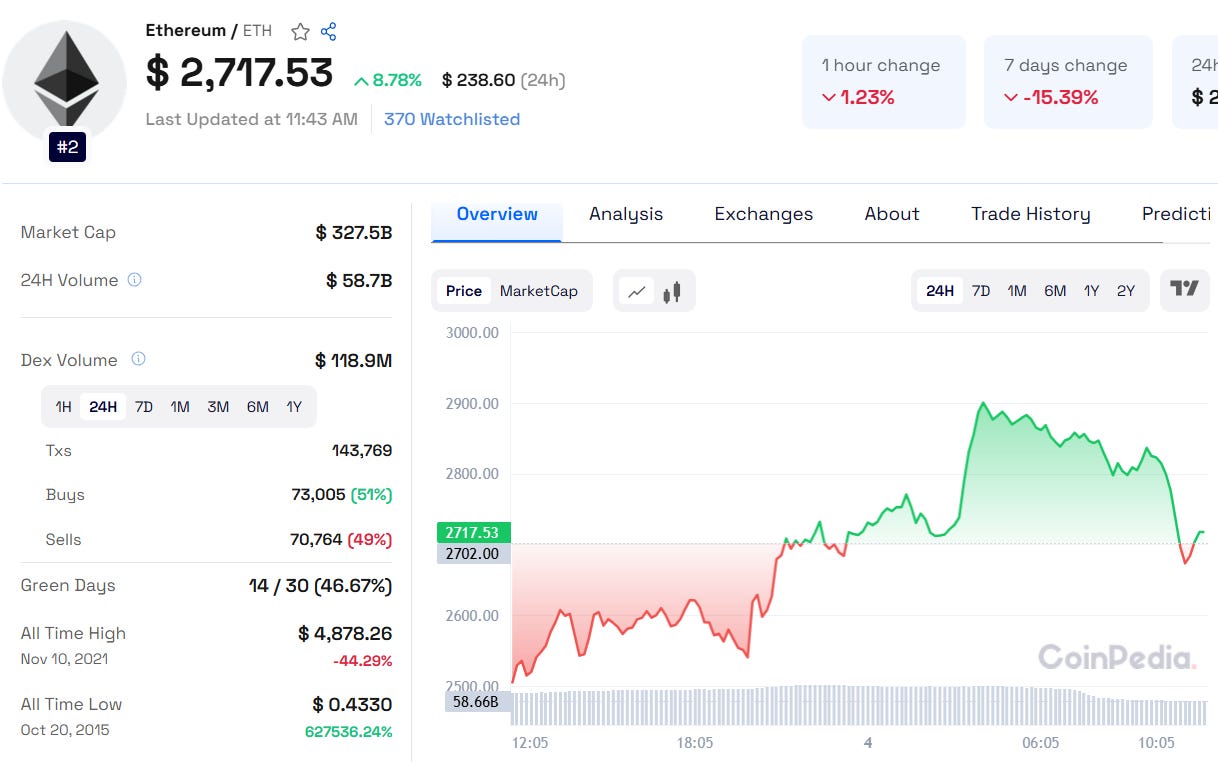

Ethereum (ETH) has surged 300% from its 2022 low of $880, yet it continues to lag behind Bitcoin’s performance. As of today, Ethereum price stands at $3,107, struggling against key resistance levels at $3,300 and $3,400. Analysts believe a breakout past these levels is essential for ETH to target $4,000 in the near term.

Key Resistance Levels & Market Insights

100-Day Moving Average: $3,300

Bullish Flag Upper Boundary: $3,400

Breakout Target: $3,240 (could liquidate over $1 billion in shorts)

Despite testing $3,500 on February 1, ETH failed to hold its gains, leading to a retracement. If ETH cannot break above $3,400, a drop to $3,000 remains likely.

Read Ethereum Price Prediction 2030 for more insights

Ethereum Market Liquidations & Whale Activity

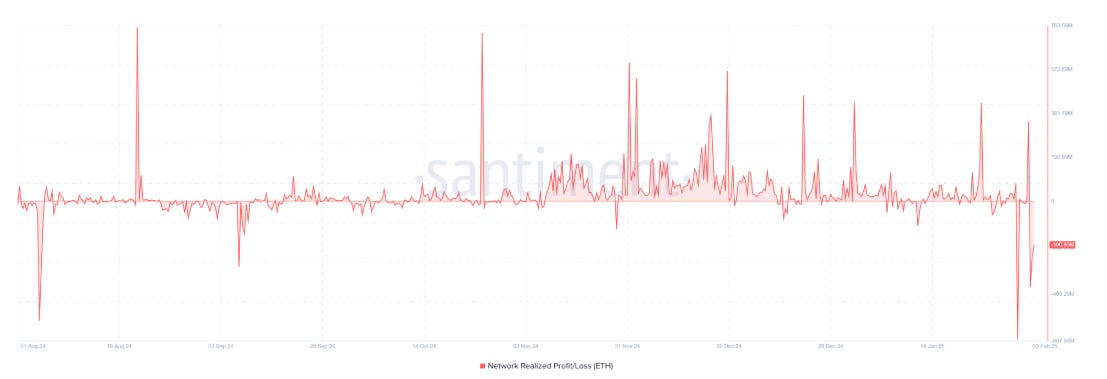

Ethereum suffered a 25% single-day drop before rebounding, causing over $620 million in liquidated futures positions—making it the most liquidated crypto asset in the past 24 hours.

