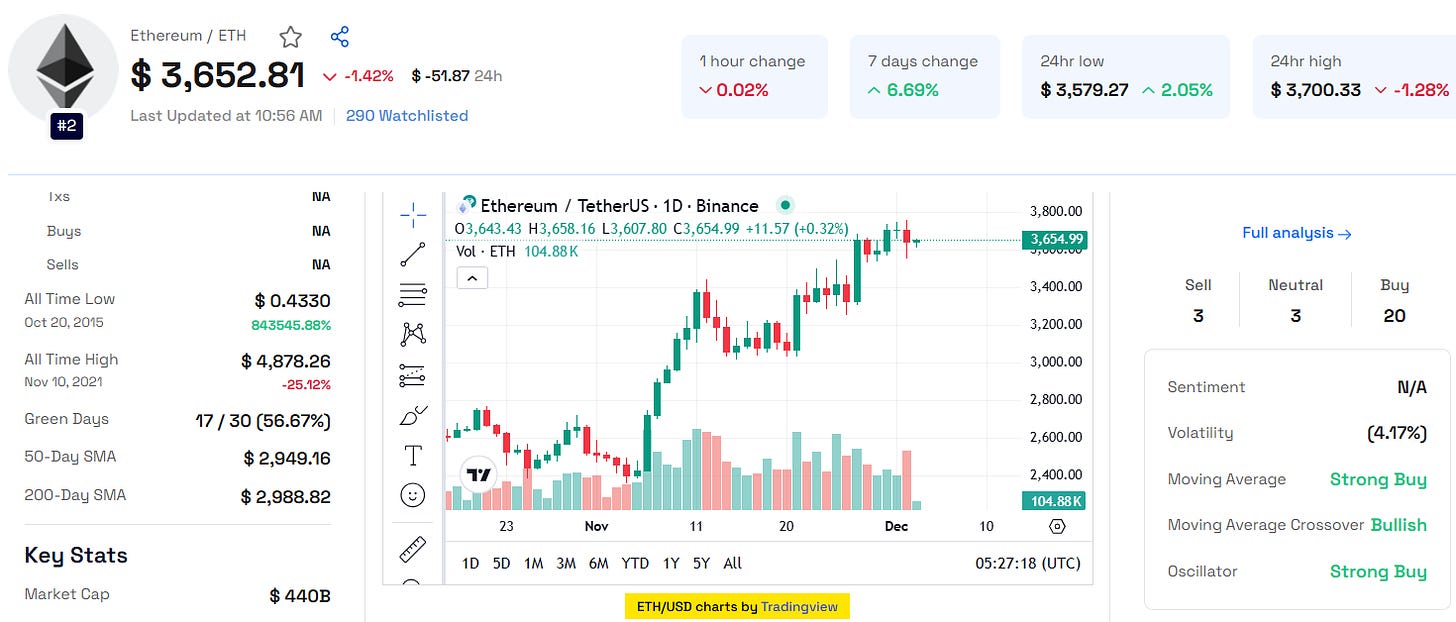

Ethereum Price Hits $3,760 but Faces 4% Dip—What’s Next?

ETH Price Could Surge to New ATH with ETF Approval

Hey, Crypto Crusaders!

Ethereum (ETH) has surged after bouncing off the key $3,545 support, staying strong within a bullish channel. With targets of $3,740 and $3,900 in sight. Let’s dive deeper into the latest Ethereum price prediction and what’s influencing Ether’s movements.

Ethereum Technical Analysis

Technical indicators signal a bullish wave for Ethereum, provided the price holds above the critical $3,515 support level. A break below this level could invalidate the positive trend, triggering a potential slide toward $3,440 or even $3,350. However, if ETH sustains its momentum, it could approach new heights within the Ethereum price today forecast range of $3,515 to $3,790.

Key Levels to Watch

Resistance Levels: $3,650, $3,740, $3,900

Support Levels: $3,600, $3,580, $3,515

If Ethereum clears the $3,650 resistance, the next targets are $3,740 and $3,900. Failure to break $3,650 may lead to a pullback, with immediate support at $3,600 and stronger support near $3,515.

Also Read ImmutableX Price Prediction: Is IMX A Good Investment?

Surging Institutional Interest

Record ETF Inflows: November saw Ethereum ETFs record inflows of 245,000 ETH, surpassing Bitcoin ETF inflows for the first time.

Weekly Performance: Ethereum ETFs posted $466.5 million in net inflows last week, their highest since launch, while Bitcoin ETFs faced $136.5 million in net outflows.

Altcoin Season Narrative: These trends reinforce the idea that Ethereum could lead an upcoming altcoin season.

Potential for Staking Yield Growth

Current Yields: Ethereum staking yields currently average around 3%.

Projected Increase: Analysts predict yields could rise to 4%-5%, driven by growing network activity.

ETF Approval: Approval of staking within Ethereum ETFs could make these products even more attractive to institutional investors.

Federal Reserve Impact: With interest rates decreasing, ETH staking yields offer a lucrative opportunity for investors.

Rising On-Chain Activity

Active Addresses: Weekly active Ethereum addresses surged by over 25% in November, reaching 2.64 million.

Layer 2 Growth: Increased demand for Layer 2 transaction storage, known as “blobs,” has contributed to frequent price discovery.

Bullish Indicators: These on-chain metrics suggest strong growth potential, supporting bullish Ethereum price predictions for 2024 and 2025.

Bright Prospects Ahead

Ethereum is showing signs of upward momentum, supported by strong technicals, rising institutional interest, and growing on-chain activity. The current Ethereum news today highlights the potential for ETH to resume its bullish trend, aiming for $3,740 and beyond.