Ethereum Price Next Move: $3,000 or All-Time High?

Here’s Why You Need to be Bullish on Ethereum

Ethereum’s price is at a pivotal moment, with market trends indicating potential opportunities for investors. Here's a comprehensive breakdown of the current ETH landscape, including key levels, market momentum, and long-term predictions.

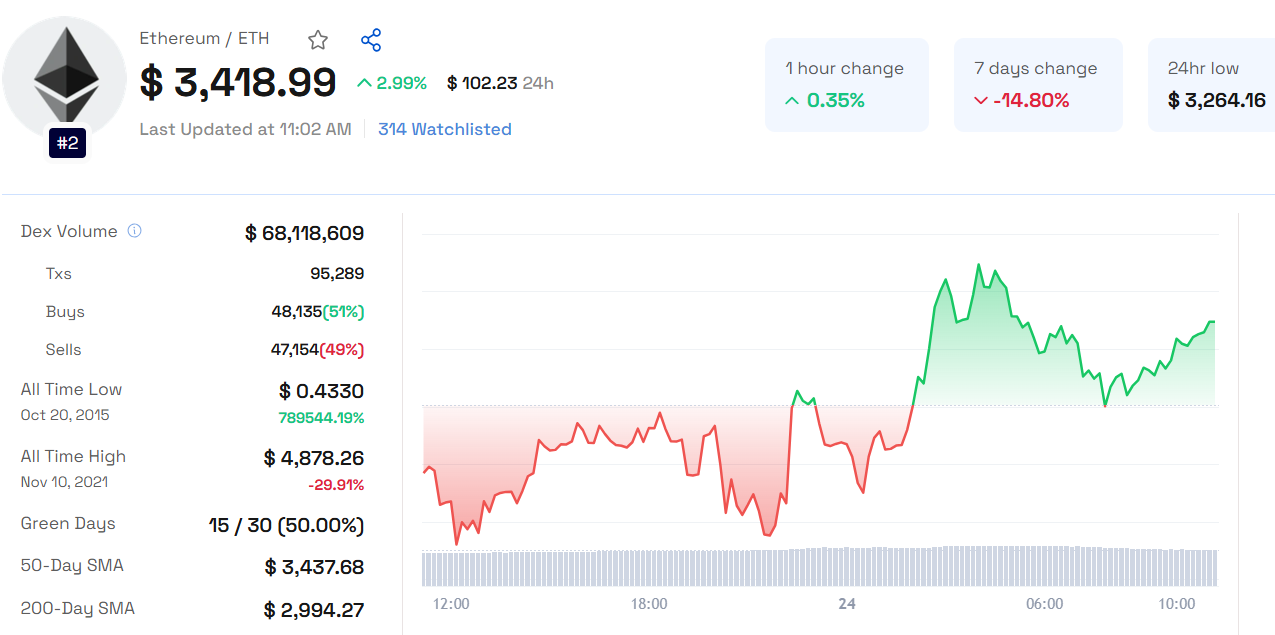

Critical Support and Resistance Levels

Ethereum (ETH) is currently trading within a range, stabilizing near $3,250 support and $3,423 resistance levels. These levels are crucial for predicting short-term price movements:

$3,250 Support Level: A critical threshold. If ETH breaks below this, it could decline to the $3,000 psychological level.

$3,000 Support Zone: Backed by the 100-day and 200-day SMAs, this level is a strong potential cushion.

Potential Downside: Breaching $3,000 could validate a rounding top pattern, driving prices further down to $2,817 or even $2,000.

Upside Recovery: For ETH to resume an uptrend, it must reclaim the $3,550 level with strong volume.

Read our detailed Ethereum Price Prediction 2025 for more insights

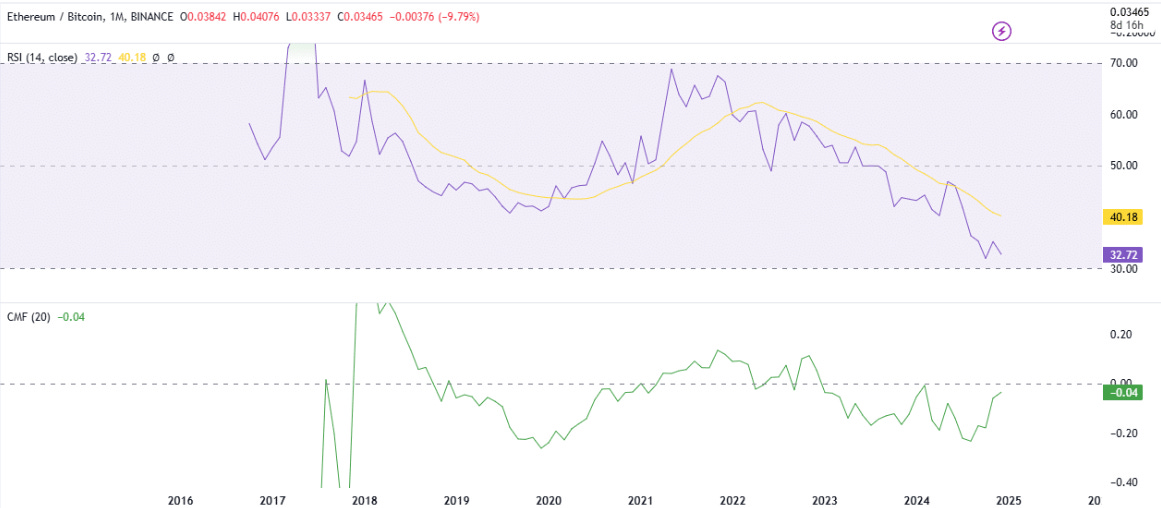

Market Momentum and Indicators

Recent indicators suggest a potential shift in market sentiment:

RSI Near Oversold: The Relative Strength Index (RSI) stands at 32.19, close to the oversold region. This signals diminishing selling pressure, which could pave the way for a price reversal.