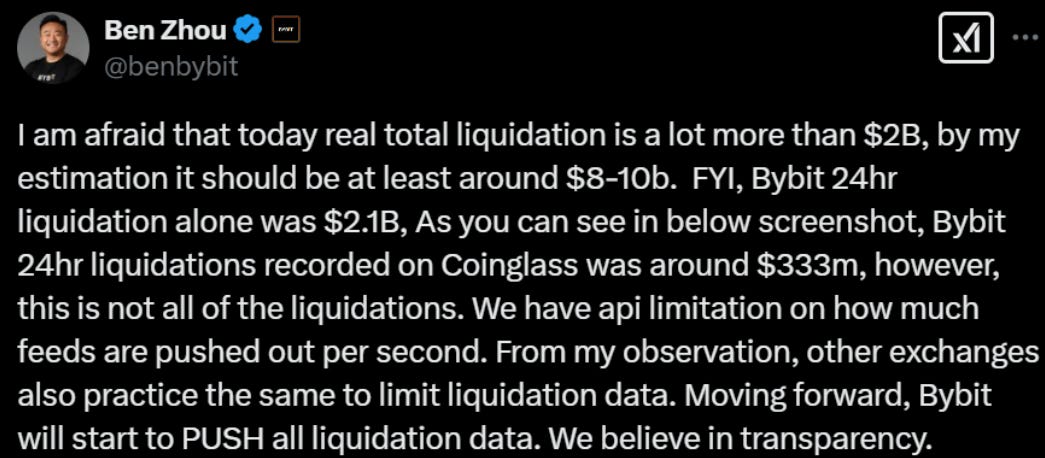

📌 Spot Market Losses: Over $1.2 billion in realized losses within three days—the highest since September 2023. Bybit CEO Ben Zhou noted that actual liquidations may be even higher due to API limitations.

📌 Whale Alert: A whale wallet known as “7 Siblings” purchased 50,429 ETH for $126 million after the crash, signaling confidence in Ethereum’s long-term potential.

Also Read: Near Protocol Price Prediction 2025, 2026 – 2030

Ethereum’s Future: What to Expect Next?

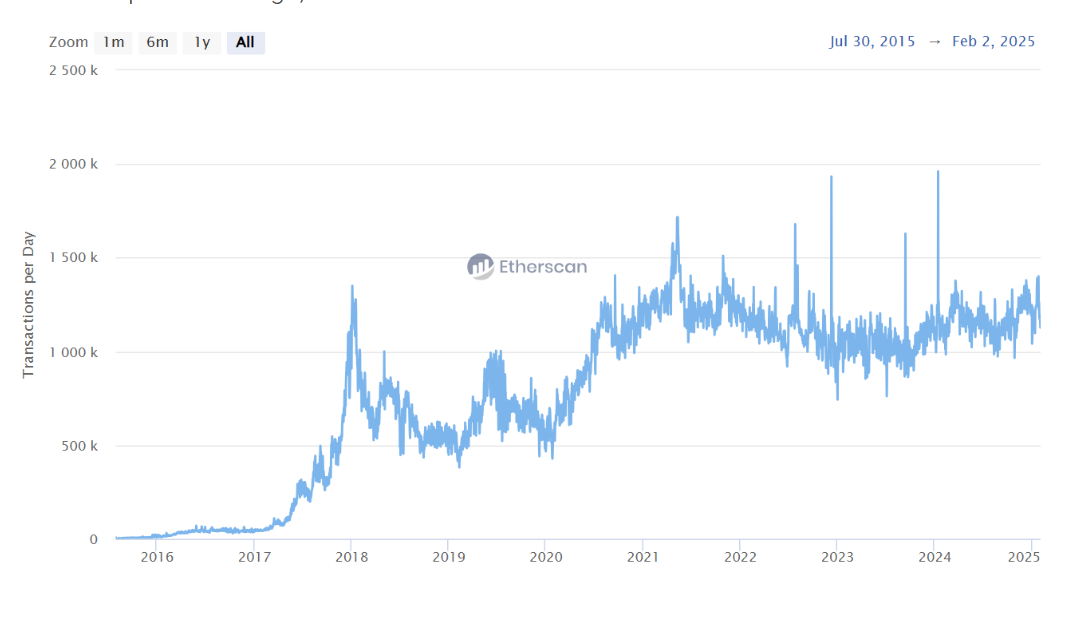

Ethereum’s market dominance has dropped from 17.3% in early 2024 to 10.9%. Meanwhile, daily transactions remain flat at 1.25 million per day, despite the Merge and network upgrades.

Short-Term Ethereum Price Prediction:

ETH must break $3,400 to confirm a bullish reversal.

A failure to break resistance could lead to further downside toward $3,000.

Long-Term Ethereum Price Prediction:

2025: Institutional adoption & ETF growth could push ETH higher.

2030: DeFi expansion and real-world adoption will be crucial for sustained gains.

ETH remains a dominant force in crypto, but breaking resistance and broader adoption beyond DeFi are essential for long-term success. Keep an eye on whale movements, ETF flows, and key resistance levels for potential trading opportunities.