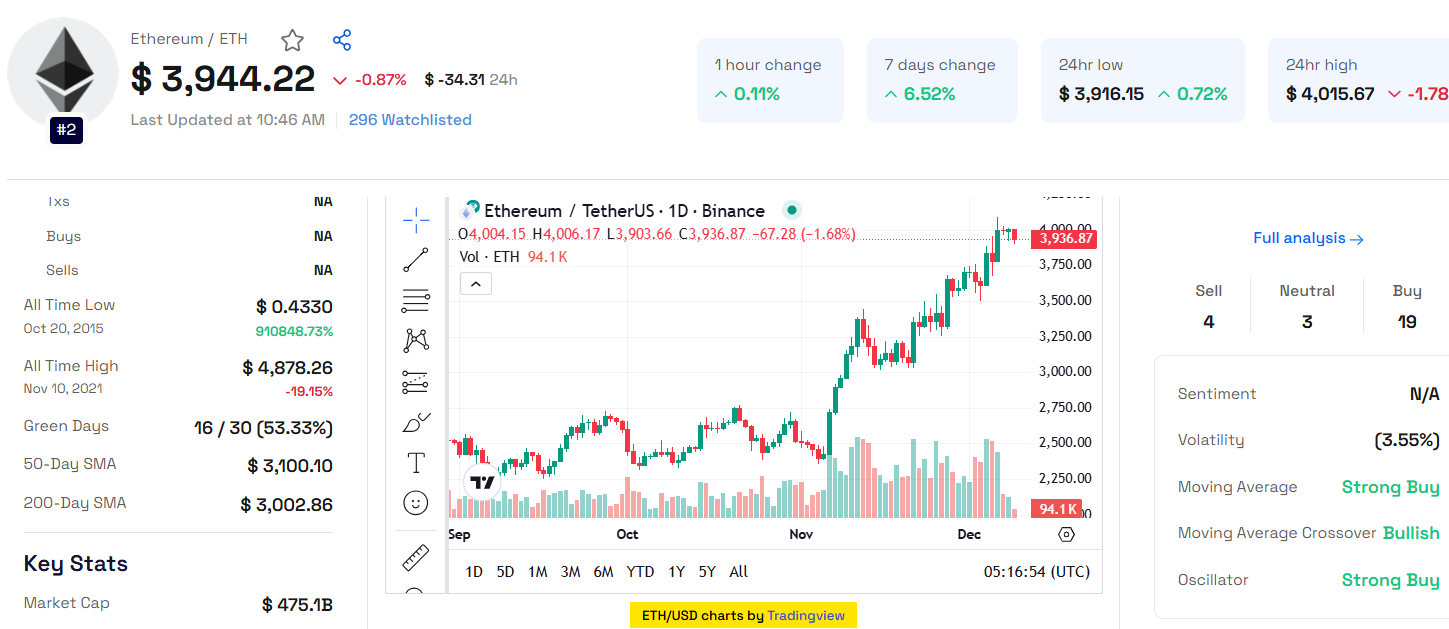

Ethereum’s price is currently trading within a narrow bearish channel, hinting at the formation of a bullish flag pattern. This pattern suggests a potential breakout above $4,010, which could drive the Ether price towards $4,090. However, any dip below $3,770 could disrupt this bullish momentum, leading to a short-term bearish correction.

Key Levels to Watch

Ethereum price today is forecasted to trade between $3,800 and $4,050.

Breaking above $4,010 could confirm the bullish trend.

A drop below $3,770 might signal a bearish turn.

Expert Insights: Can ETH Sustain the Momentum?

Nicolai Sondergaard, a research analyst, highlights the psychological importance of the $4,000 level. “It’s crucial for ETH to break $4,000 with conviction to maintain its bullish trajectory,” he said. Recent inflows into Ethereum ETFs, which were previously underperforming, also reflect growing optimism.

While Ethereum price has struggled in recent months, it appears undervalued, potentially paving the way for strong upside. However, Sondergaard cautions that the ETH/BTC chart must show sustained strength beyond short-term momentum.

Also read: Toncoin Price Prediction 2024, 2025 - 2030

The Rise of Decentralized Exchanges (DEXs)

The growing dominance of DEXs is transforming the crypto landscape. Tokens increasingly launch on DEXs, bypassing centralized exchanges (CEXs). Key developments include:

Hyperliquid’s HYPE token airdrop: A $1.2 billion event underscored the benefits of transparency and self-custody.

Solana’s DEX success: Platforms saw $41 billion in trading volume last quarter, 168% more than Ethereum’s mainnet.