Chaikin Money Flow (CMF): The CMF indicator is trending upwards, hinting at growing buyer momentum.

If these trends persist, Ethereum could be positioned for significant gains, aligning with bullish Ethereum price predictions for 2024 and 2025.

Also Read: AMP Price Prediction 2025 2026 - 2030

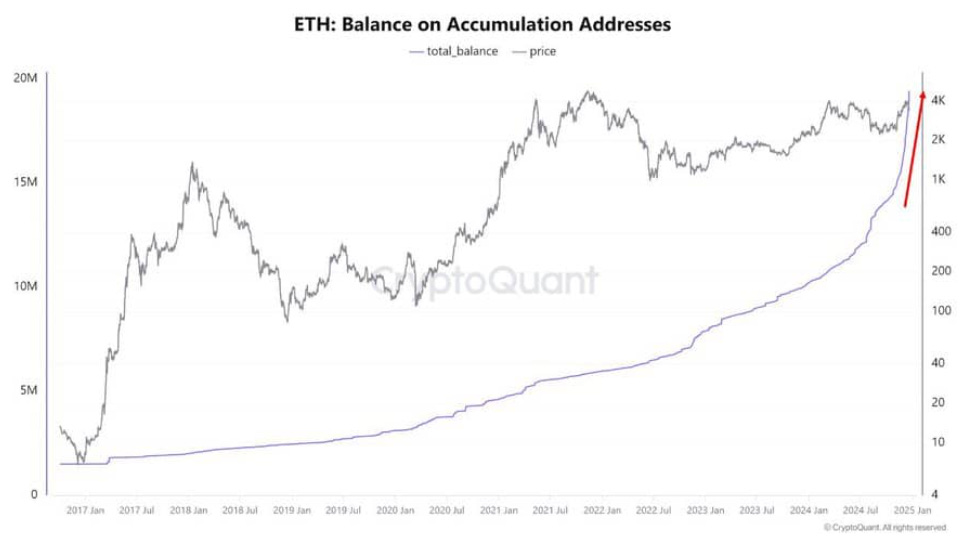

Rising Accumulation Trends

Data from CryptoQuant highlights an ongoing accumulation spree among Ethereum investors:

60% Surge in Long-Term Holdings: Addresses holding ETH for the long term now account for 16% of the total supply (approximately 19.4 million ETH), up from 10% in August.

Whale Activity: Whales holding 100K to 1M ETH recently increased their holdings by 410K ETH, signaling renewed confidence in the asset.

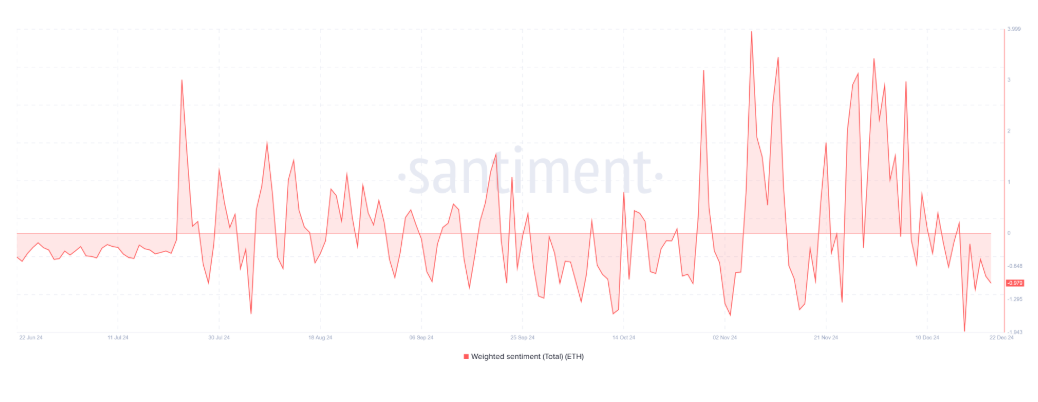

Sentiment and Market Activity

Despite recent bearish sentiment, including a $340 million profit sell-off:

Exchange Reserves Decline: Investors continue withdrawing ETH from exchanges, a bullish sign.

Ethereum ETFs on the Rise: US spot Ethereum ETFs recorded $62.7 million in net inflows last week, marking a four-week streak.

These factors indicate that while short-term sentiment may appear bearish, underlying market activity supports a more optimistic outlook.

Key Takeaways

Short-Term Price Outlook: $3,250 is a critical level; breaching it could lead to $3,000 or lower.

Indicators Pointing to Reversal: RSI and CMF suggest waning selling pressure and growing buyer interest.

Whale and ETF Activity: Whale accumulation and ETF inflows signal growing institutional and investor confidence.

Will Ethereum Go Up?

The answer depends on key factors:

Short-Term Momentum: If ETH reclaims $3,550, it could aim for higher levels.

Long-Term Predictions: With increased accumulation and institutional interest, Ethereum could achieve new all-time highs by 2025 or even 2030.

Investors should monitor these critical levels and trends closely to make informed decisions. Ethereum’s journey is far from over, and the coming months could define its trajectory in the blockchain space.