This shift aligns with crypto’s decentralized ethos, with many experts predicting that by 2025, most tokens will launch exclusively on DEXs.

Can Ethereum Reach $4,500?

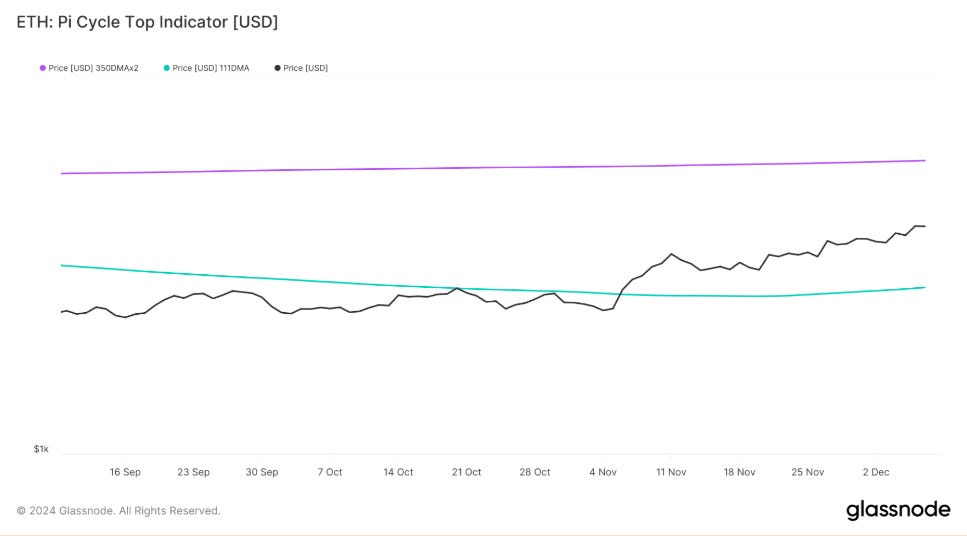

On-chain metrics provide mixed signals. The Pi Cycle Top indicator suggests ETH’s potential market top at $5,900, making $4,500 achievable soon. However, Ethereum’s Relative Strength Index (RSI) is in overbought territory, raising the risk of selling pressure.

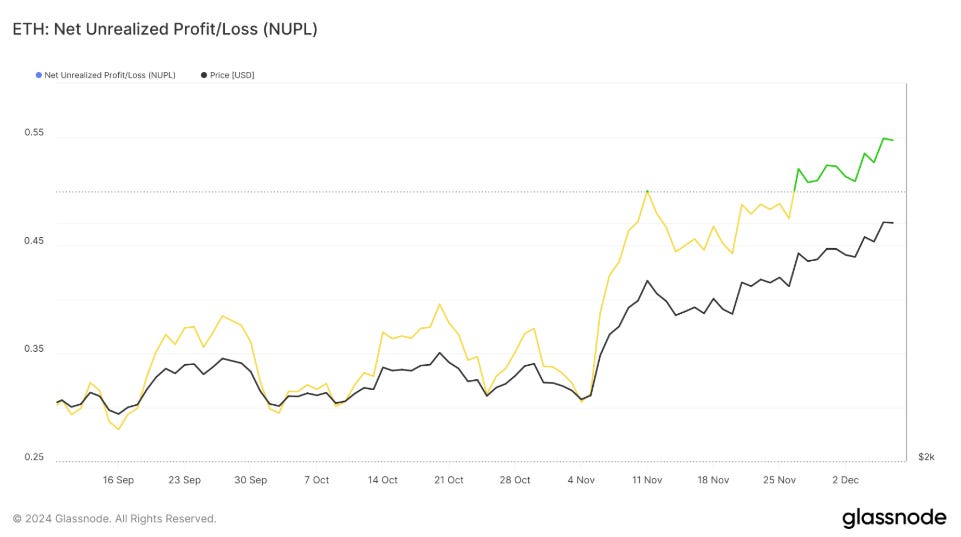

Historical patterns, such as the Net Unrealized Profit/Loss (NUPL) entering the “belief” phase, also suggest potential price corrections. Despite these warnings, the moving average (MA) cross indicator favors the bulls, with the 9-day MA above the 21-day MA.

Long-Term Ethereum Price Predictions

Looking ahead, Ethereum Price Prediction 2024 and Ethereum Price Prediction 2025 remain optimistic. With rising adoption, innovative DeFi projects, and the expanding role of DEXs, Ethereum could achieve new milestones, potentially surpassing its all-time high.

For now, all eyes are on the critical $4,000 resistance. Will ETH overcome it and resume its bullish journey? The coming days will be crucial for Ethereum’s trajectory.